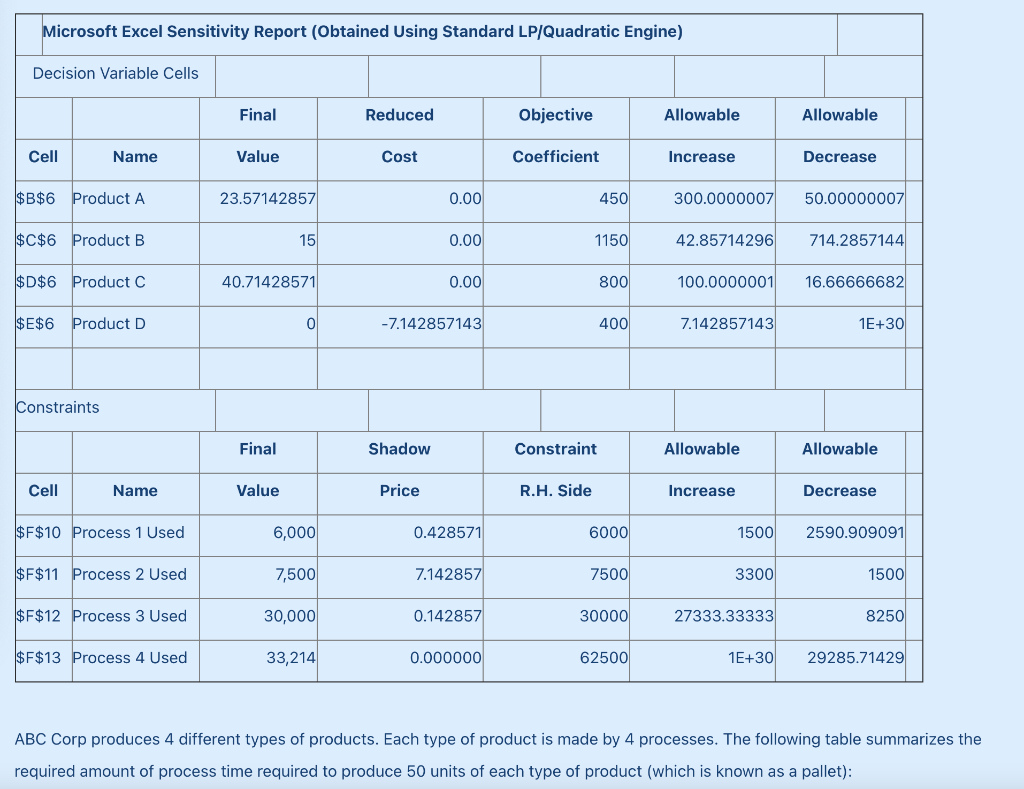

Question: Microsoft Excel Sensitivity Report (Obtained Using Standard LP/Quadratic Engine) Decision Variable Cells Final Reduced Objective Allowable Allowable Cell Name Value Cost Coefficient Increase Decrease $B$6

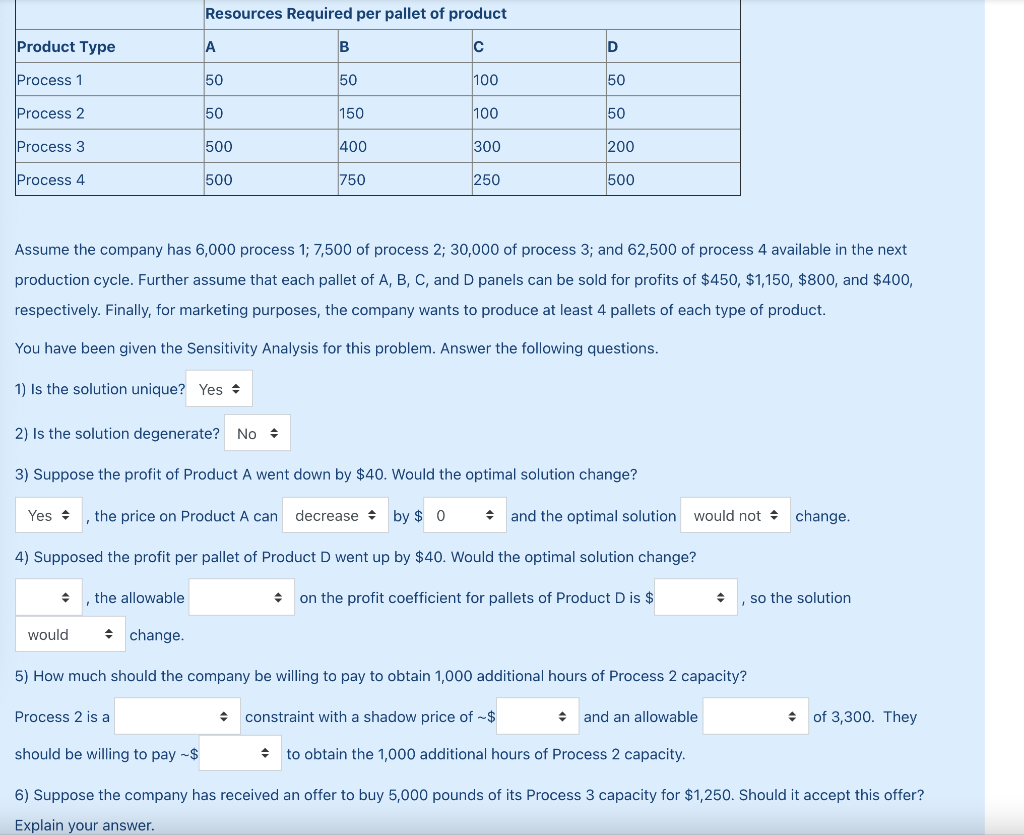

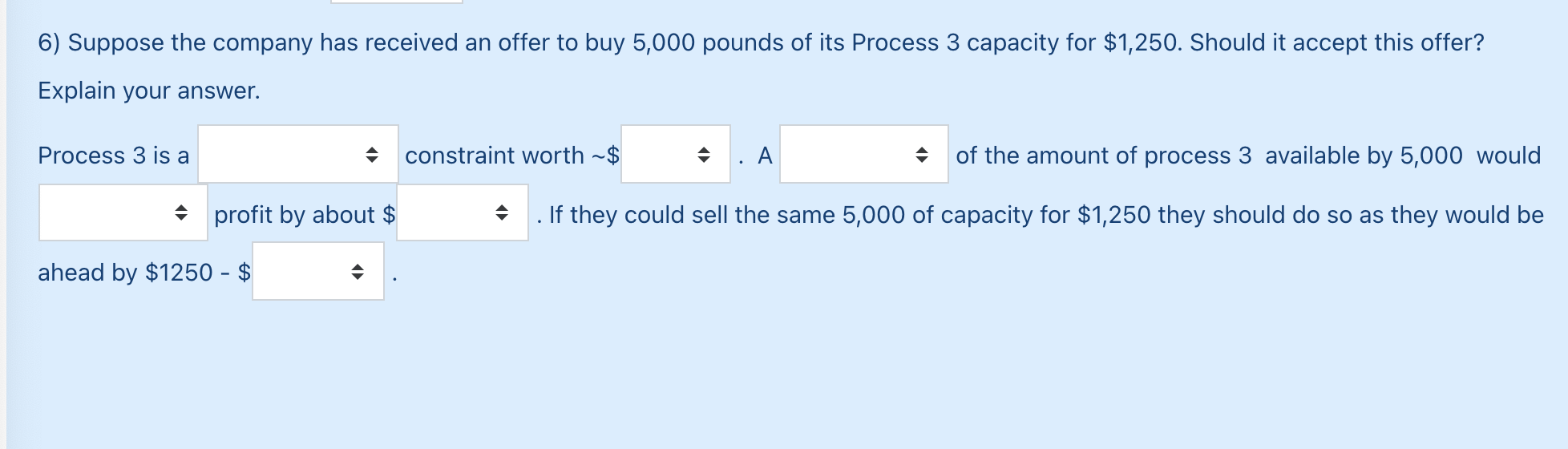

Microsoft Excel Sensitivity Report (Obtained Using Standard LP/Quadratic Engine) Decision Variable Cells Final Reduced Objective Allowable Allowable Cell Name Value Cost Coefficient Increase Decrease $B$6 Product A 23.57142857 0.00 450 300.0000007 50.00000007 $C$6 Product B 15 0.00 1150 42.85714296 714.2857144 $D$6 Product C 40.71428571 0.00 800 100.0000001 16.66666682 $E$6 Product D 0 -7.142857143 400 7.142857143 1E+30 Constraints Final Shadow Constraint Allowable Allowable Cell Name Value Price R.H. Side Increase Decrease $F$10 Process 1 Used 6,000 0.428571 6000 1500 2590.909091 $F$11 Process 2 Used 7,500 7.142857 7500 3300 1500 $F$12 Process 3 Used 30,000 0.142857 30000 27333.33333 8250 $F$13 Process 4 Used 33,214 0.000000 62500 1E+30 29285.71429 ABC Corp produces 4 different types of products. Each type of product is made by 4 processes. The following table summarizes the required amount of process time required to produce 50 units of each type of product (which is known as a pallet): Resources Required per pallet of product Product Type A B D Process 1 50 50 100 50 Process 2 50 150 100 50 Process 3 500 400 300 200 Process 4 500 750 250 500 Assume the company has 6,000 process 1; 7,500 of process 2; 30,000 of process 3; and 62,500 of process 4 available in the next production cycle. Further assume that each pallet of A, B, C, and D panels can be sold for profits of $450, $1,150, $800, and $400, respectively. Finally, for marketing purposes, the company wants to produce at least 4 pallets of each type of product. You have been given the Sensitivity Analysis for this problem. Answer the following questions. 1) Is the solution unique? Yes 2) Is the solution degenerate? No 3) Suppose the profit of Product A went down by $40. Would the optimal solution change? Yes 1 the price on Product A can decrease by $ 0 and the optimal solution would not change. 4) Supposed the profit per pallet of Product D went up by $40. Would the optimal solution change? the allowable on the profit coefficient for pallets of Product Dis $ so the solution would change. 5) How much should the company be willing to pay to obtain 1,000 additional hours of Process 2 capacity? Process 2 is a constraint with a shadow price of -$ and an allowable of 3,300. They should be willing to pay -$ to obtain the 1,000 additional hours of Process 2 capacity. 6) Suppose the company has received an offer to buy 5,000 pounds of its Process 3 capacity for $1,250. Should it accept this offer? Explain your answer. 6) Suppose the company has received an offer to buy 5,000 pounds of its Process 3 capacity for $1,250. Should it accept this offer? Explain your answer. Process 3 is a constraint worth ~$ A of the amount of process 3 available by 5,000 would profit by about $ . If they could sell the same 5,000 of capacity for $1,250 they should do so as they would be ahead by $1250 - $ Microsoft Excel Sensitivity Report (Obtained Using Standard LP/Quadratic Engine) Decision Variable Cells Final Reduced Objective Allowable Allowable Cell Name Value Cost Coefficient Increase Decrease $B$6 Product A 23.57142857 0.00 450 300.0000007 50.00000007 $C$6 Product B 15 0.00 1150 42.85714296 714.2857144 $D$6 Product C 40.71428571 0.00 800 100.0000001 16.66666682 $E$6 Product D 0 -7.142857143 400 7.142857143 1E+30 Constraints Final Shadow Constraint Allowable Allowable Cell Name Value Price R.H. Side Increase Decrease $F$10 Process 1 Used 6,000 0.428571 6000 1500 2590.909091 $F$11 Process 2 Used 7,500 7.142857 7500 3300 1500 $F$12 Process 3 Used 30,000 0.142857 30000 27333.33333 8250 $F$13 Process 4 Used 33,214 0.000000 62500 1E+30 29285.71429 ABC Corp produces 4 different types of products. Each type of product is made by 4 processes. The following table summarizes the required amount of process time required to produce 50 units of each type of product (which is known as a pallet): Resources Required per pallet of product Product Type A B D Process 1 50 50 100 50 Process 2 50 150 100 50 Process 3 500 400 300 200 Process 4 500 750 250 500 Assume the company has 6,000 process 1; 7,500 of process 2; 30,000 of process 3; and 62,500 of process 4 available in the next production cycle. Further assume that each pallet of A, B, C, and D panels can be sold for profits of $450, $1,150, $800, and $400, respectively. Finally, for marketing purposes, the company wants to produce at least 4 pallets of each type of product. You have been given the Sensitivity Analysis for this problem. Answer the following questions. 1) Is the solution unique? Yes 2) Is the solution degenerate? No 3) Suppose the profit of Product A went down by $40. Would the optimal solution change? Yes 1 the price on Product A can decrease by $ 0 and the optimal solution would not change. 4) Supposed the profit per pallet of Product D went up by $40. Would the optimal solution change? the allowable on the profit coefficient for pallets of Product Dis $ so the solution would change. 5) How much should the company be willing to pay to obtain 1,000 additional hours of Process 2 capacity? Process 2 is a constraint with a shadow price of -$ and an allowable of 3,300. They should be willing to pay -$ to obtain the 1,000 additional hours of Process 2 capacity. 6) Suppose the company has received an offer to buy 5,000 pounds of its Process 3 capacity for $1,250. Should it accept this offer? Explain your answer. 6) Suppose the company has received an offer to buy 5,000 pounds of its Process 3 capacity for $1,250. Should it accept this offer? Explain your answer. Process 3 is a constraint worth ~$ A of the amount of process 3 available by 5,000 would profit by about $ . If they could sell the same 5,000 of capacity for $1,250 they should do so as they would be ahead by $1250 - $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts