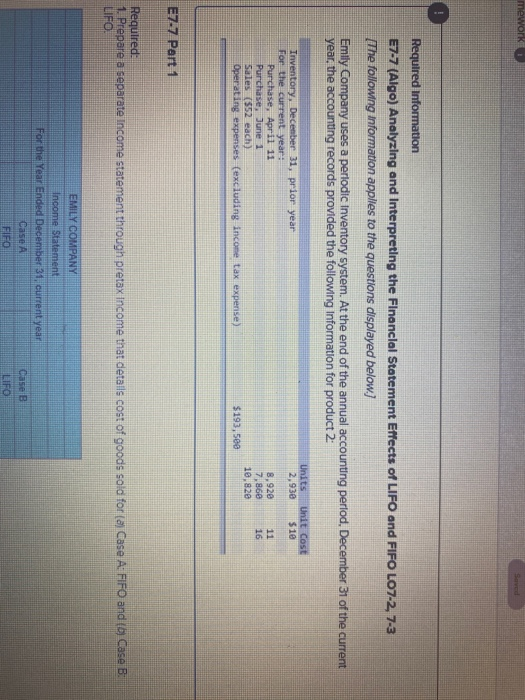

Question: mework Saved Required Information E7-7 (Algo) Analyzing and Interpreting the Financial Statement Effects of LIFO and FIFO LO7-2, 7-3 The following Information applies to the

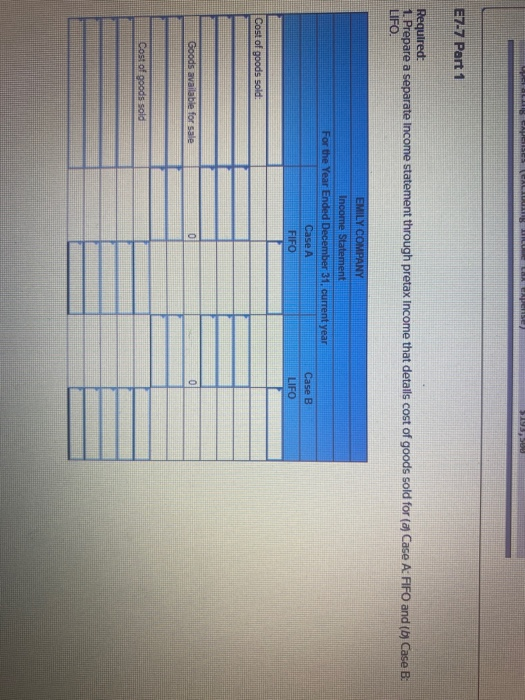

mework Saved Required Information E7-7 (Algo) Analyzing and Interpreting the Financial Statement Effects of LIFO and FIFO LO7-2, 7-3 The following Information applies to the questions displayed below.) Emily Company uses a periodic Inventory system. At the end of the annual accounting period. December 31 of the current year, the accounting records provided the following Information for product 2 Units 2,93e Unit Cost $1e Inventory, December 31, prior year For the current year: Purchase, April 11 Purchase, June 1 Sales (552 each) Operating expenses (excluding income tax expense) 8,920 7,860 10.820 11 16 $193,500 E7.7 Part 1 Required: 1. Prepare a separate Income statement through pretax income that details cost of goods sold for (aCase A: FIFO and (b) Case B. LIFO EMILY COMPANY Income Statement For the Year Ended December 31, current year Case A FIFO Case B LIFO $195, E7-7 Part 1 Required: 1. Prepare a separate Income statement through pretax income that details cost of goods sold for (aCase A: FIFO and (b) Case B: LIFO. EMILY COMPANY Income Statement For the Year Ended December 31, current year Case A FIFO Case B LIFO Cost of goods sold Goods available for sale 0 0 Cost of goods sold

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts