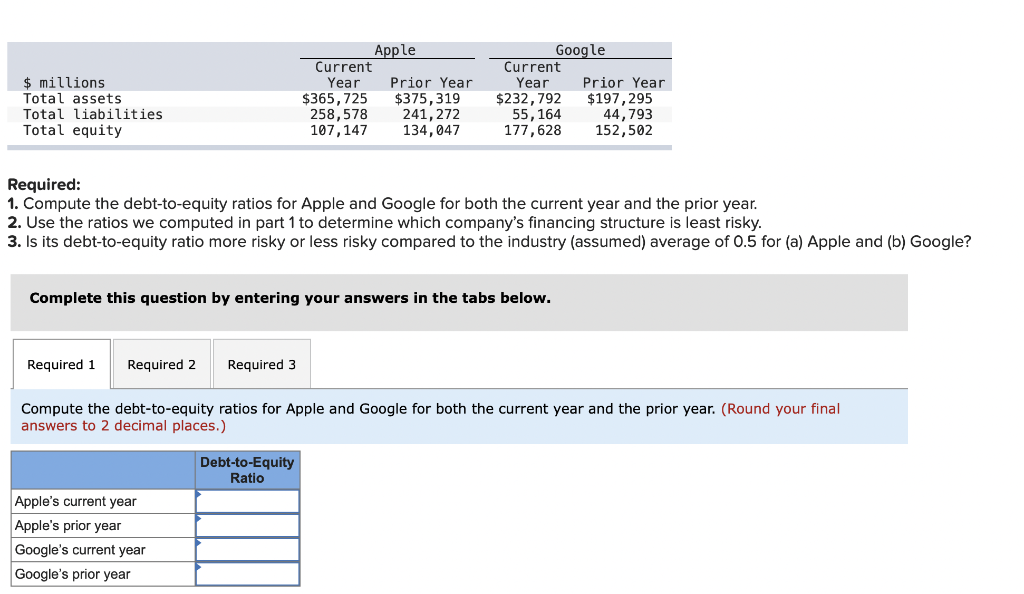

Question: $ millions Total assets Total liabilities Total equity Apple Current Year Prior Year $365,725 $375, 319 258,578 241, 272 107, 147 134,047 Google Current Year

$ millions Total assets Total liabilities Total equity Apple Current Year Prior Year $365,725 $375, 319 258,578 241, 272 107, 147 134,047 Google Current Year Prior Year $232,792 $197, 295 55,164 44,793 177,628 152,502 Required: 1. Compute the debt-to-equity ratios for Apple and Google for both the current year and the prior year. 2. Use the ratios we computed in part 1 to determine which company's financing structure is least risky. 3. Is its debt-to-equity ratio more risky or less risky compared to the industry (assumed) average of 0.5 for (a) Apple and (b) Google? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute the debt-to-equity ratios for Apple and Google for both the current year and the prior year. (Round your final answers to 2 decimal places.) Debt-to-Equity Ratio Apple's current year Apple's prior year Google's current year Google's prior year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts