Question: Microeconomics. Find solutions for these. (31] points} Consider an expected prot maximizing monopolist who faces an uncertain demand. He supplies q units of goods at

Microeconomics. Find solutions for these.

![Microeconomics. Find solutions for these. (31] points} Consider an expected prot maximizing](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f6b48940e49_10566f6b4891cd23.jpg)

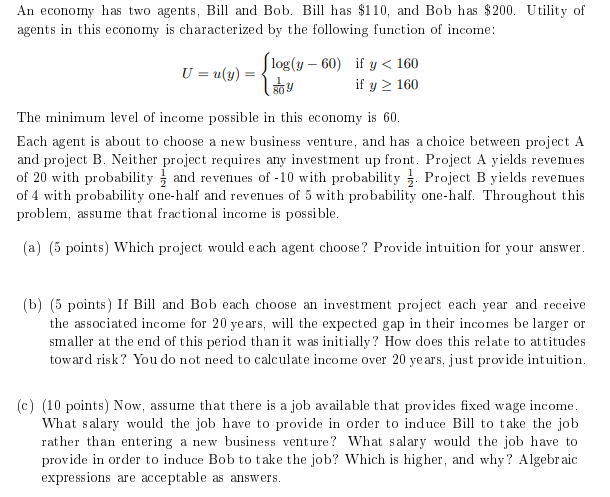

(31] points} Consider an expected prot maximizing monopolist who faces an uncertain demand. He supplies q units of goods at zem cost and sells it at price 3 q, where H is nnlmown. [The price and the supply level can be negative] (11] Asemmhg that 3 ~ N {3:152}, compute the monopolist's uptilnal Suppl}...r q and his expected prot under the optimal supply. [h] Suppose that, through market research, the monopolist can learn about H. In particularT by investing :12, he can learn the value of a random variable 1' before charming his Suppl]? 1;, such that. H = X+Y, X ~ N [[1,]. c] and lr' ~ N[,c]. How much should the monopolist invest? [Note that the utility function of the monopolist is [H q] q 22.] An economy has two agents, Bill and Bob. Bill has $110, and Bob has $200. Utility of agents in this economy is characterized by the following function of income: U = u(y) = [ log(y - 60) if y 160 The minimum level of income possible in this economy is 60. Each agent is about to choose a new business venture, and has a choice between project A and project B. Neither project requires any investment up front. Project A yields revenues of 20 with probability = and revenues of -10 with probability -. Project B yields revenues of 4 with probability one-half and revenues of 5 with probability one-half. Throughout this problem, assume that fractional income is possible. (a) (5 points) Which project would each agent choose? Provide intuition for your answer. (b) (5 points ) If Bill and Bob each choose an investment project each year and receive the associated income for 20 years, will the expected gap in their incomes be larger or smaller at the end of this period than it was initially ? How does this relate to attitudes toward risk? You do not need to calculate income over 20 years, just provide intuition. (c) (10 points) Now, assume that there is a job available that provides fixed wage income. What salary would the job have to provide in order to induce Bill to take the job rather than entering a new business venture? What salary would the job have to provide in order to induce Bob to take the job? Which is higher, and why? Algebraic expressions are acceptable as answers.\f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts