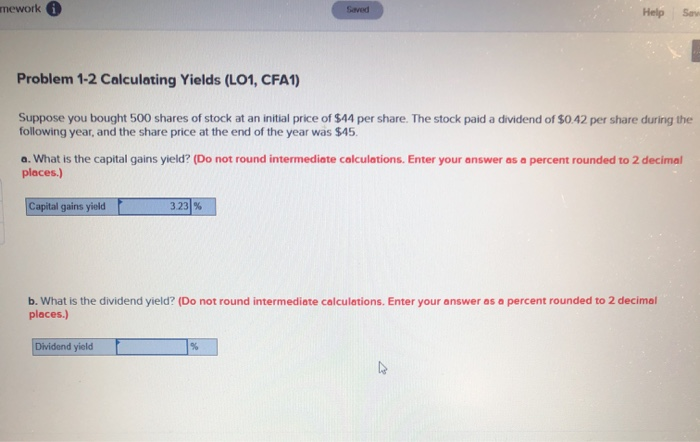

Question: mework Saved Help Sav Problem 1-2 Calculating Yields (L01, CFA1) Suppose you bought 500 shares of stock at an initial price of $14 per share.

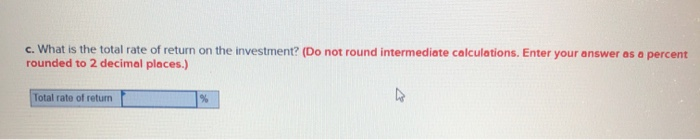

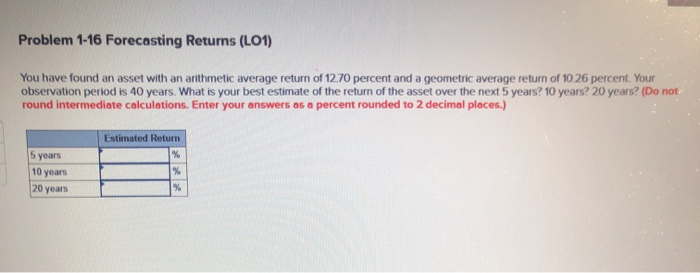

mework Saved Help Sav Problem 1-2 Calculating Yields (L01, CFA1) Suppose you bought 500 shares of stock at an initial price of $14 per share. The stock paid a dividend of $0.42 per share during the following year, and the share price at the end of the year was $45. a. What is the capital gains yield? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Capital gains yield 323% b. What is the dividend yield? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Dividend yield c. What is the total rate of return on the investment? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Total rate of return Problem 1-16 Forecasting Returns (L01) You have found an asset with an arithmetic average return of 12.70 percent and a geometric average return of 10 26 percent. Your observation period is 40 years. What is your best estimate of the return of the asset over the next 5 years? 10 years? 20 years? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) 5 years 10 years 20 years Estimated Return % % %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts