Question: Mia Yes, I do. Let's see if we can make these terms make sense by talking through their meaning and their significance to investors The

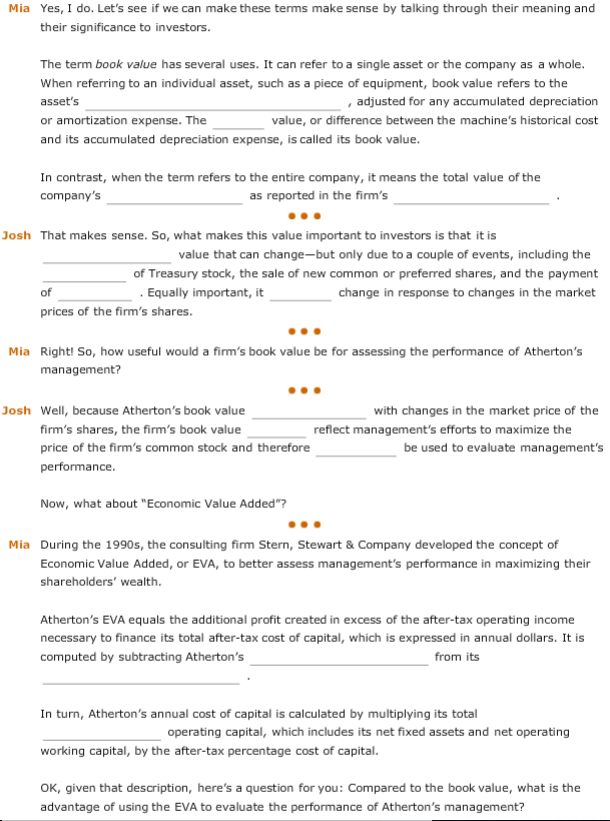

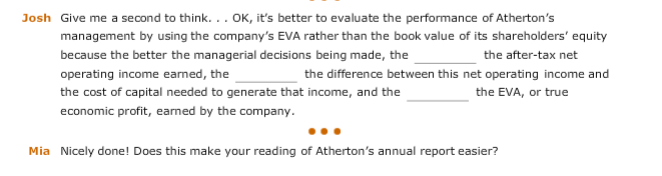

Mia Yes, I do. Let's see if we can make these terms make sense by talking through their meaning and their significance to investors The term book value has several uses. It can refer to a single asset or the company as a whole When referring to an individual asset, such as a piece of equipment, book value refers to the asset's or amortization expense. The and its accumulated depreciation expense, is called its book value any accumulated depreciation value, or difference between the machine's historical cost , adjusted for In contrast, when the term refers to the entire company, it means the total value of the company's as reported in the firm's Josh That makes sense. So, what makes this value important to investors is that it is alue that can change-but only due to a couple of events, including the of Treasury stock, the sale of new common or preferred shares, and the payment change in response to changes in the market of Equally important, it prices of the firm's shares Mia Right! So, how useful would a firm's book value be for assessing the performance of Atherton's management? Josh Well, because Atherton's book value with changes in the market price of the firm's shares, the firm's book value price of the firm's common stock and therefore performance reflect management's efforts to maximize the be used to evaluate management's Now, what about "Economic Value Added"? Mia During the 1990s, the consulting firm Stern, Stewart &Company developed the concept of Economic Value Added, or EVA, to better assess management's performance in maximizing their shareholders' wealth Atherton's EVA equals the additional profit created in excess of the after-tax operating income necessary to finance its total after-tax cost of capital, which is expressed in annual dollars. It is computed by subtracting Atherton's from its In turn, Atherton's annual cost of capital is calculated by multiplying its total working capital, by the after-tax percentage cost of capital. OK, given that description, here's a question for you: Compared to the book value, what is the operating capital, which includes its net fixed assets and net operating advantage of using the EVA to evaluate the performance of Atherton's management? Josh Give me a second to think... OK, it's better to evaluate the performance of Atherton's management by using the company's EVA rather than the book value of its shareholders' equity because the better the managerial decisions being made, the operating income earned, the the cost of capital needed to generate that income, and the economic profit, earned by the company. the after-tax net the difference between this net operating income and the EVA, or true Mia Nicely done! Does this make your reading of Atherton's annual report easier? Mia Yes, I do. Let's see if we can make these terms make sense by talking through their meaning and their significance to investors The term book value has several uses. It can refer to a single asset or the company as a whole When referring to an individual asset, such as a piece of equipment, book value refers to the asset's or amortization expense. The and its accumulated depreciation expense, is called its book value any accumulated depreciation value, or difference between the machine's historical cost , adjusted for In contrast, when the term refers to the entire company, it means the total value of the company's as reported in the firm's Josh That makes sense. So, what makes this value important to investors is that it is alue that can change-but only due to a couple of events, including the of Treasury stock, the sale of new common or preferred shares, and the payment change in response to changes in the market of Equally important, it prices of the firm's shares Mia Right! So, how useful would a firm's book value be for assessing the performance of Atherton's management? Josh Well, because Atherton's book value with changes in the market price of the firm's shares, the firm's book value price of the firm's common stock and therefore performance reflect management's efforts to maximize the be used to evaluate management's Now, what about "Economic Value Added"? Mia During the 1990s, the consulting firm Stern, Stewart &Company developed the concept of Economic Value Added, or EVA, to better assess management's performance in maximizing their shareholders' wealth Atherton's EVA equals the additional profit created in excess of the after-tax operating income necessary to finance its total after-tax cost of capital, which is expressed in annual dollars. It is computed by subtracting Atherton's from its In turn, Atherton's annual cost of capital is calculated by multiplying its total working capital, by the after-tax percentage cost of capital. OK, given that description, here's a question for you: Compared to the book value, what is the operating capital, which includes its net fixed assets and net operating advantage of using the EVA to evaluate the performance of Atherton's management? Josh Give me a second to think... OK, it's better to evaluate the performance of Atherton's management by using the company's EVA rather than the book value of its shareholders' equity because the better the managerial decisions being made, the operating income earned, the the cost of capital needed to generate that income, and the economic profit, earned by the company. the after-tax net the difference between this net operating income and the EVA, or true Mia Nicely done! Does this make your reading of Atherton's annual report easier

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts