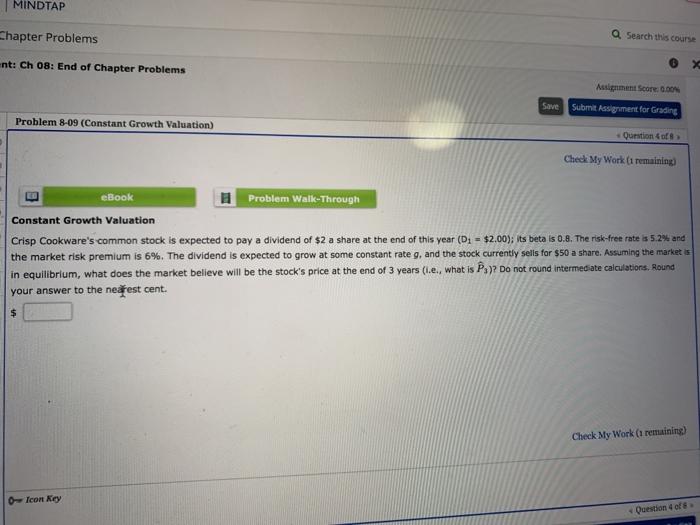

Question: MINDTAP Chapter Problems Q Search this course ent: Ch 08: End of Chapter Problems Assignment Score: 0.004 Save Submit Assignment for Grading Problem 8-09 (Constant

MINDTAP Chapter Problems Q Search this course ent: Ch 08: End of Chapter Problems Assignment Score: 0.004 Save Submit Assignment for Grading Problem 8-09 (Constant Growth Valuation) Question of Check My Work (1 remaining eBook Problem Walk-Through Constant Growth Valuation Crisp Cookware's common stock is expected to pay a dividend of $2 a share at the end of this year (D1 = $2.00); its beta is 0.8. The risk-free rate is 5.2% and the market risk premium is 6%. The dividend is expected to grow at some constant rate 9, and the stock currently sells for $50 a share. Assuming the market is in equilibrium, what does the market believe will be the stock's price at the end of 3 years (.e., what is Psy? Do not round intermediate calculations. Round your answer to the nearest cent. $ Check My Work (1 remaining) 0 Icon Key Question of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts