Question: MEWORK HOMEWORK Points 12 Submitting an external tool Attempts o Allowed Attempts 1 Available until Apr 25 at 11pm JS Kome, Accounting, 72 Help 1

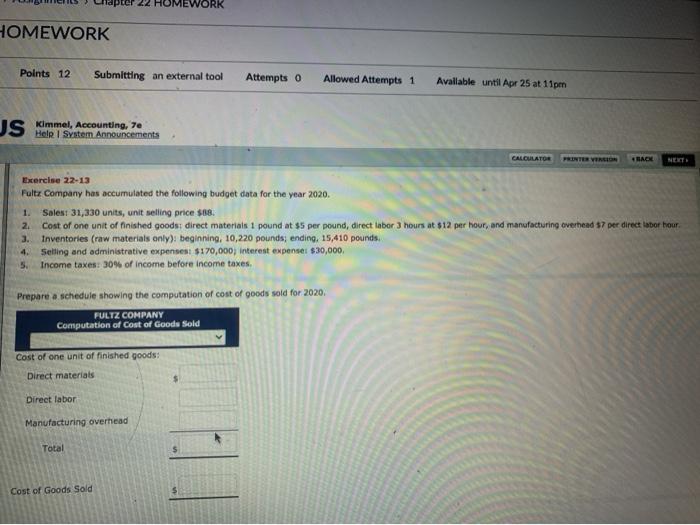

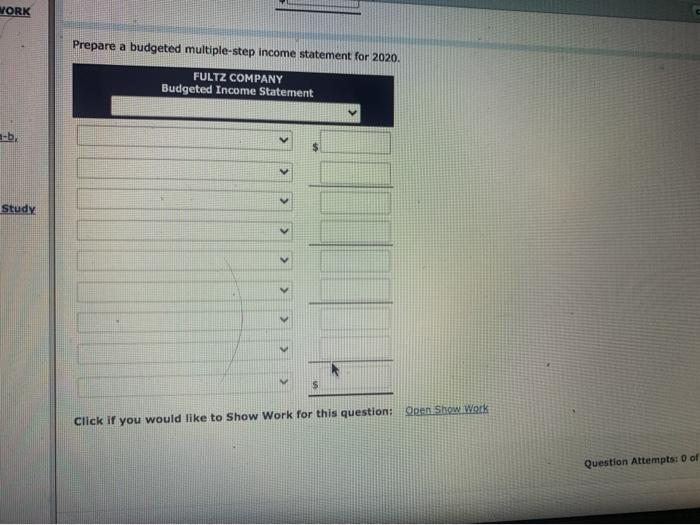

MEWORK HOMEWORK Points 12 Submitting an external tool Attempts o Allowed Attempts 1 Available until Apr 25 at 11pm JS Kome, Accounting, 72 Help 1 System Announcements CALCULATOR BABE Exercise 22-13 Fultz Company has accumulated the following budget data for the year 2020. 1. Sales: 31,330 units, unit selling price $88. 2 Cost of one unit of finished goods: direct materials 1 pound at $5 per pound, direct labor 3 hours at 12 per hour, and manufacturing overhead 37 per direct labor hour Inventories (raw materials only): beginning, 10,220 pounds, ending, 15,410 pounds 4. Selling and administrative expenses $170,000, interest expenses $30,000, 5. Income taxes: 30% of income before income taxes, 3. Prepare a schedule showing the computation of cost of goods sold for 2020, FULTZ COMPANY Computation of Cost of Goods Sold Cost of one unit of finished goods: Direct materials Direct labor Manufacturing overhead Total Cost of Goods Sold VORK Prepare a budgeted multiple-step income statement for 2020 FULTZ COMPANY Budgeted Income Statement -b. Study 5 Click if you would like to Show Work for this question: Dren Show Wark Question Attempts: 0 of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts