Question: Mini case 2: Insurance Attached is a cash flow statement and balance sheet for the Johnsons to reflect their lives 7 years since we first

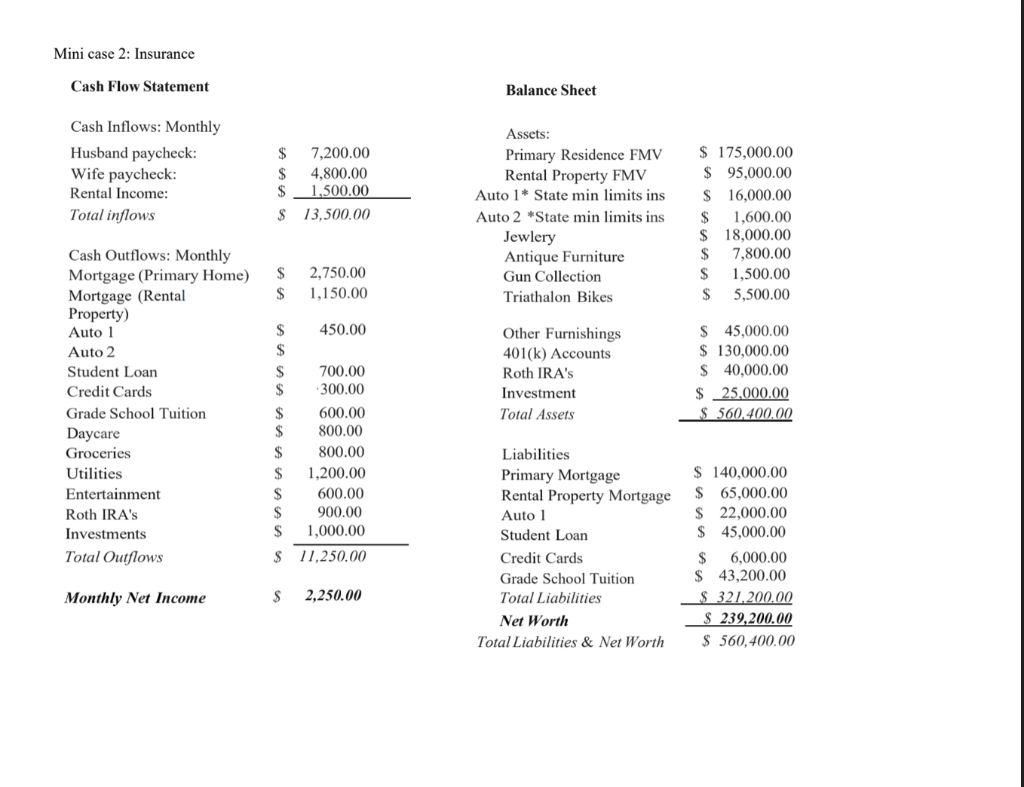

Mini case 2: Insurance Attached is a cash flow statement and balance sheet for the Johnsons to reflect their lives 7 years since we first met them. Please use the information on this document along with the information that you have received in class to develop an insurance portfolio for the Johnsons. The report should let the Johnson's know what kind of coverage they currently have, Where the gaps are, and how they can address these gaps with insurance coverage that you recommend They currently have their primary residence insured for $138,000 and their rental property insured for $100,000. The replacement cost for those dwellings are $225,000 and $160,000 respectively Mr. Johnson does have some short-term disability coverage through his employer, but Mrs. Johnson does not. The Johnson's have a son (Brandon 6) and a Rottweiler dog (Frankie) since we have last met with them. Mrs. Johnson has really gotten into fitness and currently competes in Biathlons (running and biking) while Mr. Johnson loves to deer hunt when in season. They are a happy family, and while they have 1x their salary of life insurance through their employer, that is their only life insurance coverage. Mr. Johnson carries the family's health insurance through his job. They are a little unclear about the coverage they have (70/30, $4000ded/per $8000/family). The Johnson's currently live in Tulsa Oklahoma, they are not in a flood plain and currently a have no sewer backup or earthquake coverage on their property. For this mini case develop an insurance portfolio for the Johnsons: 1. Tell the Johnson's where they currently stand regarding their insurance protection (10 pts) 2. Let them know what gaps in coverage they have (what their risk exposure is) (10 pts) 3. Give them your team's recommendations to close the Gaps you point out in section 2 (15 pts) 4. Justify why your recommendations make sense based on the facts of the their situation. (15 pts) Mini case 2: Insurance Cash Flow Statement Balance Sheet Cash Inflows: Monthly Husband paycheck: Wife paycheck: Rental Income: Total inflows $ 7,200.00 $ 4,800.00 $ 1,500.00 $ 13,500.00 Assets: Primary Residence FMV Rental Property FMV Auto 1* State min limits ins Auto 2 *State min limits ins Jewlery Antique Furniture Gun Collection Triathalon Bikes $ 175,000.00 $ 95,000.00 $ 16,000.00 $ 1,600.00 $ 18,000.00 $ 7,800.00 S 1,500.00 S 5,500.00 2,750.00 1,150.00 $ Cash Outflows: Monthly Mortgage (Primary Home) Mortgage (Rental Property) Auto 1 Auto 2 Student Loan Credit Cards Grade School Tuition Daycare Groceries Utilities Entertainment Roth IRA's Investments Total Outflows Other Furnishings 401(k) Accounts Roth IRA's Investment Total Assets $ 45,000.00 $ 130,000.00 S 40,000.00 $ 25,000.00 S $ 560.400.00 $ 450.00 $ S 700.00 $ 300.00 $ 600.00 $ 800.00 $ 800.00 $ 1,200.00 $ 600.00 S 900.00 S 1.000.00 $ 11.250.00 Liabilities Primary Mortgage Rental Property Mortgage Auto 1 Student Loan Credit Cards Grade School Tuition Total Liabilities Net Worth Total Liabilities & Net Worth $ 140,000.00 $ 65,000.00 S 22,000.00 $ 45,000.00 $ 6,000.00 S 43,200.00 $ 321.200.00 $ 239,200.00 $ 560,400.00 Monthly Net Income $ 2,250.00 Mini case 2: Insurance Attached is a cash flow statement and balance sheet for the Johnsons to reflect their lives 7 years since we first met them. Please use the information on this document along with the information that you have received in class to develop an insurance portfolio for the Johnsons. The report should let the Johnson's know what kind of coverage they currently have, Where the gaps are, and how they can address these gaps with insurance coverage that you recommend They currently have their primary residence insured for $138,000 and their rental property insured for $100,000. The replacement cost for those dwellings are $225,000 and $160,000 respectively Mr. Johnson does have some short-term disability coverage through his employer, but Mrs. Johnson does not. The Johnson's have a son (Brandon 6) and a Rottweiler dog (Frankie) since we have last met with them. Mrs. Johnson has really gotten into fitness and currently competes in Biathlons (running and biking) while Mr. Johnson loves to deer hunt when in season. They are a happy family, and while they have 1x their salary of life insurance through their employer, that is their only life insurance coverage. Mr. Johnson carries the family's health insurance through his job. They are a little unclear about the coverage they have (70/30, $4000ded/per $8000/family). The Johnson's currently live in Tulsa Oklahoma, they are not in a flood plain and currently a have no sewer backup or earthquake coverage on their property. For this mini case develop an insurance portfolio for the Johnsons: 1. Tell the Johnson's where they currently stand regarding their insurance protection (10 pts) 2. Let them know what gaps in coverage they have (what their risk exposure is) (10 pts) 3. Give them your team's recommendations to close the Gaps you point out in section 2 (15 pts) 4. Justify why your recommendations make sense based on the facts of the their situation. (15 pts) Mini case 2: Insurance Cash Flow Statement Balance Sheet Cash Inflows: Monthly Husband paycheck: Wife paycheck: Rental Income: Total inflows $ 7,200.00 $ 4,800.00 $ 1,500.00 $ 13,500.00 Assets: Primary Residence FMV Rental Property FMV Auto 1* State min limits ins Auto 2 *State min limits ins Jewlery Antique Furniture Gun Collection Triathalon Bikes $ 175,000.00 $ 95,000.00 $ 16,000.00 $ 1,600.00 $ 18,000.00 $ 7,800.00 S 1,500.00 S 5,500.00 2,750.00 1,150.00 $ Cash Outflows: Monthly Mortgage (Primary Home) Mortgage (Rental Property) Auto 1 Auto 2 Student Loan Credit Cards Grade School Tuition Daycare Groceries Utilities Entertainment Roth IRA's Investments Total Outflows Other Furnishings 401(k) Accounts Roth IRA's Investment Total Assets $ 45,000.00 $ 130,000.00 S 40,000.00 $ 25,000.00 S $ 560.400.00 $ 450.00 $ S 700.00 $ 300.00 $ 600.00 $ 800.00 $ 800.00 $ 1,200.00 $ 600.00 S 900.00 S 1.000.00 $ 11.250.00 Liabilities Primary Mortgage Rental Property Mortgage Auto 1 Student Loan Credit Cards Grade School Tuition Total Liabilities Net Worth Total Liabilities & Net Worth $ 140,000.00 $ 65,000.00 S 22,000.00 $ 45,000.00 $ 6,000.00 S 43,200.00 $ 321.200.00 $ 239,200.00 $ 560,400.00 Monthly Net Income $ 2,250.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts