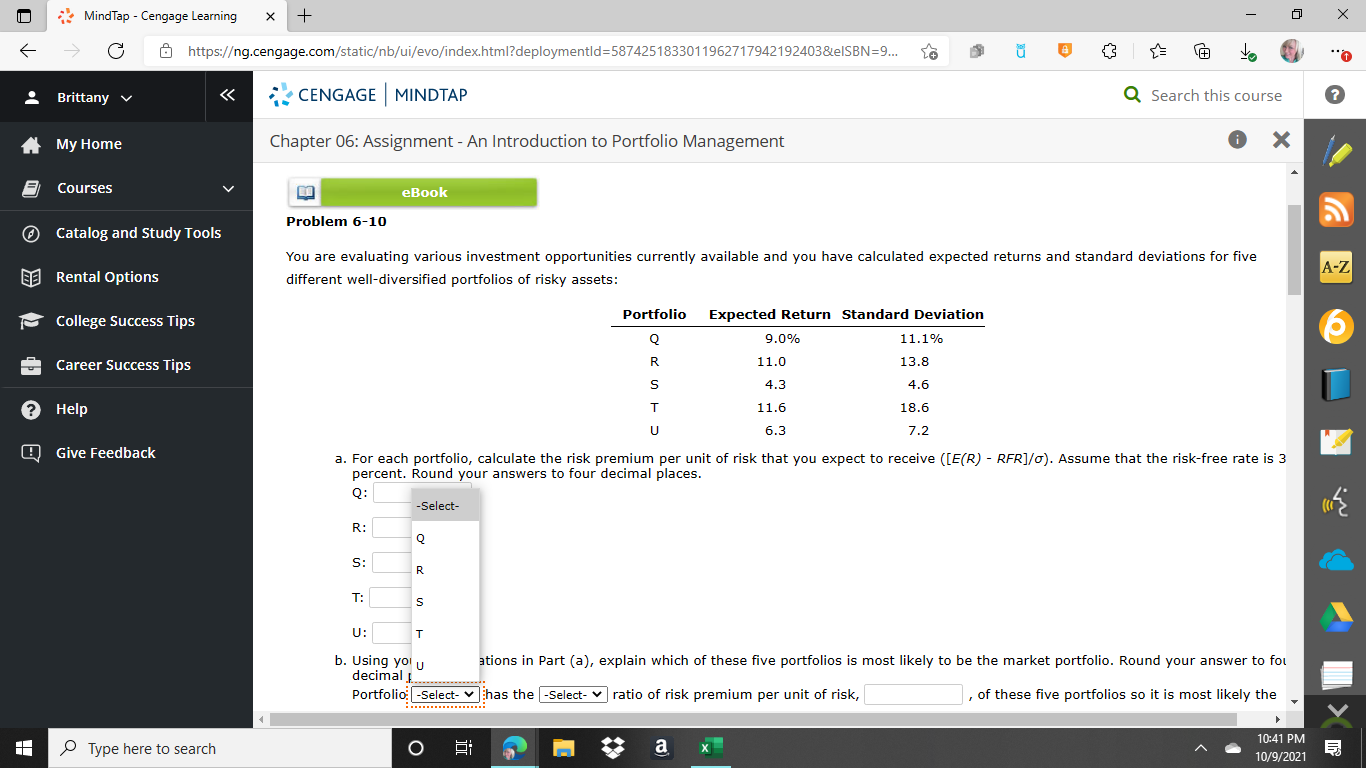

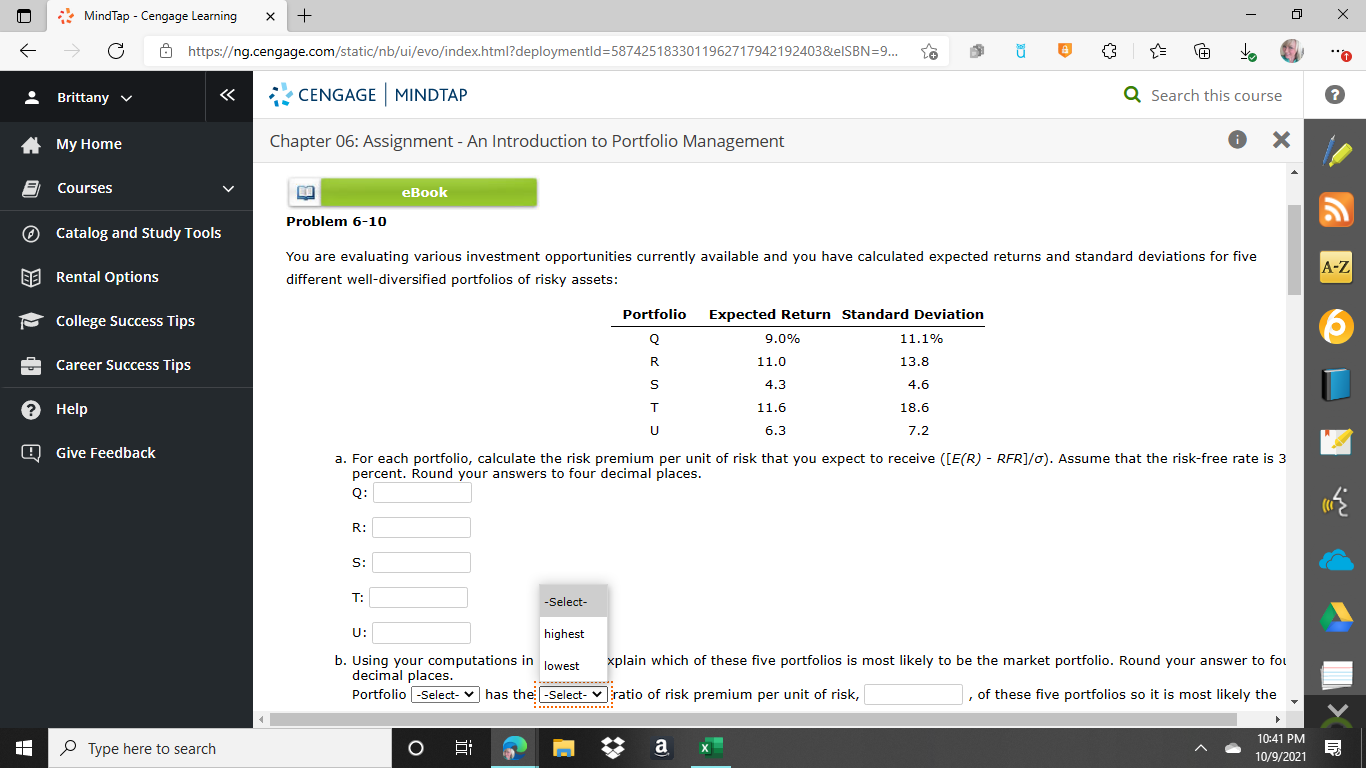

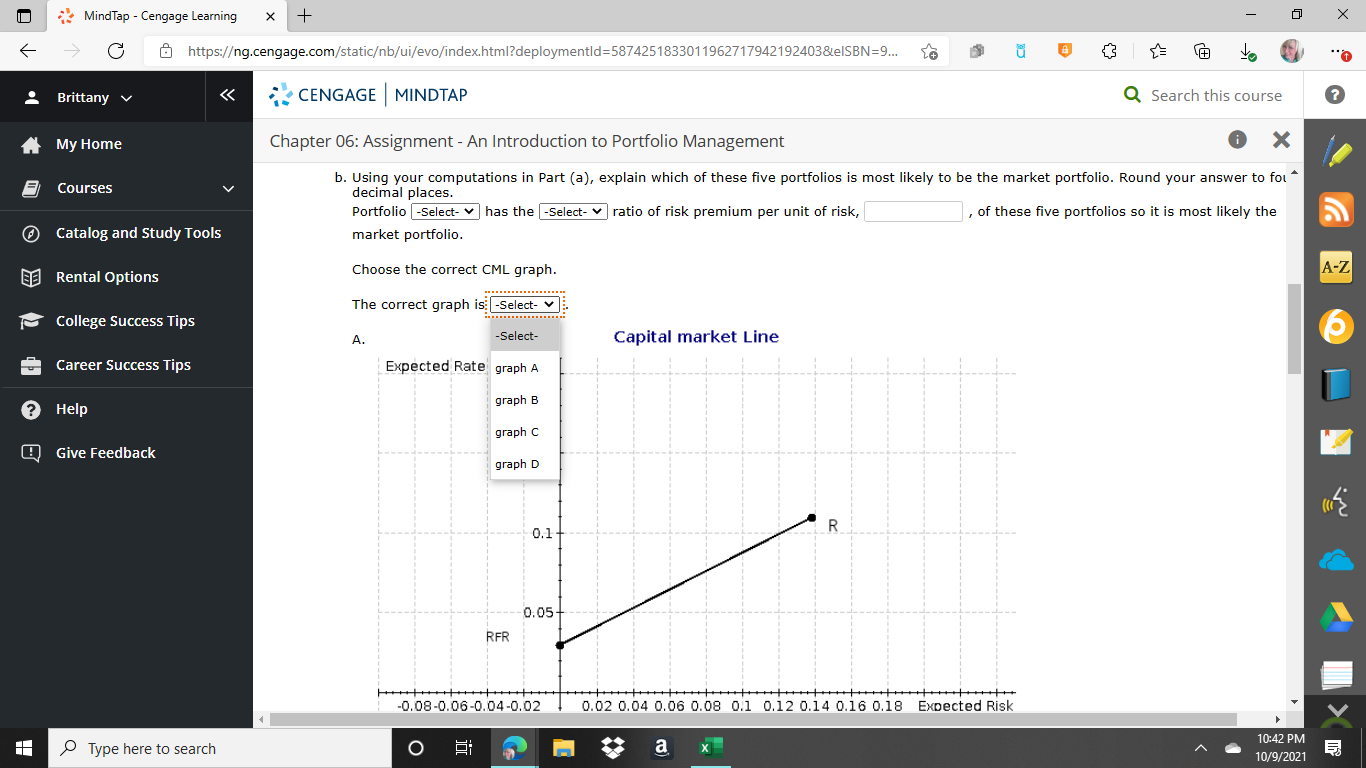

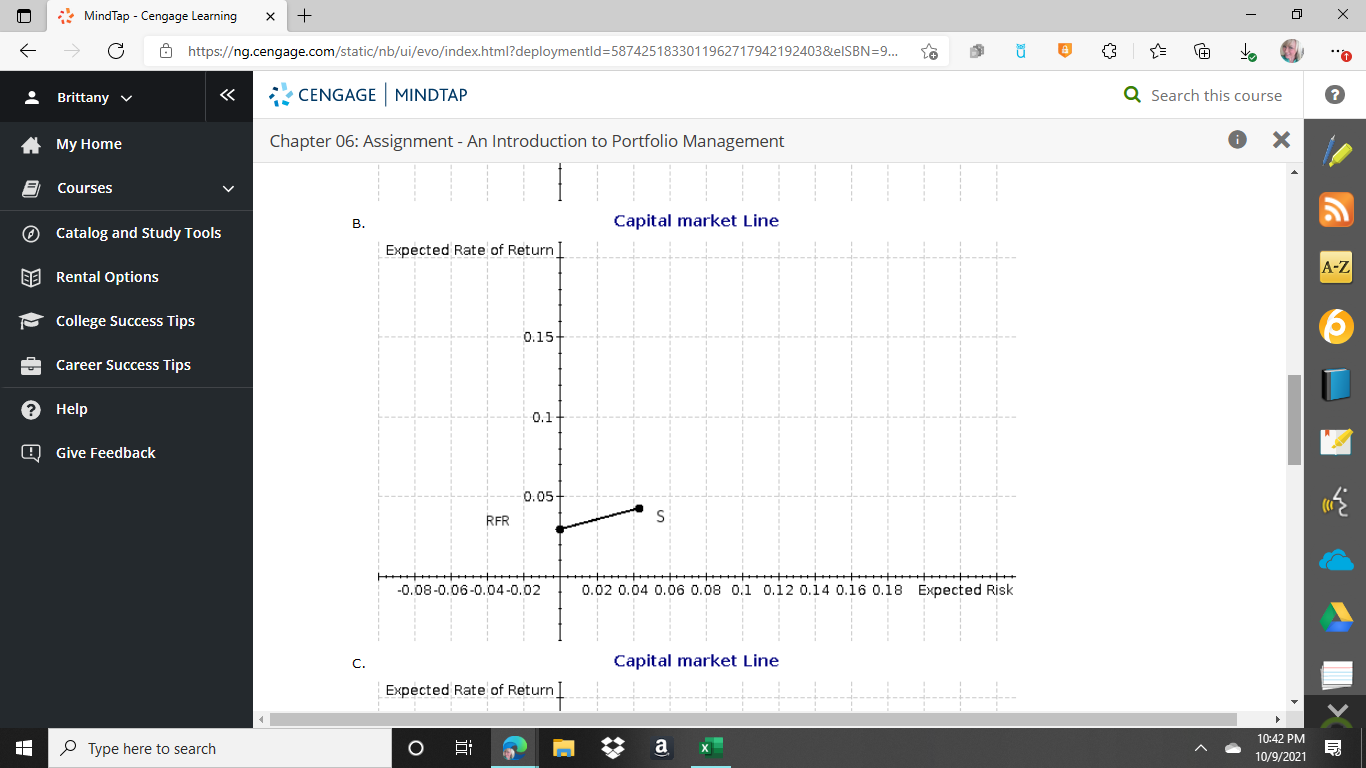

Question: MindTap - Cengage Learning X + X C https:/g.cengage.com/staticb/ui/evo/index.html?deploymentld=5874251833011962717942192403&eISBN=9.. to . Brittany v CENGAGE |MINDTAP Q Search this course ? My Home Chapter 06: Assignment

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock