Question: MHE Reader current ratio Topic:El Teatro Cam. : Homework Saved The most recent financial statements for Fleury Inc., follow. Interest expense will remain constant; the

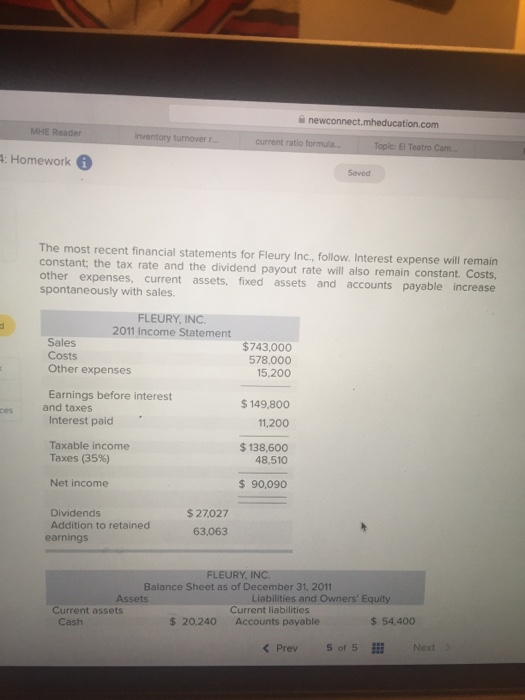

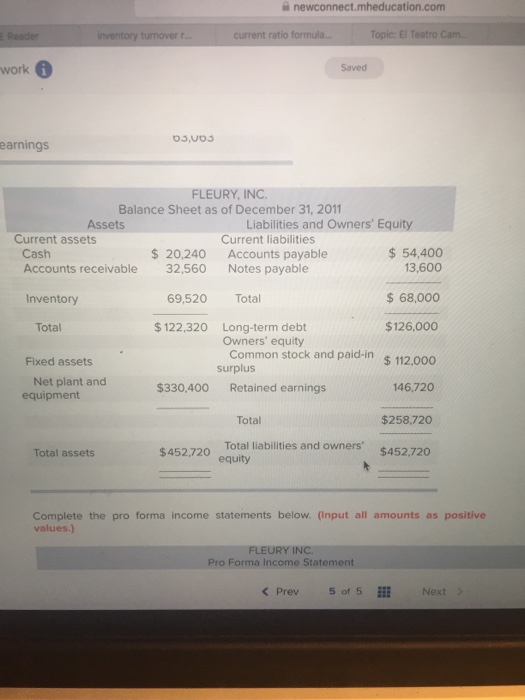

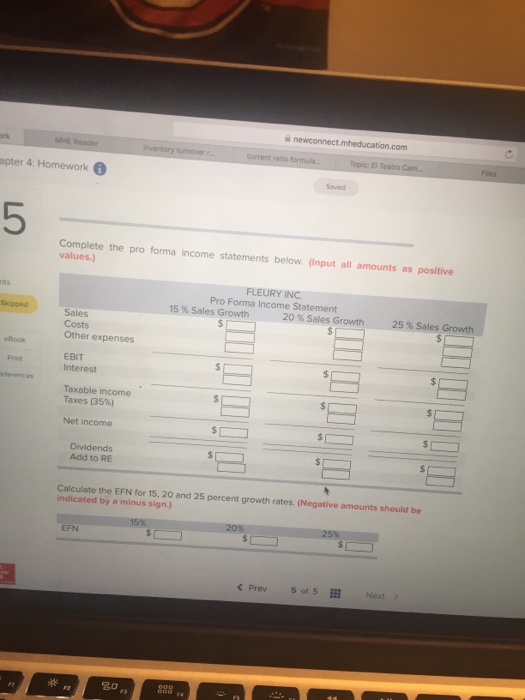

MHE Reader current ratio Topic:El Teatro Cam. : Homework Saved The most recent financial statements for Fleury Inc., follow. Interest expense will remain constant; the tax rate and the dividend payout rate will also remain constant. Costs other expenses, current assets, fixed assets and accounts payable increase spontaneously with sales. FLEURY, INC. 2011 Income Statement Sales Costs Other expenses $743,000 578,000 15.200 Earnings before interest $149,800 11,200 $138,600 and taxes Interest paid Taxable income Taxes (35%) 48,510 Net income $90,090 Dividends Addition to retained earnings $27027 63,063 FLEURY, INC Balance Sheet as of December 31, 2011 Liabilities and Owners Current liabilities Accounts payable Current assets $ 20,240 $ 54,400 Cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts