Question: Midterm One Practice Questions Question 1: Kate works for Priority Packaging in Alberta and is paid $987.98 weekly. She contributes 4% of her gross earnings

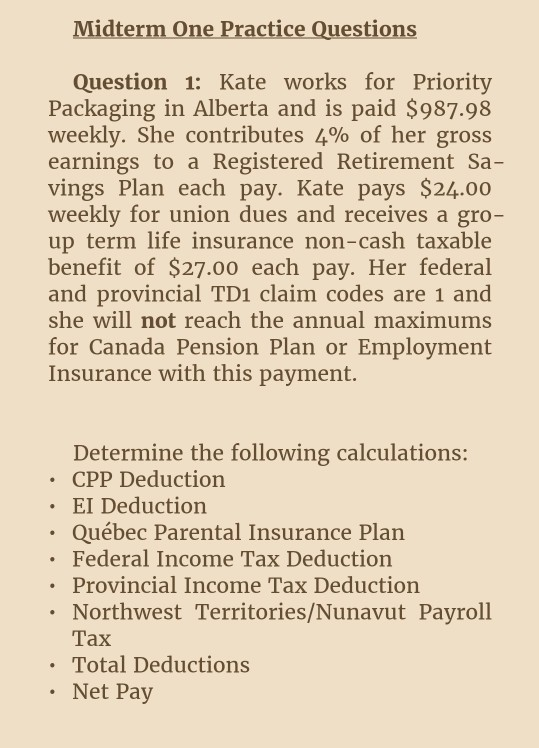

Midterm One Practice Questions Question 1: Kate works for Priority Packaging in Alberta and is paid $987.98 weekly. She contributes 4% of her gross earnings to a Registered Retirement Sa- vings Plan each pay. Kate pays $24.00 weekly for union dues and receives a gro- up term life insurance non-cash taxable benefit of $27.00 each pay. Her federal and provincial TD1 claim codes are 1 and she will not reach the annual maximums for Canada Pension Plan or Employment Insurance with this payment. Determine the following calculations: CPP Deduction EI Deduction Qubec Parental Insurance Plan Federal Income Tax Deduction Provincial Income Tax Deduction Northwest Territories/Nunavut Payroll Tax Total Deductions Net Pay

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts