Question: Michael Jackson is attempting to evaluate 2 possible portfolios consisting of the same 5 assets but held in different proportions. He is particularly interested in

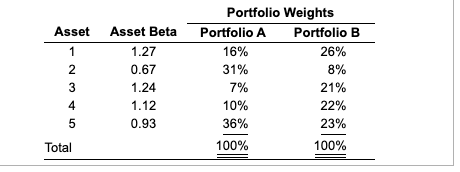

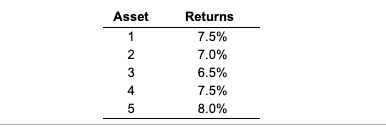

Michael Jackson is attempting to evaluate 2 possible portfolios consisting of the same 5 assets but held in different proportions. He is particularly interested in using beta to compare the risk of the portfolios and, in this regard, has gathered the following data a. Calculate the betas for portfolios A and B. b. If the risk-free rate is 2.8% and the market return is 8.2%, calculate the required return for each portfolio using the CAPM. c. Then assume you believe that each of the five assets will earn the return () shown in this table: Based on these figures and the weights , what returns do you believe that Portfolios A and B will earn? Which portfolio you would invest in and why?

\begin{tabular}{cccc} & & \multicolumn{2}{c}{ Portfolio Weights } \\ \cline { 3 - 4 } Asset & Asset Beta & Portfolio A & Portfolio B \\ \hline 1 & 1.27 & 16% & 26% \\ 2 & 0.67 & 31% & 8% \\ 3 & 1.24 & 7% & 21% \\ 4 & 1.12 & 10% & 22% \\ 5 & 0.93 & 36% & 23% \\ Total & & 100% & = \\ \hline \end{tabular} \begin{tabular}{cc} Asset & Returns \\ \hline 1 & 7.5% \\ 2 & 7.0% \\ 3 & 6.5% \\ 4 & 7.5% \\ 5 & 8.0% \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts