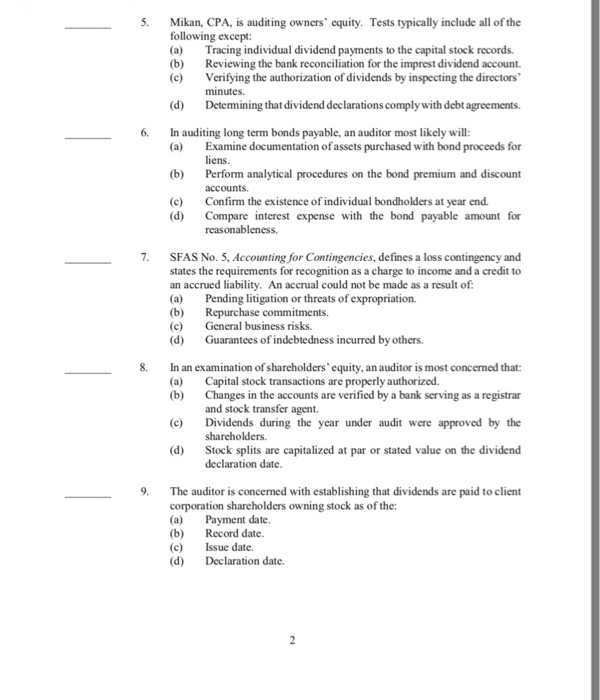

Question: . Mikan, CPA, is auditing owners' equity. Tests typically include all of the following except: (aTracing individual dividend payments to the capital stock records. (b)

. Mikan, CPA, is auditing owners' equity. Tests typically include all of the following except: (aTracing individual dividend payments to the capital stock records. (b) Reviewing the bank reconciliation for the imprest dividend account. (c) Verifying the authorization of dividends by inspecting the directors minutes. d Detemining that dividend declarations comply with debt agreements. 6. In auditing long term bonds payable, an auditor most likely will: (a Examine documentation of assets purchased with bond proceeds for liens Perform analytical procedures on the bond premium and discount accounts. (b) (c) Confirm the existence of individual bondholders at year end. (d Compare interest expense with the bond payable amount for 7. SFAS No. 5, Accounting for Contingencies, defines a loss contingency and states the requirements for recognition as a charge to income and a credit to an accrued liability. An accrual could not be made as a result of (a) Pending litigation or threats of expropriation. (b) Repurchase commitments. (c) General business risks. d Garantees of indebtedness incurred by others. 8. In an examination of shareholders'equity, an auditor is most concerned that: (a Capital stock transactions are properly authorized. (b) Changes in the accounts are verified by a bank serving as a registrar and stock transfer agent shareholders. declaration date c Dividends during the year under audit were approved by the d Stock splits are capitalized at par or stated value on the dividend 9. The auditor is concerned with establishing that dividends are paid to client corporation shareholders owning stock as of the: (a) Payment date. (b) Record date (c) Issue date. (d) Declaration date

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts