Question: MGMT 159 - Group Project Case In 2006, Roger Gardner incorporated Dogani Inc. (DI). In 2016, Roger's children, Gale, Louis, and Marc, took over

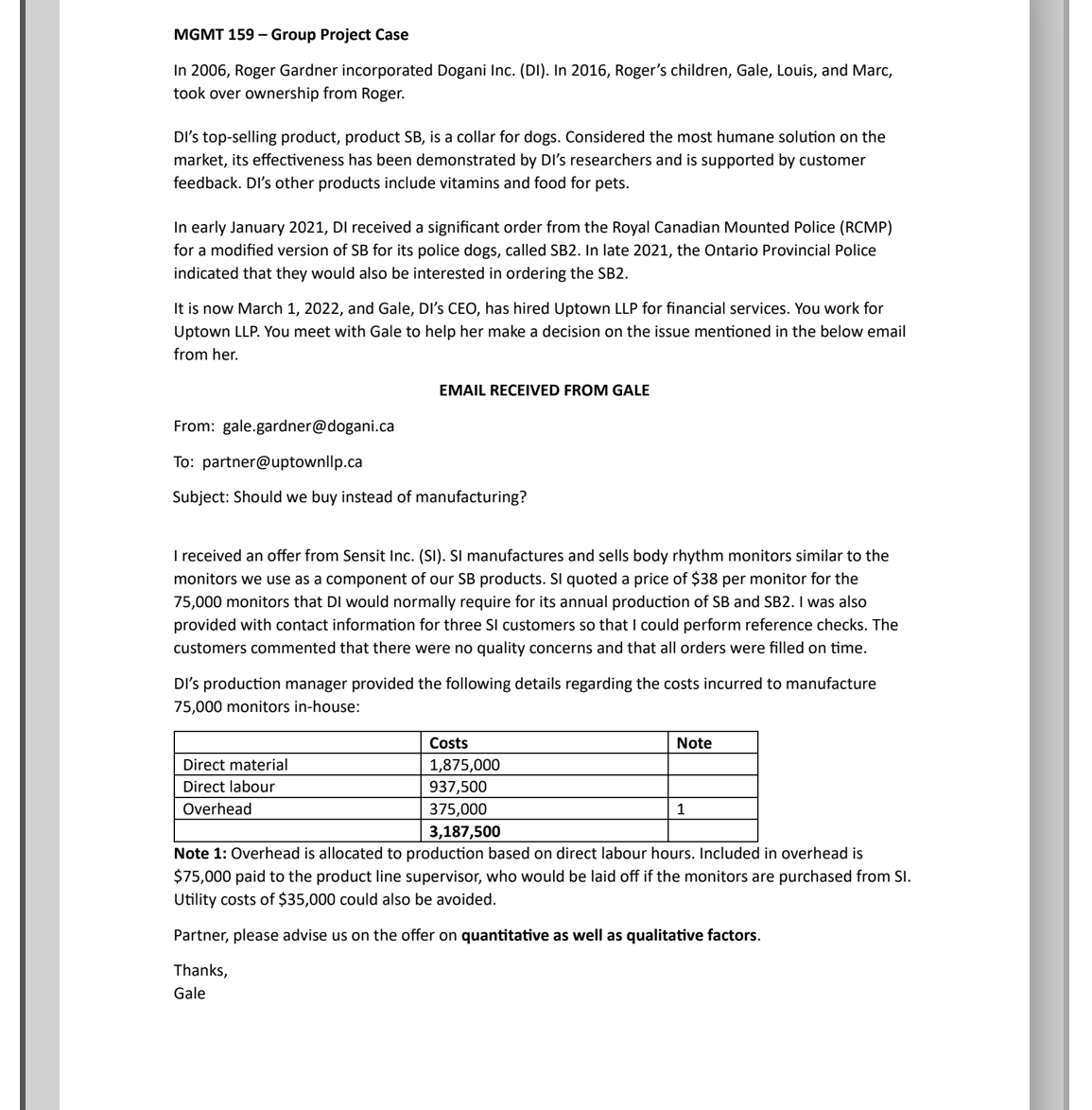

MGMT 159 - Group Project Case In 2006, Roger Gardner incorporated Dogani Inc. (DI). In 2016, Roger's children, Gale, Louis, and Marc, took over ownership from Roger. DI's top-selling product, product SB, is a collar for dogs. Considered the most humane solution on the market, its effectiveness has been demonstrated by DI's researchers and is supported by customer feedback. Dl's other products include vitamins and food for pets. In early January 2021, DI received a significant order from the Royal Canadian Mounted Police (RCMP) for a modified version of SB for its police dogs, called SB2. In late 2021, the Ontario Provincial Police indicated that they would also be interested in ordering the SB2. It is now March 1, 2022, and Gale, DI's CEO, has hired Uptown LLP for financial services. You work for Uptown LLP. You meet with Gale to help her make a decision on the issue mentioned in the below email from her. EMAIL RECEIVED FROM GALE From: gale.gardner@dogani.ca To: partner@uptownllp.ca Subject: Should we buy instead of manufacturing? I received an offer from Sensit Inc. (SI). SI manufactures and sells body rhythm monitors similar to the monitors we use as a component of our SB products. SI quoted a price of $38 per monitor for the 75,000 monitors that DI would normally require for its annual production of SB and SB2. I was also provided with contact information for three SI customers so that I could perform reference checks. The customers commented that there were no quality concerns and that all orders were filled on time. DI's production manager provided the following details regarding the costs incurred to manufacture 75,000 monitors in-house: Direct material Direct labour Overhead Costs 1,875,000 937,500 375,000 3,187,500 Note 1 Note 1: Overhead is allocated to production based on direct labour hours. Included in overhead is $75,000 paid to the product line supervisor, who would be laid off if the monitors are purchased from SI. Utility costs of $35,000 could also be avoided. Partner, please advise us on the offer on quantitative as well as qualitative factors. Thanks, Gale

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts