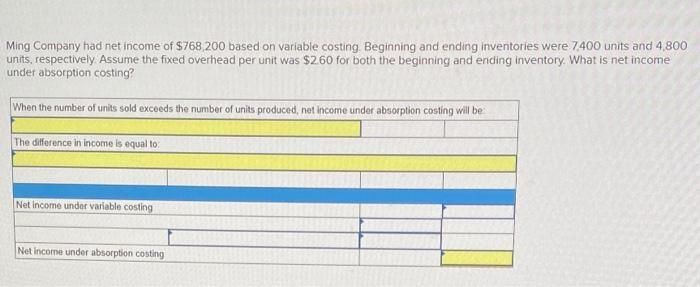

Question: Ming Company had net income of $768 200 based on variable costing Beginning and ending inventories were 7400 units and 4,800 units, respectively. Assume the

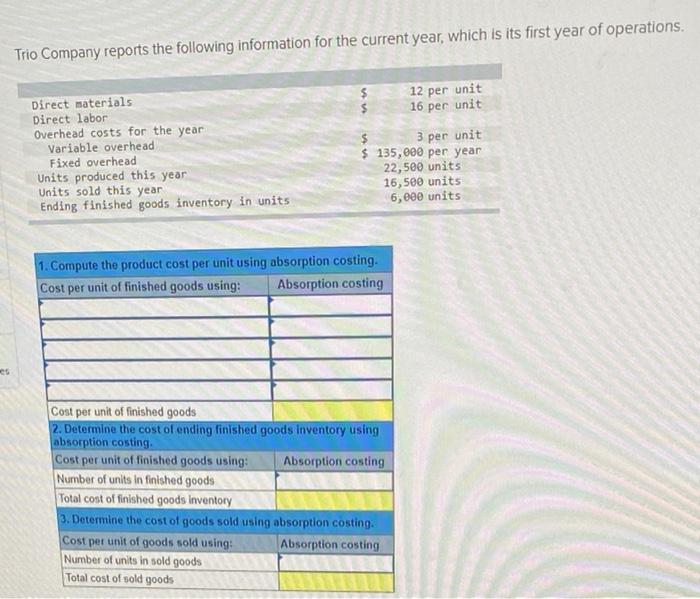

Ming Company had net income of $768 200 based on variable costing Beginning and ending inventories were 7400 units and 4,800 units, respectively. Assume the fixed overhead per unit was $260 for both the beginning and ending inventory. What is net income under absorption costing? When the number of units sold exceeds the number of units produced, net income under absorption costing will be The difference in income is equal to Net Income under variable costing Net Income under absorption costing Trio Company reports the following information for the current year, which is its first year of operations. Direct materials Direct labor Overhead costs for the year Variable overhead Fixed overhead Units produced this year Units sold this year Ending finished goods inventory in units $ 12 per unit $ 16 per unit $ 3 per unit $ 135,000 per year 22,500 units 16,500 units 6,000 units 1. Compute the product cost per unit using absorption costing. Cost per unit of finished goods using: Absorption costing Cost per unit of finished goods 2. Determine the cost of ending finished goods inventory using absorption costing Cost per unit of finished goods using: Absorption costing Number of units in finished goods Total cost of finished goods Inventory 3. Determine the cost of goods sold using absorption costing. Cost per unit of goods sold using: Absorption costing Number of units in sold goods Total cost of sold goods

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts