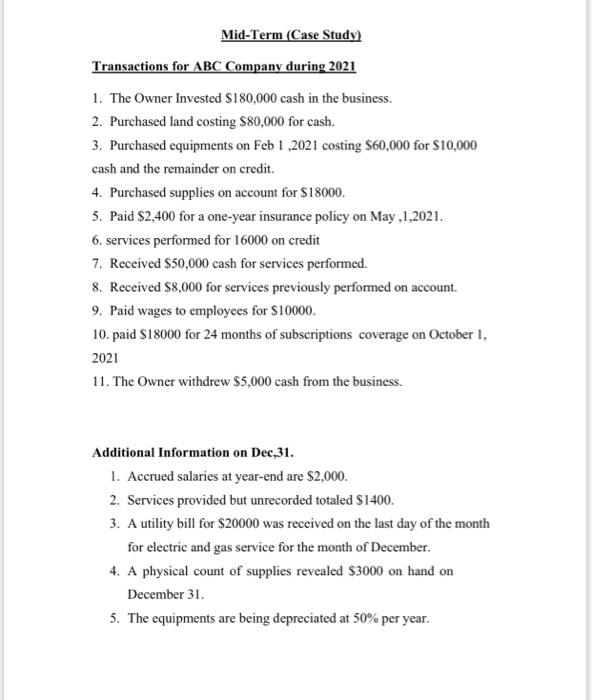

Question: Mid-Term (Case Study) Transactions for ABC Company during 2021 1. The Owner Invested $180,000 cash in the business. 2. Purchased land costing $80,000 for cash.

Mid-Term (Case Study) Transactions for ABC Company during 2021 1. The Owner Invested $180,000 cash in the business. 2. Purchased land costing $80,000 for cash. 3. Purchased equipments on Feb 1,2021 costing $60,000 for $10,000 cash and the remainder on credit. 4. Purchased supplies on account for $18000. 5. Paid $2,400 for a one-year insurance policy on May , 1,2021. 6. services performed for 16000 on credit 7. Received $50,000 cash for services performed. 8. Received $8,000 for services previously performed on account. 9. Paid wages to employees for $10000. 10. paid $18000 for 24 months of subscriptions coverage on October 1 , 2021 11. The Owner withdrew $5,000 cash from the business. Additional Information on Dec,31. 1. Accrued salaries at year-end are $2,000. 2. Services provided but unrecorded totaled $1400. 3. A utility bill for $20000 was received on the last day of the month for electric and gas service for the month of December. 4. A physical count of supplies revealed $3000 on hand on December 31 . 5. The equipments are being depreciated at 50% per year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts