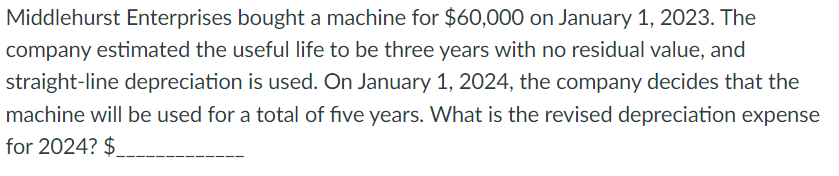

Question: Middlehurst Enterprises bought a machine for $ 6 0 , 0 0 0 on January 1 , 2 0 2 3 . The company estimated

Middlehurst Enterprises bought a machine for $ on January The company estimated the useful life to be three years with no residual value, and straightline depreciation is used. On January the company decides that the machine will be used for a total of five years. What is the revised depreciation expense for

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock