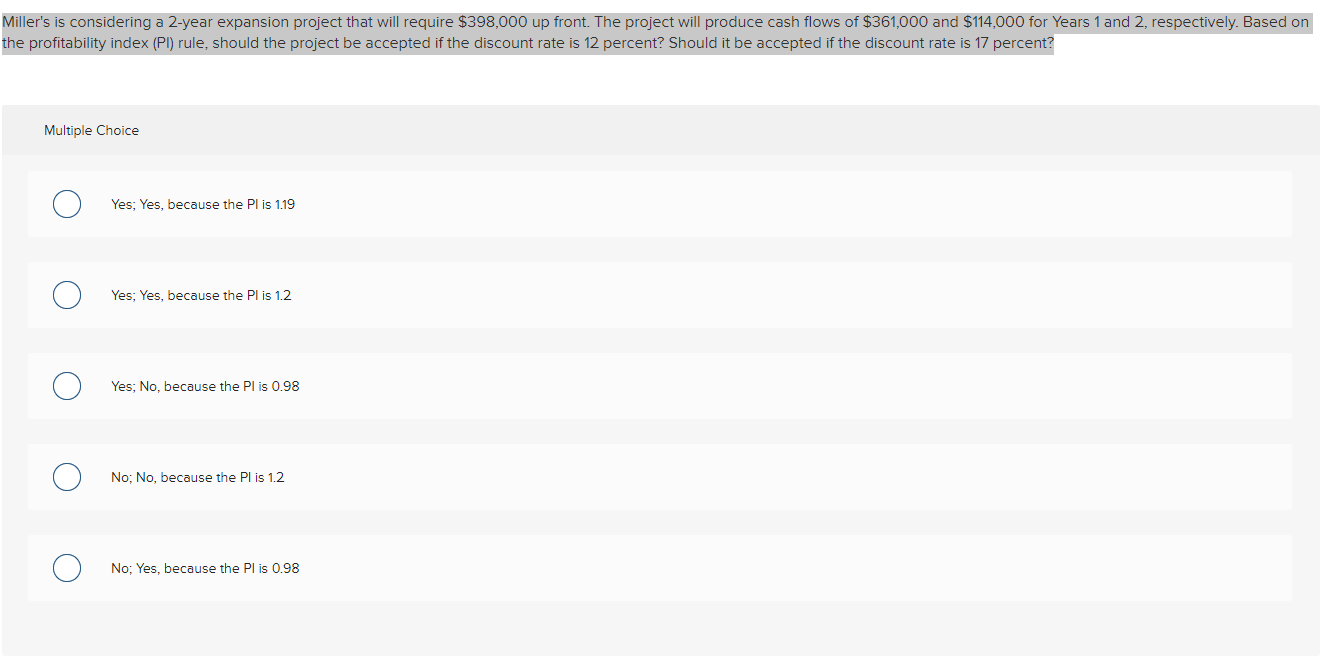

Question: Miller's is considering a 2-year expansion project that will require $398,000 up front. The project will produce cash flows of $361,000 and $114,000 for Years

Miller's is considering a 2-year expansion project that will require $398,000 up front. The project will produce cash flows of $361,000 and $114,000 for Years 1 and 2, respectively. Based on the profitability index (PI) rule, should the project be accepted if the discount rate is 12 percent? Should it be accepted if the discount rate is 17 percent? Multiple Choice Yes; Yes, because the Pl is 1.19 O O Yes; Yes, because the Pl is 1.2 Yes; No, because the Pl is 0.98 No; No, because the Pl is 1.2 No; Yes, because the Pl is 0.98 O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts