Question: MHE Reader A SINGLE FATHER'S TAX SITUATION Untitled document Ever since his wife's death, Eric Stanford has faced difficult personal and financial circumstances. His job

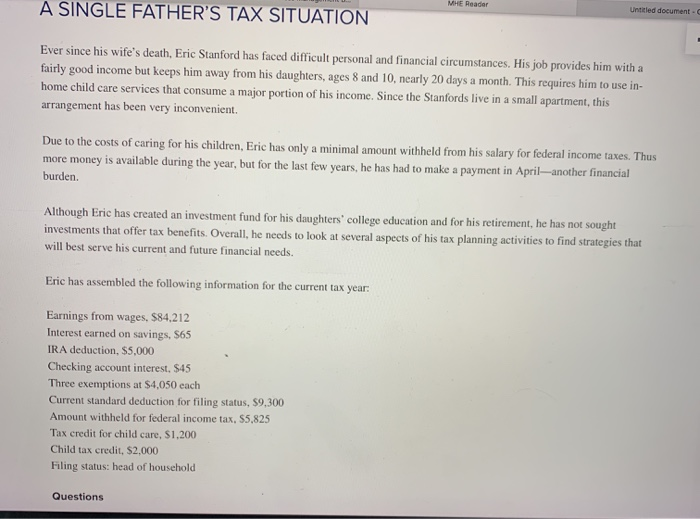

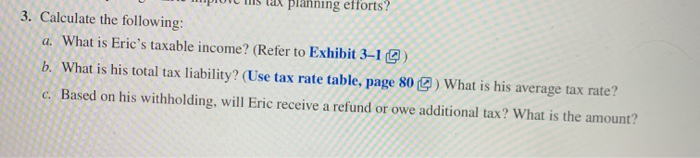

MHE Reader A SINGLE FATHER'S TAX SITUATION Untitled document Ever since his wife's death, Eric Stanford has faced difficult personal and financial circumstances. His job provides him with a fairly good income but keeps him away from his daughters, ages 8 and 10, nearly 20 days a month. This requires him to use in- home child care services that consume a major portion of his income. Since the Stanfords live in a small apartment, this arrangement has been very inconvenient. Due to the costs of caring for his children, Eric has only a minimal amount withheld from his salary for federal income taxes. Thus more money is available during the year, but for the last few years, he has had to make a payment in April-another financial burden. Although Eric has created an investment fund for his daughters' college education and for his retirement, he has not sought investments that offer tax benefits. Overall, he needs to look at several aspects of his tax planning activities to find strategies that will best serve his current and future financial needs. Eric has assembled the following information for the current tax year: Earnings from wages, $84.212 Interest earned on savings, $65 IRA deduction, $5,000 Checking account interest, $45 Three exemptions at $4,050 each Current standard deduction for filing status, 89,300 Amount withheld for federal income tax, 55,825 Tax credit for child care, $1,200 Child tax credit, $2,000 Filing status: head of household Questions planning efforts? 3. Calculate the following: a. What is Eric's taxable income? (Refer to Exhibit 3-10) b. What is his total tax liability? (Use tax rate table, page 80 ) What is his average tax rate? c. Based on his withholding, will Eric receive a refund or owe additional tax? What is the amount? MHE Reader A SINGLE FATHER'S TAX SITUATION Untitled document Ever since his wife's death, Eric Stanford has faced difficult personal and financial circumstances. His job provides him with a fairly good income but keeps him away from his daughters, ages 8 and 10, nearly 20 days a month. This requires him to use in- home child care services that consume a major portion of his income. Since the Stanfords live in a small apartment, this arrangement has been very inconvenient. Due to the costs of caring for his children, Eric has only a minimal amount withheld from his salary for federal income taxes. Thus more money is available during the year, but for the last few years, he has had to make a payment in April-another financial burden. Although Eric has created an investment fund for his daughters' college education and for his retirement, he has not sought investments that offer tax benefits. Overall, he needs to look at several aspects of his tax planning activities to find strategies that will best serve his current and future financial needs. Eric has assembled the following information for the current tax year: Earnings from wages, $84.212 Interest earned on savings, $65 IRA deduction, $5,000 Checking account interest, $45 Three exemptions at $4,050 each Current standard deduction for filing status, 89,300 Amount withheld for federal income tax, 55,825 Tax credit for child care, $1,200 Child tax credit, $2,000 Filing status: head of household Questions planning efforts? 3. Calculate the following: a. What is Eric's taxable income? (Refer to Exhibit 3-10) b. What is his total tax liability? (Use tax rate table, page 80 ) What is his average tax rate? c. Based on his withholding, will Eric receive a refund or owe additional tax? What is the amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts