Question: Micron Technology, inc. designs, develops, and manulactures leading - edge semiconductor memory products. The Company is a leading global manufacturer of semiconductor memory products with

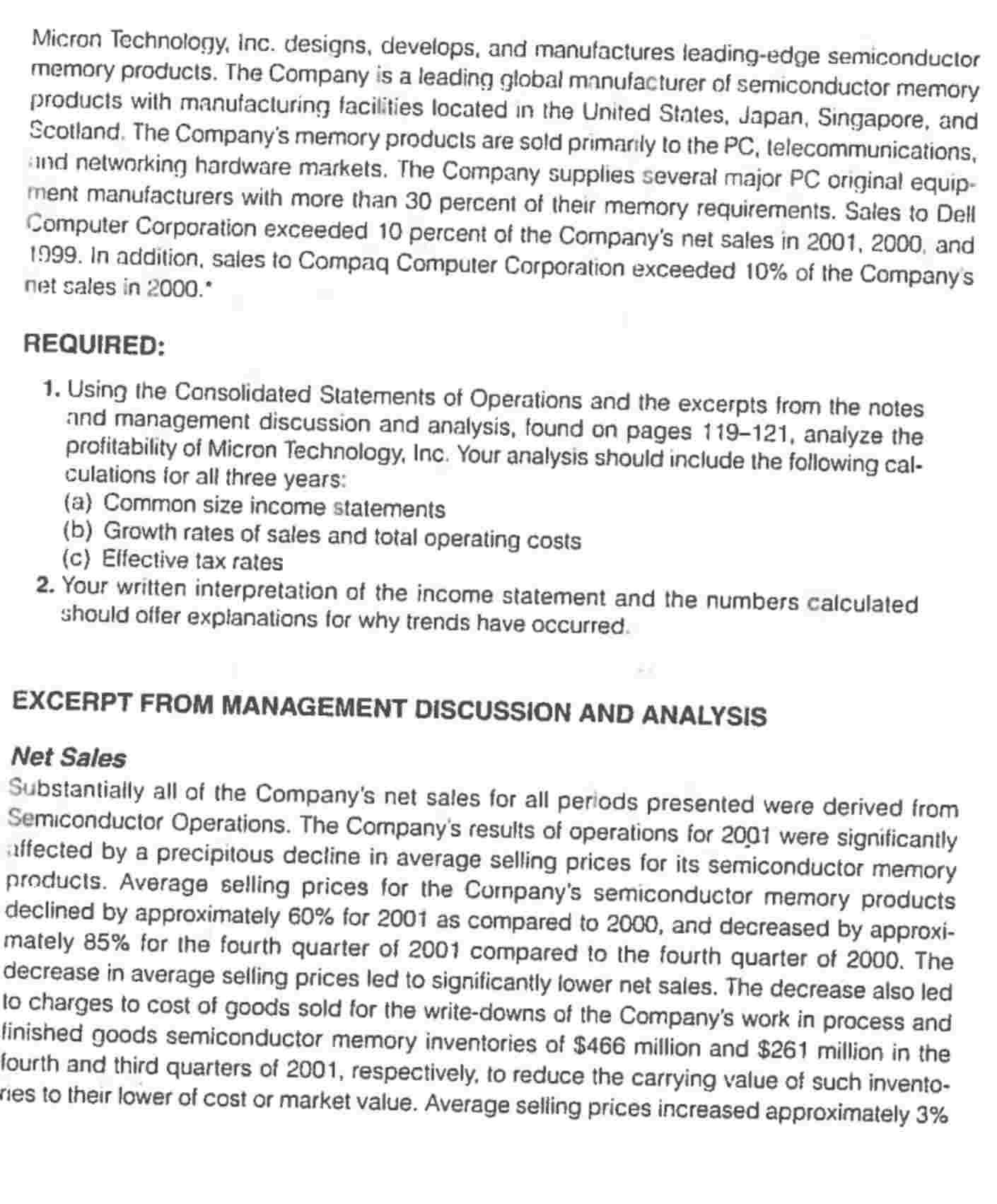

Micron Technology, inc. designs, develops, and manulactures leadingedge semiconductor memory products. The Company is a leading global manufacturer of semiconductor memory products with manufacturin facilities located in the United States, Japan, Singapore, and Scotland. The Company's memory producls are sold primanly to the PC telecommunications, and networking hardware markets. The Company supplies several major PC original equipment manufacturers with more than percent of their memory requirements. Sales to Dell Computer Corporation exceeded percent of the Company's net sales in and In addition, sales to Compaq Computer Corporation exceeded of the Company's net sales in REQUIRED: Using the Consolidated Statements of Operations and the excerpts from the notes and management discussion and analysis, found on pages analyze the profitability of Micron Technology, Inc. Your analysis should include the following calculations for all three years: a Common size income statements b Growth rates of sales and total operating costs c Elfective tax rates Your written interpretation of the income statement and the numbers calculated should offer explanations for why trends have occurred. EXCERPT FROM MANAGEMENT DISCUSSION AND ANALYSIS Net Sales Substantially all of the Company's net sales for all periods presented were derived from Semiconductor Operations. The Company's results of operations for were significantly affected by a precipitous decline in average selling prices for its semiconductor memory products. Average selling prices for the Company's semiconductor memory products declined by approximately for as compared to and decreased by approximately for the fourth quarter of compared to the fourth quarter of The decrease in average selling prices led to significantly lower net sales. The decrease also led to charges to cost of goods sold for the writedowns of the Company's work in process and finished goods semiconductor memory inventories of $ million and $ million in the fourth and third quarters of respectively, to reduce the carrying value of such inventories to their lower of cost or market value. Average selling prices increased approximately Micron Technology, Inc.

Consolidated Statements of Operations

Amounts in millions except per share amounts

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock