Question: Miami Inc. is examining its capital structure with the intent of arriving at an optimal debt ratio. It currently has no debt and has a

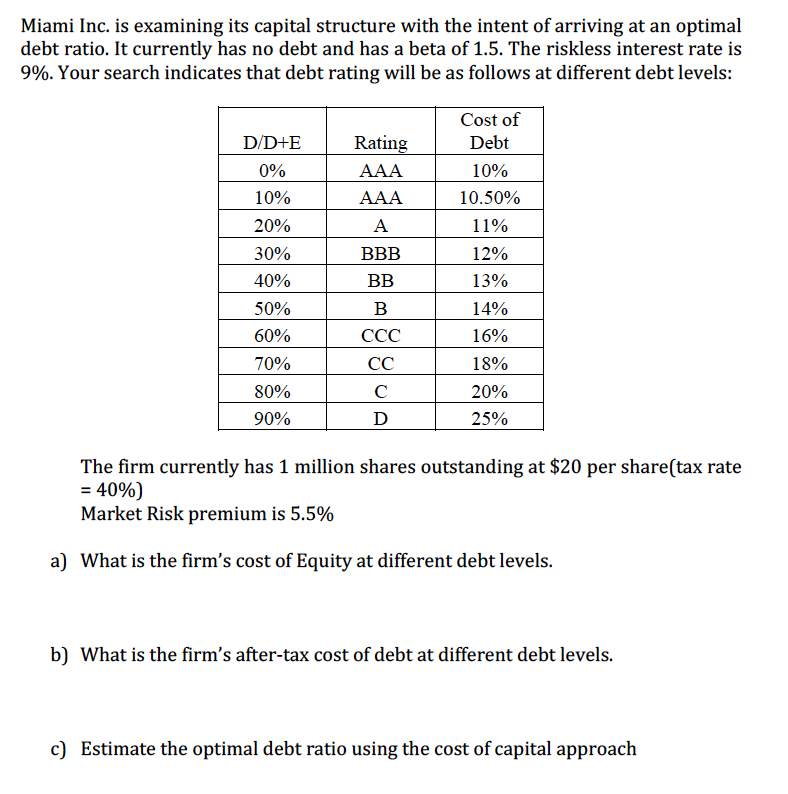

Miami Inc. is examining its capital structure with the intent of arriving at an optimal debt ratio. It currently has no debt and has a beta of 1.5. The riskless interest rate is 9%. Your search indicates that debt rating will be as follows at different debt levels: DD+E 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% Cost of Debt 10% 10.50% 11% 12% 13% 14% 16% 18% 20% 25% Rating The firm currently has 1 million shares outstanding at $20 per share(tax rate = 40%) Market Risk premium is 5.5% a) What is the firm's cost of Equity at different debt levels. b) What is the firm's after-tax cost of debt at different debt levels. c) Estimate the optimal debt ratio using the cost of capital approach

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts