Question: MILESTONE IV: PART I. Intangible Assets, Amortization under GAAP [ Learning Objectives 6 , 7 ] Hein Technologies conducted the following cash transactions on January

MILESTONE IV:

PART I. Intangible Assets, Amortization under GAAP Learning Objectives

Hein Technologies conducted the following cash transactions on January

Paid $ to fund internal research designed to develop a new digital scanner. The company expects the useful life to be years.

Patented a product based on internal research that could be sold to consumers. Before applying for the patent, incurred additional costs of $ to complete product development ensuring that the product was technologically feasible. Paid $ for patent filing costs and legal fees to successfully defend the patent. The company expects the new technology will be profitable for a year period.

Leased three floors of office space. The lease was secured by making an advance payment of $ The lease is a year lease with no renewal options.

Paid $ to renovate the leased property to prepare the leased floors for intended use. The useful life of the renovations is estimated at years.

Paid $ to acquire a franchise to distribute ICC external hard drives for a year period.

DELIVERABLES

A Prepare the journal entries to record each of the transactions.

B Assume that Hein acquired Dolan Development last year. Hein recorded the following intangible assets on the date of acquisition:

Goodwill, $

Dolan Development trademark, $

Renewable licenses, $

Prepare the yearend adjusting entries required for each of Heins intangible assets. Assume that the straightline method is used and a full years amortization is taken in the year of acquisition.

C Indicate the effects of these transactions on the current yearend income statement, balance sheet excluding the effect on the cash balance and cash flow statement using the direct and the indirect methods.

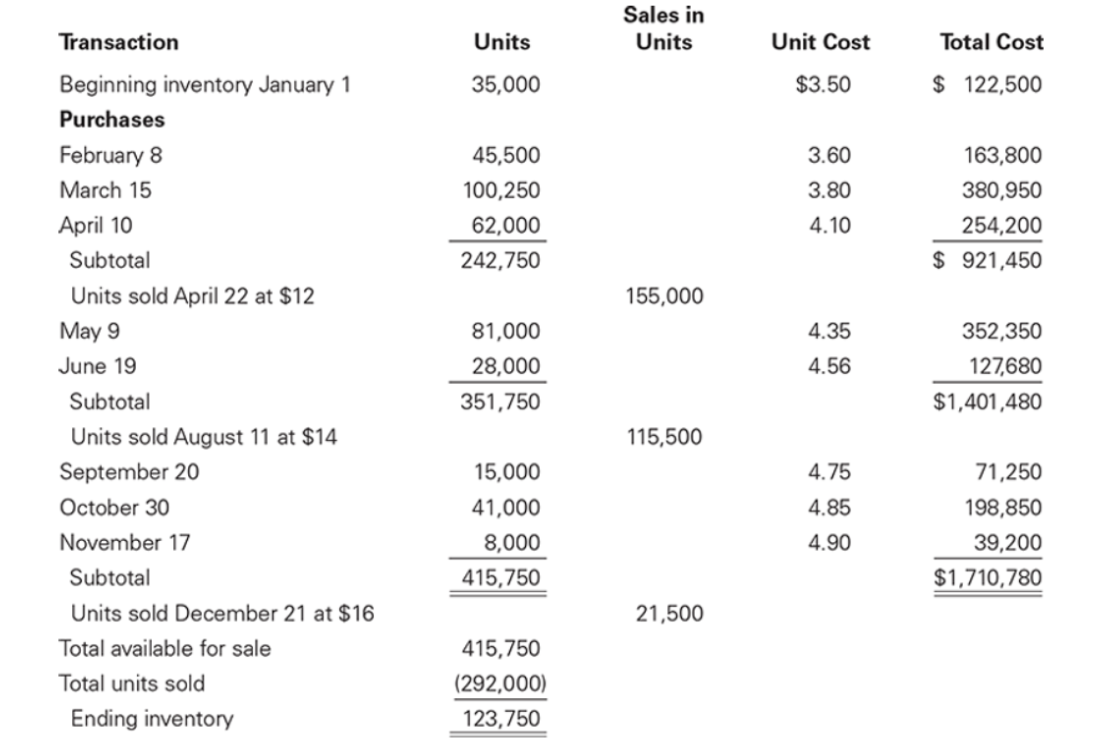

IMAGES below should show important information on what I want within your answer the first image is just information, the second is for deliverable A the second two images are for deliverable B then the last image is for deliverable C THANK YOU

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock