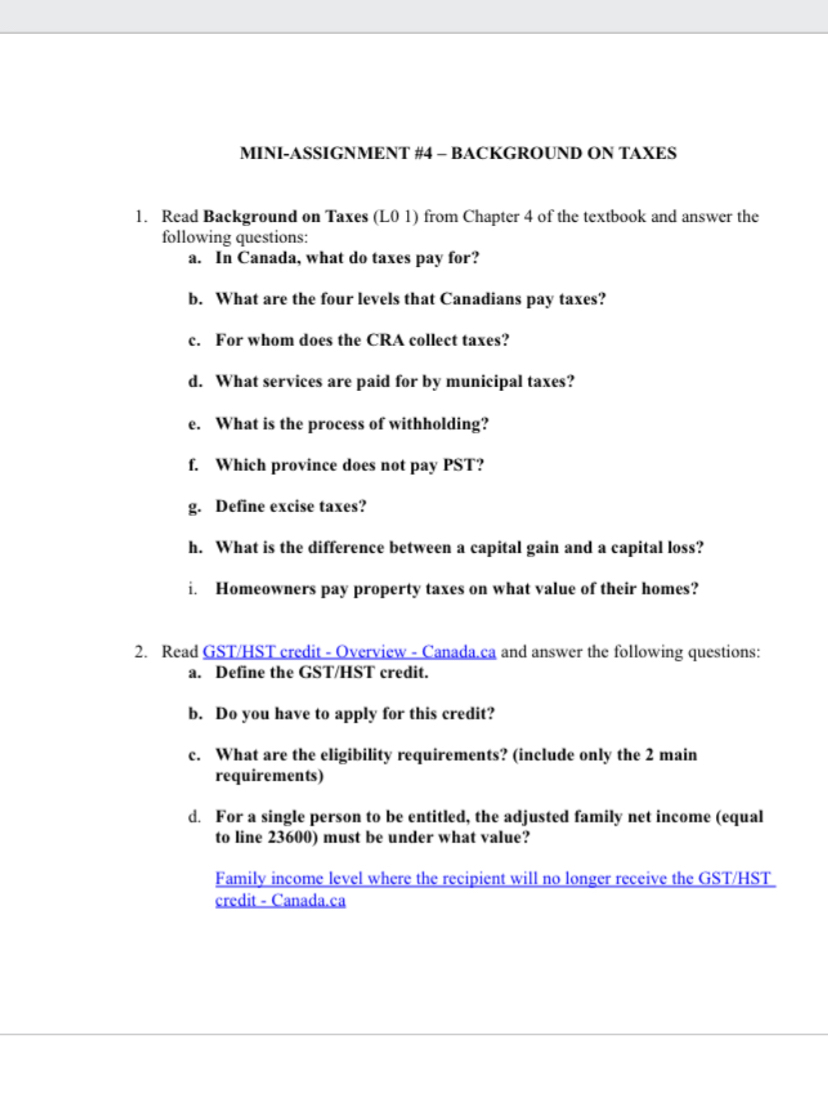

Question: MINI - ASSIGNMENT # 4 - BACKGROUND ON TAXES Read Background on Taxes ( L 0 1 ) from Chapter 4 of the textbook and

MINIASSIGNMENT # BACKGROUND ON TAXES

Read Background on Taxes L from Chapter of the textbook and answer the following questions:

a In Canada, what do taxes pay for?

b What are the four levels that Canadians pay taxes?

c For whom does the CRA collect taxes?

d What services are paid for by municipal taxes?

e What is the process of withholding?

f Which province does not pay PST

g Define excise taxes?

h What is the difference between a capital gain and a capital loss?

i Homeowners pay property taxes on what value of their homes?

Read GSTHST credit Overview

Canada.ca and answer the following questions:

a Define the GSTHST credit.

b Do you have to apply for this credit?

c What are the eligibility requirements? include only the main requirements

d For a single person to be entitled, the adjusted family net income equal to line must be under what value?

Family income level where the recipient will no longer receive the GSTHST credit

Canada.ca

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock