Question: mickel bhd is seeking your advice on which proposal shall be chosen for its long- term expansion project. The floatation cost of using bond is

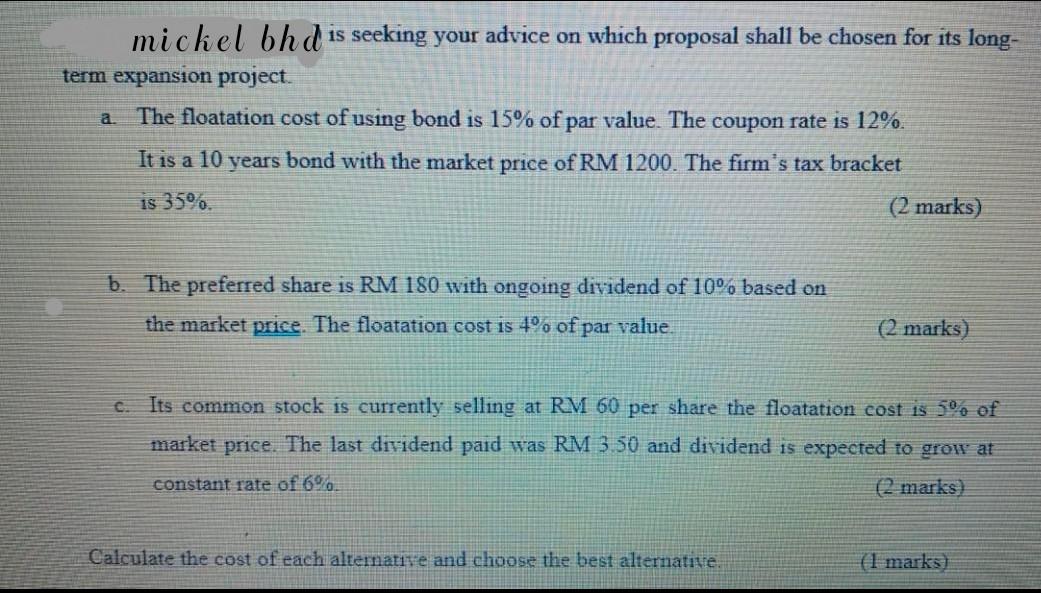

mickel bhd is seeking your advice on which proposal shall be chosen for its long- term expansion project. The floatation cost of using bond is 15% of par value. The coupon rate is 12%. It is a 10 years bond with the market price of RM 1200. The firm's tax bracket a is 35%. (2 marks) b. The preferred share is RM 180 with ongoing dividend of 10% based on the market price. The floatation cost is to of par value. (2 marks) c. Its common stock is currently selling at RM 60 per share the floatation cost is 5% of market price. The last dividend paid was RM 3.50 and dividend is expected to grow at constant rate of 6%. (2 marks) Calculate the cost of each alternative and choose the best alternative. (1 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts