Question: Michael and Michelle Williams believe they have a solid financial future; however, they are concerned about actions they need to take to ensure college educations

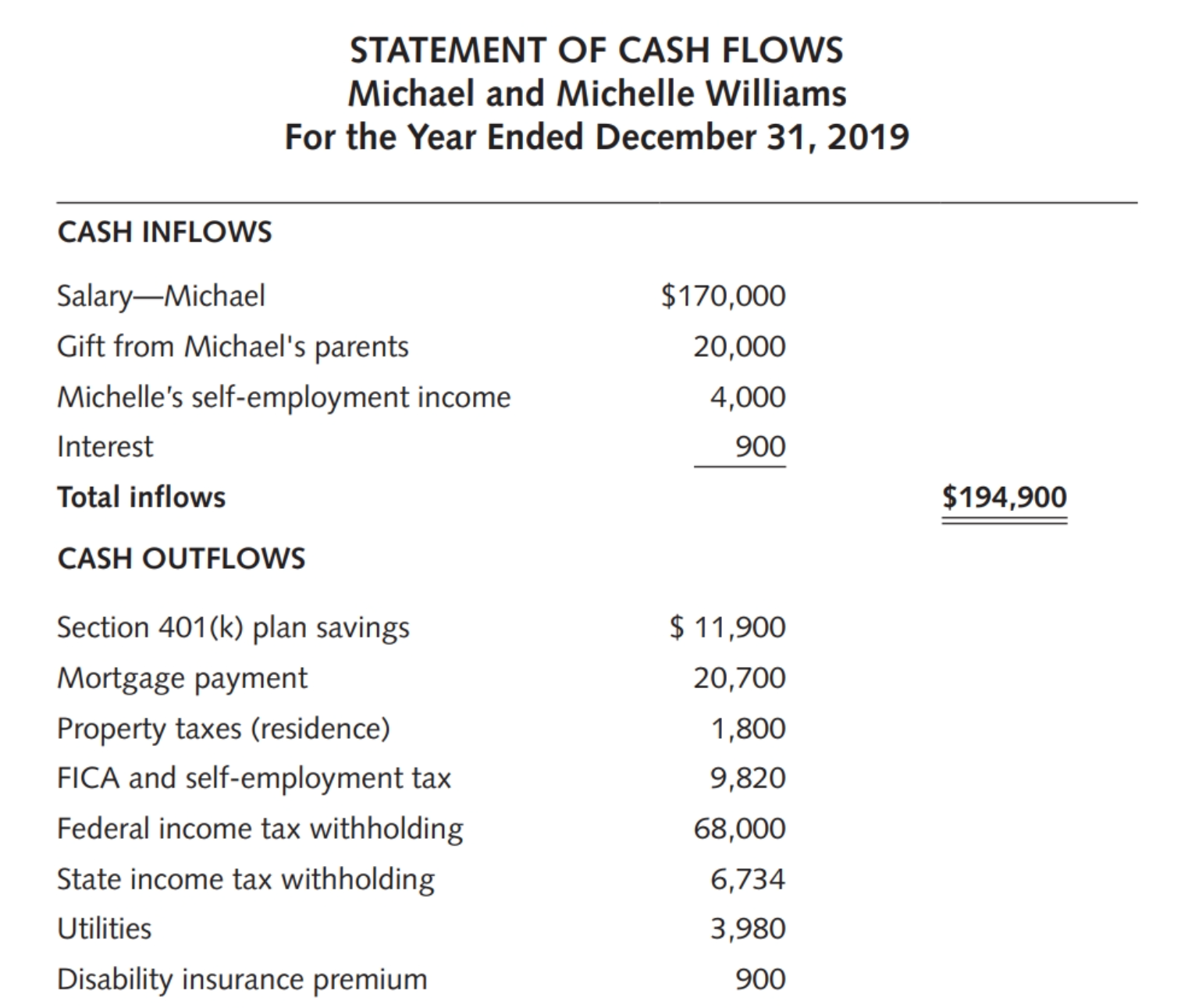

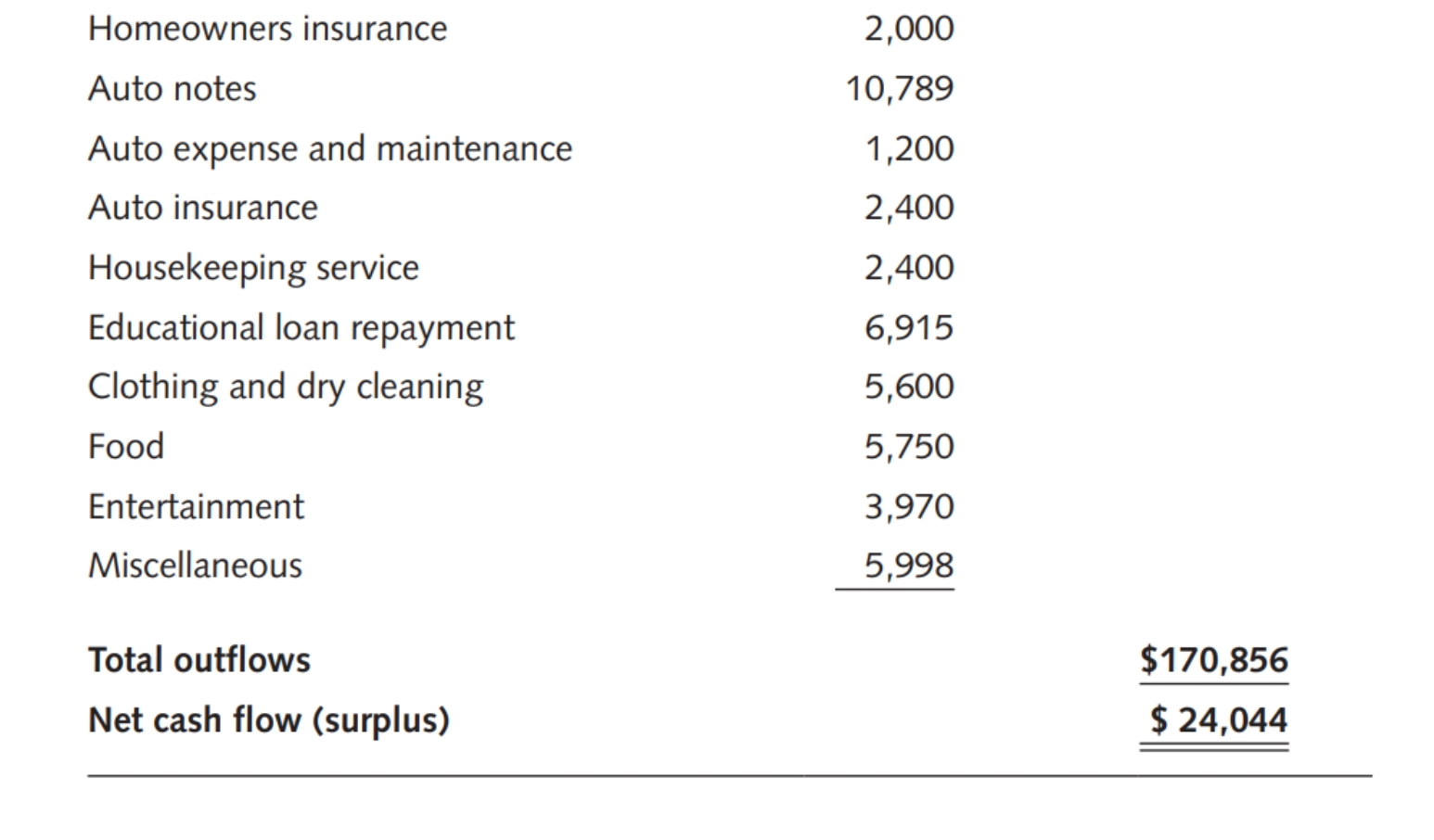

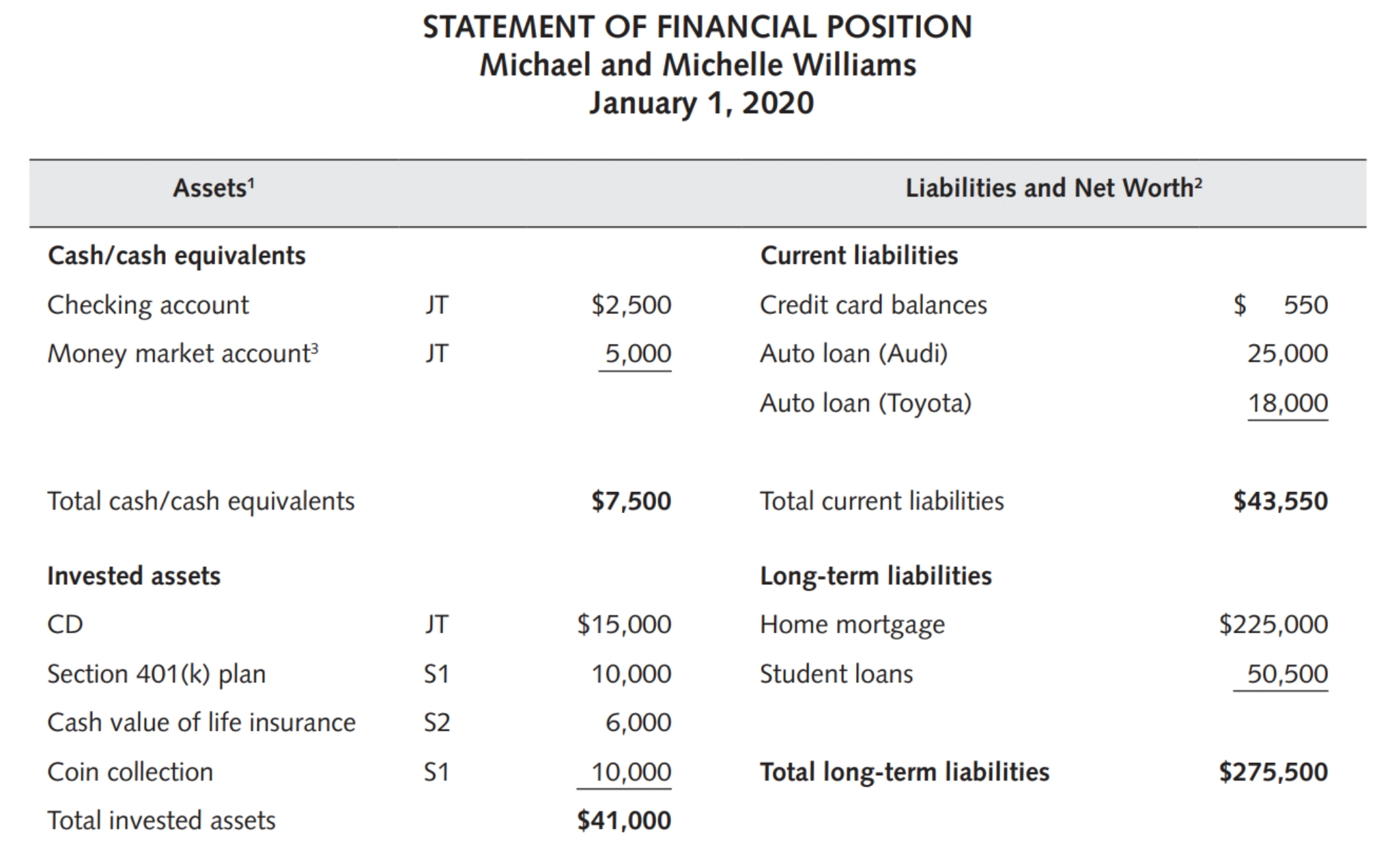

Michael and Michelle Williams believe they have a solid financial future; however, they are concerned about actions they need to take to ensure college educations for two of their children and a secure future for a third child with special needs. They have come to you for assistance in determining how they can achieve these goals. Today is January 1, 2020.

Personal Background and Information

Michael Williams (Age 35)

Michael is a doctor who specializes in internal medicine. He is an employee of

Lakeside Hospital. The salary that Michael earns compensates him for patients seen at both the hospital and the Lakeside-owned clinic. Michael is starting his sixth year of practice. He has been discouraged lately with the medical economic environment. Given the proliferation of managed care, he sees only a limited ability to increase his salary in the future and is concerned that his salary increases are not likely to exceed inflation.

Michelle Williams (Age 35)

Michelle grew up in a middle class family and lost both of her parents to cancer in their early 50s. Michelle is a nurse but has not worked in her profession since her children were born. Michelle is fascinated with all things technological. She is a seller on an online auction site. Michelle has an uncanny sense for shopping for unique items that she buys, adds a markup, and resells. She marks up an item 100%, does not sell the item for less than its marked-up price, and charges the online buyer for all related shipping costs. For 2020, she has changed the dynamic of her business and expects to generate up to $90,000 net income after expenses from the business this year.

Children

Michelle and Michael have three children: Beau (age 7), Elizabeth (age 5), and Madison (age 2). Madison has Down syndrome.

Michael's Family

Michael is an only child and has been his parents' pride and joy. Michael's parents (Frank and Isabelle) are first-generation immigrants from England. They immigrated before Michael was born and operate a small neighborhood deli. Michael and Michelle met at the deli when Michelle worked there during her college years. The ebb and flow of community life through the deli still fascinates Michelle, and she often visits Michael's parents there. The elder Williamses own the building (fair market value, $400,000) that houses the deli. The neighborhood has seen needed renovations in recent years, and the future outlook for continued renewal is good. The deli enjoys a steady stream of loyal customers and has generated moderate wealth for Michael's parents. They are both 60 years old and are in fair health. Frank and Isabelle have no family in this country except for Michael. As they approach retirement, their primary concerns are the high costs of long-term residential and medical care for the elderly.

Michelle's Family

Michelle's parents are both deceased. Michelle is close to her only sibling, Joan (age 40). Joan is unmarried and has no children. Joan is particularly close to the Williamses' children. In the past, Joan has mentioned to Michelle that she would consider assisting with the educational and maintenance needs of the children. Joan has given up her job as a business education teacher to be a full-time author of financial self-help books and works out of her home. To date she has enjoyed tremendous success and has raised her annual income from $45,000 per year to $100,000.

Personal and Financial Objectives

1. The Williamses want to provide Beau and Elizabeth with up to $25,000 (today's dollars) per year for four years of college education. The children will be on their own for the costs of any graduate studies.

2. They want to assist Michael's parents in their retirement years, as needed.

3. They want to be free of mortgage indebtedness by the time Michael is 55 years old.

4. They want to design a retirement plan that will provide an income to replace 70% of Michael's preretirement income.

5. They want to make necessary arrangements for Madison so that she will be cared for throughout her adult life.

6. They want to maintain an adequate emergency fund of six months' living expenses.

7. They want to prepare proper wills and an estate plan.

Economic Information

? They expect inflation to average 3%.

? They expect an educational consumer price index (CPI) of 5%.

? They expect Michael's salary to increase 3% annually.

? Rates are 3.5% for a 15-year fixed mortgage and 4% for a 30-year fixed mortgage.

? They are in a 24% federal income tax bracket and a 6% state income tax bracket.

Any refinancing will incur 3% of the mortgage as a closing cost which will not be financed.

Insurance Information

Health Insurance

Health insurance is provided for the entire immediate family through Lakeside Hospital. Lakeside Hospital's health insurance is through a preferred provider organiza-tion (PPO). The contract has a family deductible of $500 per year. If preferred contract physicians are used, the contract is an 80/20 major medical coinsurance plan. The family annual stop-loss limit is $2,000. Prescription drug, eye, or dental coverage is not included in the plan. The plan has unlimited lifetime benefits.

Life Insurance

Michael has elected $50,000 group term life insurance through the hospital. The hospital pays the entire premium. Michelle has maintained a $10,000 whole life insur-ance policy her parents purchased for her as a child. The cash value of the policy is $6,000 and the policy is paid up.

Disability Insurance

The hospital does not provide disability insurance for its employed physicians. Michael has purchased a policy through the American Medical Association. The policy provides own-occupation coverage for disability resulting from either sickness or acci-dent, pays a benefit of 60% of gross pay after an elimination period of 180 days, covers a term of 60 months with residual benefits, and is guaranteed renewable.

Malpractice Insurance

The hospital provides Michael with malpractice insurance and pays the premium. The policy covers Michael's work at both the hospital and in the clinical practice.

Homeowners Insurance

The Williamses currently have an HO-3 policy with a replacement value on con-tents endorsement. The deductible is $250 with a premium of $2,000 per year.

Automobile Insurance

Michael and Michelle have full coverage on both cars, including:

? $100,000 bodily injury for one person

? $300,000 bodily injury for all persons

? $50,000 property damage

? $100,000 uninsured motorist

? $10,000 medical payments

Deductibles are:

? $500 comprehensive

? $1,000 collision

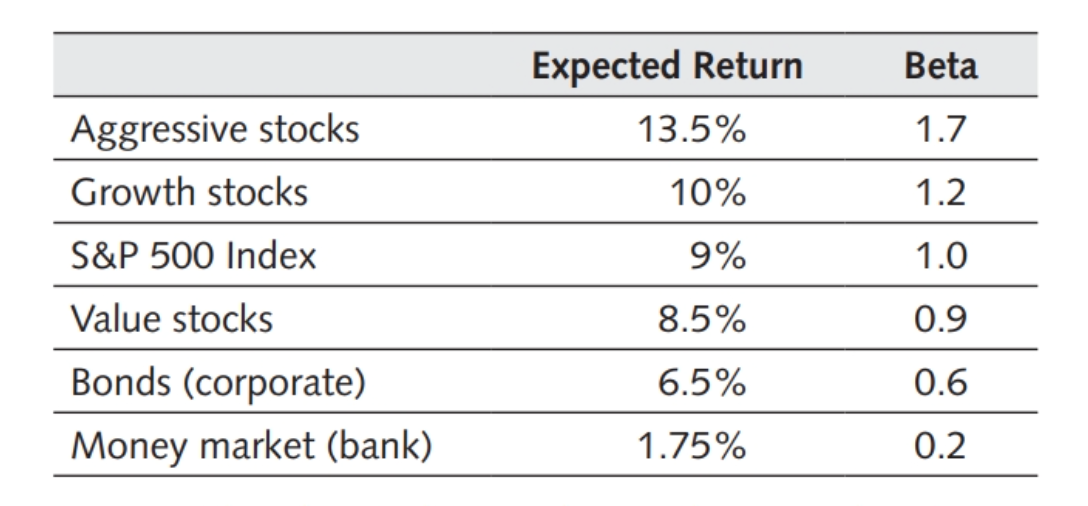

Investment Information (Assumptions)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts