Question: MGT 11A - HW 4 (Protected View) - Microsoft Word View Acrobat fe. Click for more details. Enable Editing Background: Amanda lives in a neighborhood

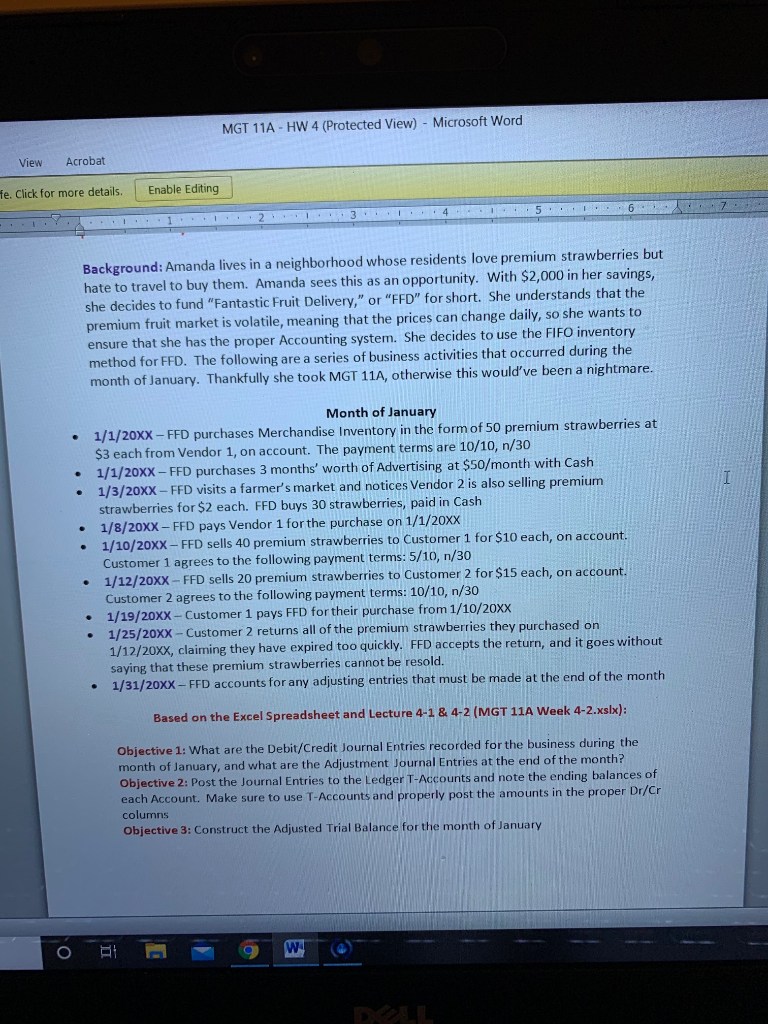

MGT 11A - HW 4 (Protected View) - Microsoft Word View Acrobat fe. Click for more details. Enable Editing Background: Amanda lives in a neighborhood whose residents love premium strawberries but hate to travel to buy them. Amanda sees this as an opportunity. With $2,000 in her savings, she decides to fund "Fantastic Fruit Delivery," or "FFD" for short. She understands that the premium fruit market is volatile, meaning that the prices can change daily, so she wants to ensure that she has the proper Accounting system. She decides to use the FIFO inventory method for FFD. The following are a series of business activities that occurred during the month of January. Thankfully she took MGT 11A, otherwise this would've been a nightmare Month of January 1/1/20XX - FFD purchases Merchandise Inventory in the form of 50 premium strawberries at $3 each from Vendor 1, on account. The payment terms are 10/10, n/30 1/1/20XX - FFD purchases 3 months' worth of Advertising at $50/month with Cash 1/3/20XX-FFD visits a farmer's market and notices Vendor 2 is also selling premium strawberries for $2 each. FFD buys 30 strawberries, paid in Cash 1/8/20XX - FFD pays Vendor 1 for the purchase on 1/1/20XX 1/10/20XX-FFD sells 40 premium strawberries to Customer 1 for $10 each, on account. Customer 1 agrees to the following payment terms: 5/10, n/30 1/12/20XX - FFD sells 20 premium strawberries to Customer 2 for $15 each, on account. Customer 2 agrees to the following payment terms: 10/10, n/30 1/19/20XX - Customer 1 pays FFD for their purchase from 1/10/20XX 1/25/20XX - Customer 2 returns all of the premium strawberries they purchased on 1/12/20XX, claiming they have expired too quickly. FFD accepts the return, and it goes without saying that these premium strawberries cannot be resold. 1/31/20XX - FFD accounts for any adjusting entries that must be made at the end of the month Based on the Excel Spreadsheet and Lecture 4-1 & 4-2 (MGT 11A Week 4-2.xslx): Objective 1: What are the Debit/Credit Journal Entries recorded for the business during the month of January, and what are the Adjustment Journal Entries at the end of the month? Objective 2: Post the Journal Entries to the Ledger T-Accounts and note the ending balances of each Account. Make sure to use T-Accounts and properly post the amounts in the proper Dr/Cr columns Objective 3: Construct the Adjusted Trial Balance for the month of January ORL = W

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts