Question: Michelle and Mark are married and file a joint return. Michelle owns an unincorporated dental practice. Marl works part - time as a high school

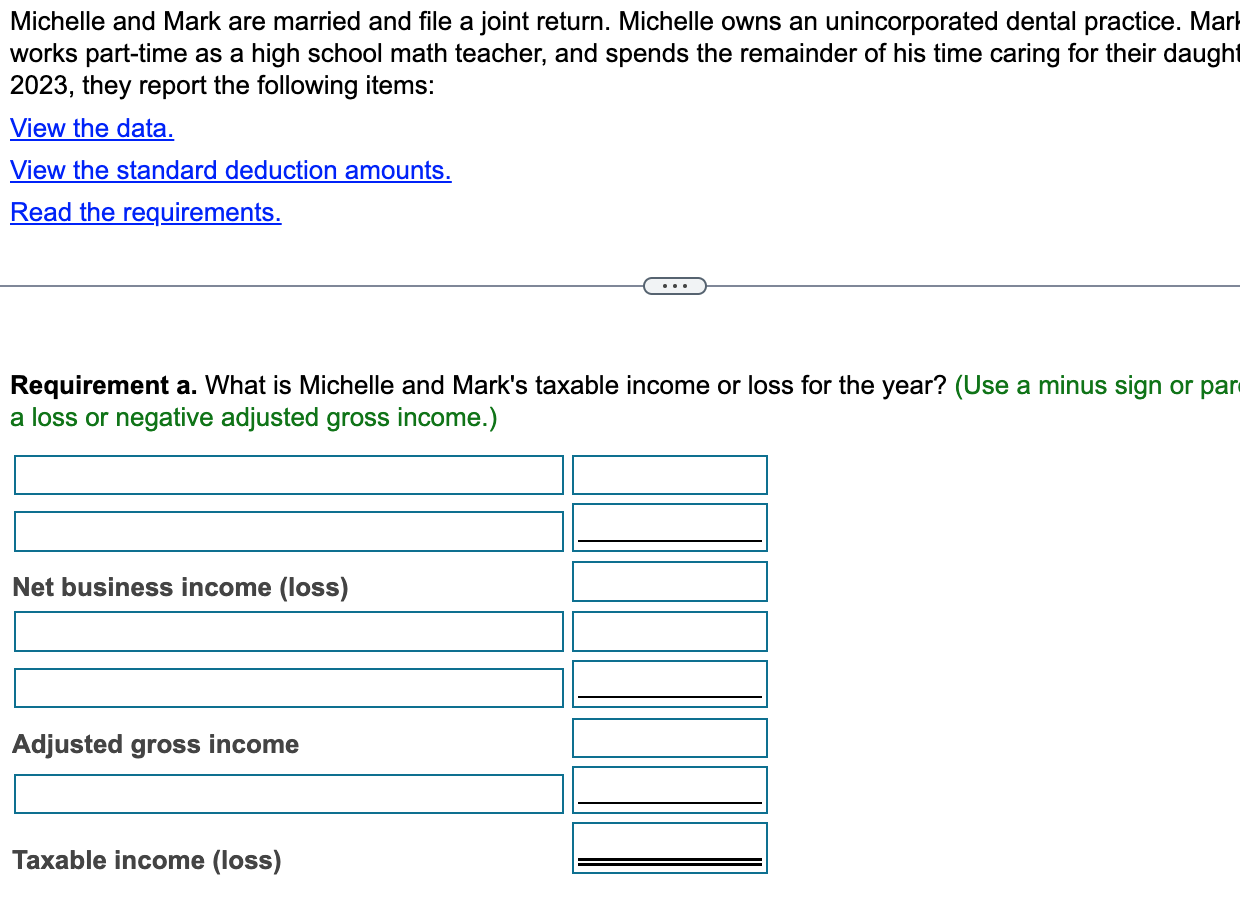

Michelle and Mark are married and file a joint return. Michelle owns an unincorporated dental practice. Marl works parttime as a high school math teacher, and spends the remainder of his time caring for their daught they report the following items: View the data. View the standard deduction amounts. Read the requirements. Requirement a What is Michelle and Mark's taxable income or loss for the year? Use a minus sign or par a loss or negative adjusted gross income. Net business income loss Adjusted gross income Taxable income loss Requirement b What is Michelle and Mark's net operating loss NOL for the year? Use a minus sign or paren for a loss or for numbers to be subtracted. Use a positive number for all amounts being added.

Excess of nonbusiness deductions over nonbusiness income:

Plus: Excess of nonbusiness deductions over nonbusiness income

Net operating loss

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock