Question: Mini Case 1 Your omployer, a mid-sized human 5 to businesses with temporary heavy workloads. resoures management company, Is considering expansion Into related felds, Including

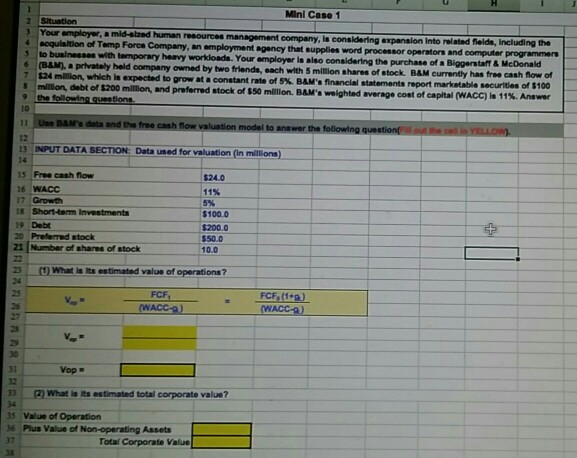

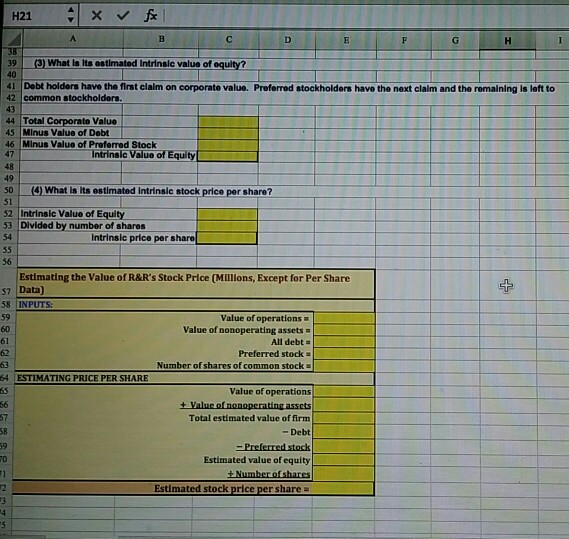

Mini Case 1 Your omployer, a mid-sized human 5 to businesses with temporary heavy workloads. resoures management company, Is considering expansion Into related felds, Including the Your employer is also considering the purchase of Biggerstaff& McDonald of Temp Force Company, an employment agency that supplies word processor operators and computer programmens BAM), privately held company owned by two friends, each with 5 million shares of stock B&M currently has 7 $24 mlilion, which is expected to grow at a constant rate of 5%. B AM's firancial statements report marketable securities of 100 million, debt of $200 mililion, and preferred stock of $50 million. BAM's welghted average cost of capital (WACC) Ie 11%. Answer the following questions 10 h flow valuation model to answer the following question 12 13 INPUT DATA SECTION: Data used for valuation (in millions) 14 15 Free cash flow 16 WAcC $24.0 11% 5% $100.0 Grow $200.0 50.0 10.0 9 Debt Preferred stock 21Number of shares of stock 29--(1) what is its estimated value of operations? FCF WACCA 2 3 2)What is its estimated total corporate value? 35 Value of Operation 36 Plus Value of Non-operating Assets 37 38 Total Corporate Value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts