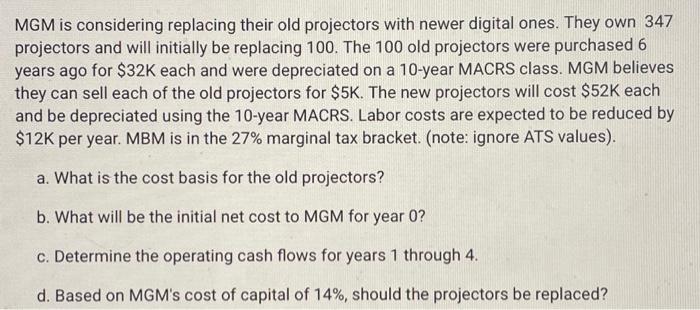

Question: MGM is considering replacing their old projectors with newer digital ones. They own 347 projectors and will initially be replacing 100 . The 100 old

MGM is considering replacing their old projectors with newer digital ones. They own 347 projectors and will initially be replacing 100 . The 100 old projectors were purchased 6 years ago for $32K each and were depreciated on a 10-year MACRS class. MGM believes they can sell each of the old projectors for $5K. The new projectors will cost $52K each and be depreciated using the 10-year MACRS. Labor costs are expected to be reduced by $12K per year. MBM is in the 27% marginal tax bracket. (note: ignore ATS values). a. What is the cost basis for the old projectors? b. What will be the initial net cost to MGM for year 0 ? c. Determine the operating cash flows for years 1 through 4 . d. Based on MGM's cost of capital of 14%, should the projectors be replaced

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts