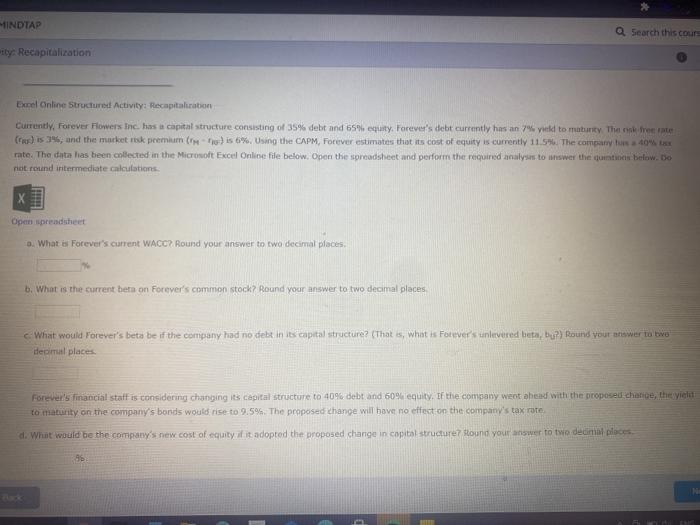

Question: MINDTAP Search this cours ity: Recapitalization Excel Online Structure Activity: Recapitalization Currently, Forever Flowers Inc. has a capital structure consisting of 35% debt and 65%.

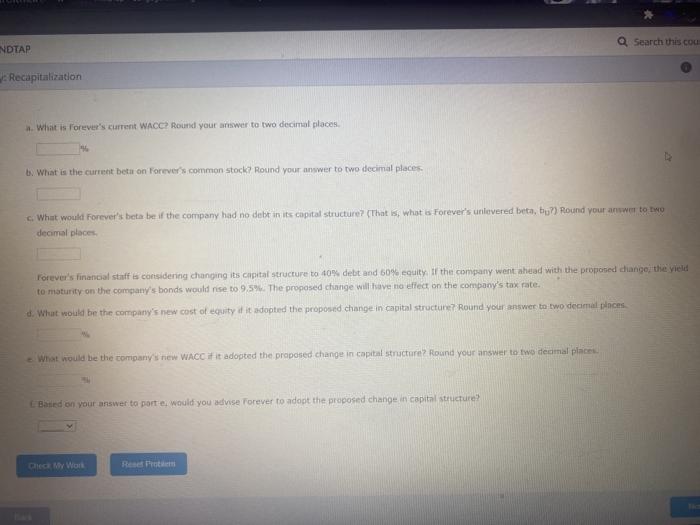

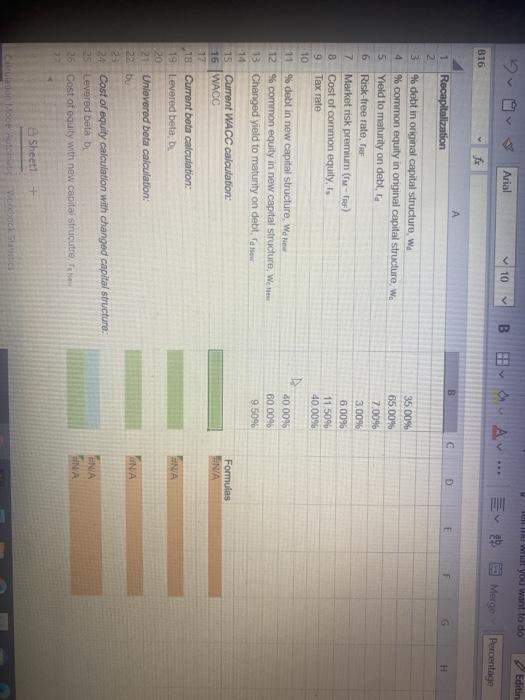

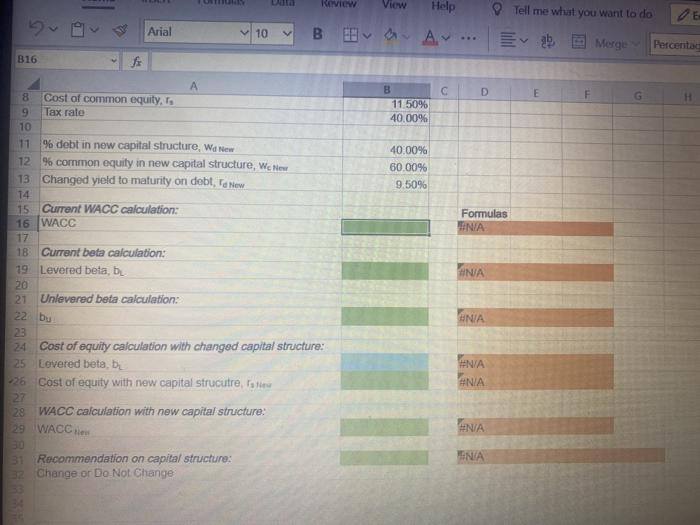

MINDTAP Search this cours ity: Recapitalization Excel Online Structure Activity: Recapitalization Currently, Forever Flowers Inc. has a capital structure consisting of 35% debt and 65%. equity Forever's debt currently has an 7% vk to mounty There ate Cris 3, and the market risk premium (H) is 6%. Using the CAPM, Forever estimates that its cost of equity is currently 11.59. The company un 40% rate. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to swer the qumes below. Do not found intermediate calculations Open spreadsheet 0. What is Forever's current WACC Round your answer to two decimal places. b. What is the current here on Forever's common stock? Round your answer to two decimal places What would Forever's beta be if the company had no debt in its capital structure? That is what is Forever's unlevered bta, bu?) Round your answer to two decimal places Forever's financial staff is considering changing its capital structure to 40% debt and 60% equity. If the company went ahead with the proposed change the to maturity on the company's bonds would rise to 9.5%. The proposed change will have no effect on the company's tax rate d. What would be the company's new cost of equity if it adopted the proposed change in capital structure Sound your answer to two dedimo ploces a Search this cou NDTAP Recapitalization What is Forever's current WACC Round your answer to two decimal places b. What is the current beton Forever's common stock Round your answer to two decimal places c. What would Forever's beta be if the company had no debt in its capital structure? (That is what is Forever's unlevered beta, bu?) Round your answer to two decimal places Forever's financial staff is considering changing its capital structure to 40 debit and 60% equity if the company went ahead with the proposed diango, the yield to maturity on the company's bonds would rise to 9.59. The proposed change will have no effect on the company's tax rate. d. What would be the company's new cost of equity if it adopted the proposed change in capital structure? Round your answer to two decimal places What would be the company's new WACC fit adopted the proposed change in capital structure? Round your answer to two decal places Based on your answer to porte, would you wise forever to adopt the proposed change in capital structure Ce My Wor will you want to do Editin Arial V10 B Av ... Merge Percentage B16 fo B G D E G H 35.00% 65.00% 7.00% 3.00% 6.00% 11 5096 40.0096 A 1. Rocapitalization 2 3 % dobt in original capital structure, Wa 4 % common equity in onginal capital structure, Wa 5 Yield to maturity on debt, 6 Risk-free rate. The 7 Market risk premium (F) 8 Cost of common equity's 9 Tax rate 10 11 % debt in new capital structure. We new 12 % common equity in new capital structure, When 13 Changed yield to maturity on debt, la 14 15 Current WACC calculation: 16 WACC 17 18 Current bota calculation: 19. Levered beta, b 20 21 Unlevered beta calculation: 22 Du 23 24 Cost of equity calculation with changed capital structure. 25 Levered bota be 26 Cost of equity with new capital strucutre, 40.00% 80.0096 9.5096 Formulas ENA ENA NA ENA SINA Sheet1 + Con Me Root Wodock tica Review View Help Tell me what you want to do Arial 10 B EA Merge Percenta B16 f D E B 11 50% 40.00% 40.00% 60.00% 9.50% 8 Cost of common equity, Is 9 Tax rate 10 11 % debt in new capital structure, Wa New 12 % common equity in new capital structure, Wc New 13 Changed yield to maturity on debt. Ta New 14 15 Current WACC calculation: 16 WACC 17 18 Currant beta calculation: 19 Levered beta, bu 20 21 Unlevered beta calculation: Formulas NA NA 22 bu #NIA #N/A 23 24 Cost of equity calculation with changed capital structure: 25 Levered beta.be -26 Cost of equity with new capital strucutre, le 27 28 WACC calculation with new capital structure: 29 WACC #NA #N/A ENIA 31 Recommendation on capital structure: 32 Change or Do Not Change

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts