Question: mework Saved Help Say Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does

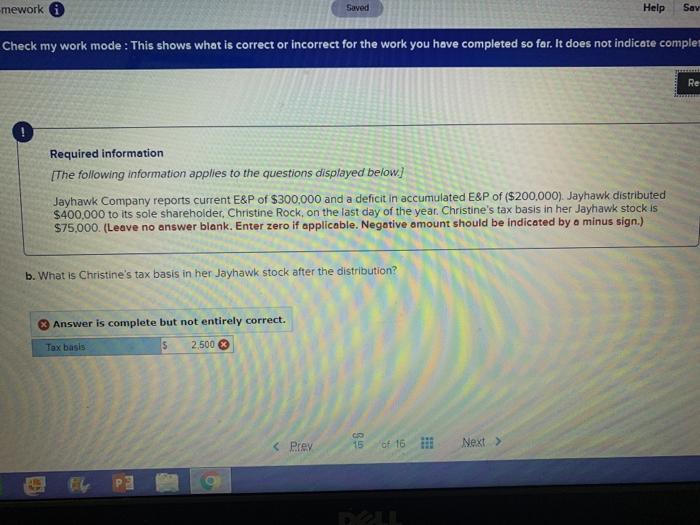

mework Saved Help Say Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate complem Re Required information [The following information applies to the questions displayed below.) Jayhawk Company reports current E&P of $300,000 and a deficit in accumulated E&P of ($200,000). Jayhawk distributed $400,000 to its sole shareholder, Christine Rock, on the last day of the year. Christine's tax basis in her Jayhawk stock is $75,000. (Leave no answer blank. Enter zero if applicable. Negative amount should be indicated by a minus sign.) b. What is Christine's tax basis in her Jayhawk stock after the distribution? Answer is complete but not entirely correct. Tax basis $ 2,500 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts