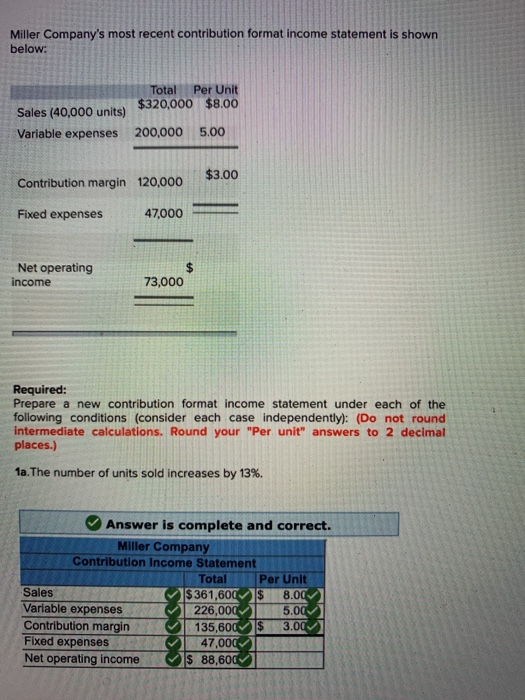

Question: Miller Company's most recent contribution format income statement is shown below: Total Per Unit Sales (40,000 units) $320,000 $8.00 Variable expenses 200,000 5.00 $3.00 Contribution

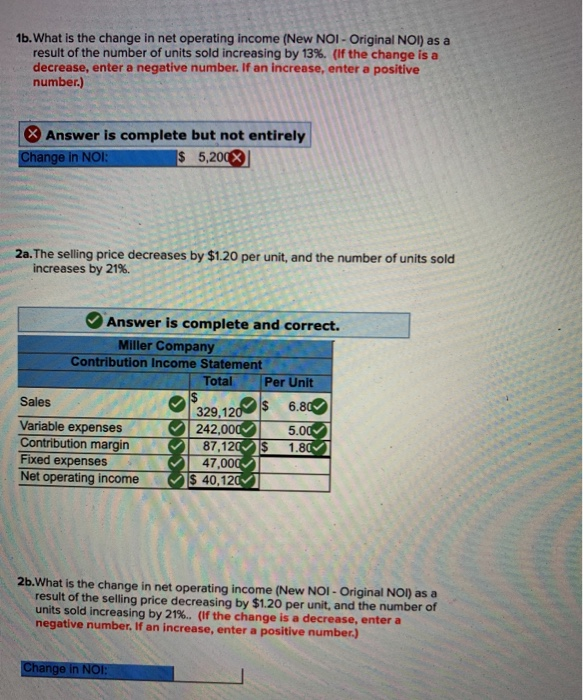

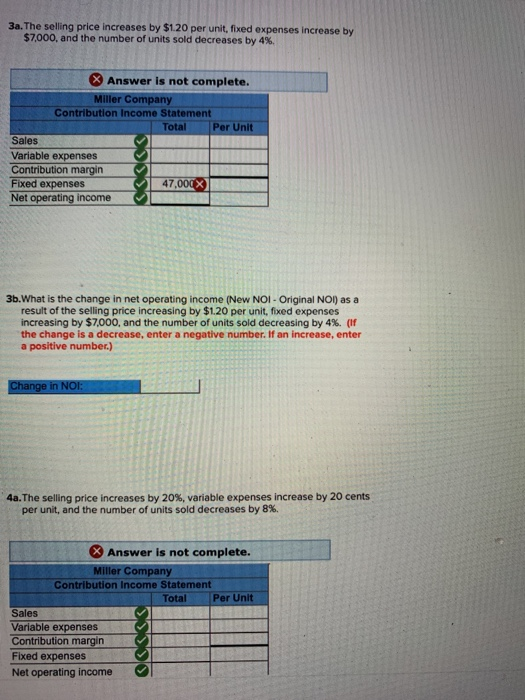

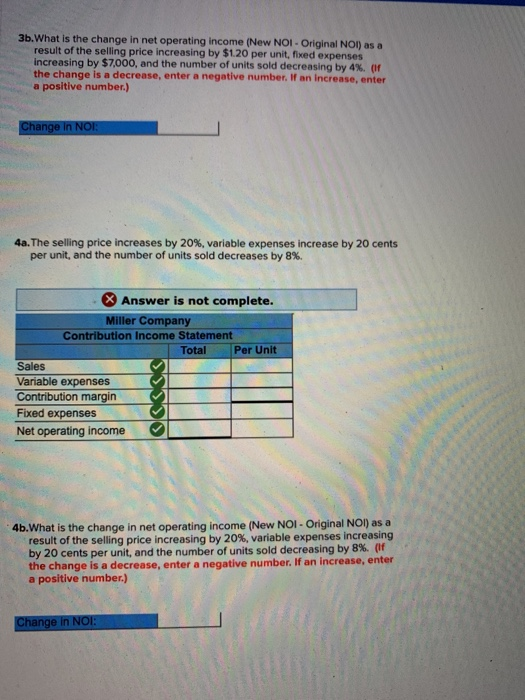

Miller Company's most recent contribution format income statement is shown below: Total Per Unit Sales (40,000 units) $320,000 $8.00 Variable expenses 200,000 5.00 $3.00 Contribution margin 120,000 Fixed expenses 47,000 $ Net operating income 73,000 Required: Prepare a new contribution format income statement under each of the following conditions (consider each case independently): (Do not round intermediate calculations. Round your "Per unit" answers to 2 decimal places.) 1a. The number of units sold increases by 13%. Answer is complete and correct. Miller Company Contribution Income Statement Total Per Unit Sales $361,600 $ 8.00 Variable expenses 226,000 5.00 Contribution margin 135,600 $ 3.00 Fixed expenses 47,000 Net operating income $ 88,600 1b. What is the change in net operating income (New NOI - Original NOI) as a result of the number of units sold increasing by 13%. (If the change is a decrease, enter a negative number. If an increase, enter a positive number.) X Answer is complete but not entirely Change in NOI: $ 5,200X 2a. The selling price decreases by $1.20 per unit, and the number of units sold increases by 21% Answer is complete and correct. Miller Company Contribution Income Statement Total Per Unit Sales $ 329,120 Variable expenses 242,000V 5.00 Contribution margin 87,120$ 1.80 Fixed expenses 47,000 Net operating income $ 40,120 6.80 2b. What is the change in net operating income (New NOI - Original NOI) as a result of the selling price decreasing by $1.20 per unit, and the number of units sold increasing by 21%.. (If the change is a decrease, enter a negative number. If an increase, enter a positive number.) Change in NOI: 3a. The selling price increases by $1.20 per unit, fixed expenses increase by $7,000, and the number of units sold decreases by 4% Answer is not complete. Miller Company Contribution Income Statement Total Per Unit Sales Variable expenses Contribution margin Fixed expenses 47,000 X Net operating income 36.What is the change in net operating income (New NOI - Original NOI) as a result of the selling price increasing by $1.20 per unit, fixed expenses increasing by $7,000, and the number of units sold decreasing by 4%. (1f the change is a decrease, enter a negative number. If an increase, enter a positive number.) Change in NOI: 4a. The selling price increases by 20%, variable expenses increase by 20 cents per unit, and the number of units sold decreases by 8%. Answer is not complete. Miller Company Contribution Income Statement Total Per Unit Sales Variable expenses Contribution margin Fixed expenses Net operating income solos 3b. What is the change in net operating income (New NOI - Original NOI) as a result of the selling price increasing by $1.20 per unit, fixed expenses increasing by $7,000, and the number of units sold decreasing by 4%. If the change is a decrease, enter a negative number. If an increase, enter a positive number.) Change in NOI: 4a. The selling price increases by 20%, variable expenses increase by 20 cents per unit, and the number of units sold decreases by 8%. Answer is not complete. Miller Company Contribution Income Statement Total Per Unit Sales Variable expenses Contribution margin Fixed expenses Net operating income 4b.What is the change in net operating income (New NOI - Original Nol) as a result of the selling price increasing by 20%, variable expenses increasing by 20 cents per unit, and the number of units sold decreasing by 8% (f the change is a decrease, enter a negative number. If an increase, enter a positive number.) Change in NOI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts