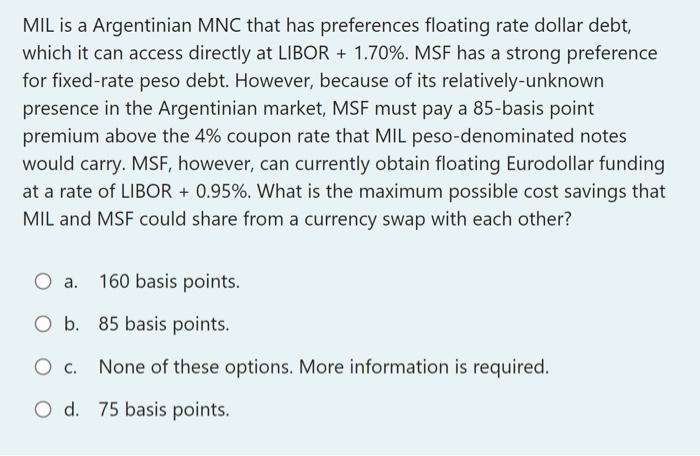

Question: MIL is a Argentinian MNC that has preferences floating rate dollar debt, which it can access directly at LIBOR + 1.70%. MSF has a strong

MIL is a Argentinian MNC that has preferences floating rate dollar debt, which it can access directly at LIBOR + 1.70%. MSF has a strong preference for fixed-rate peso debt. However, because of its relatively-unknown presence in the Argentinian market, MSF must pay a 85-basis point premium above the 4% coupon rate that MIL peso-denominated notes would carry. MSF, however, can currently obtain floating Eurodollar funding at a rate of LIBOR +0.95%. What is the maximum possible cost savings that MIL and MSF could share from a currency swap with each other? O a. 160 basis points. O b. 85 basis points. None of these options. More information is required. O d. 75 basis points

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts