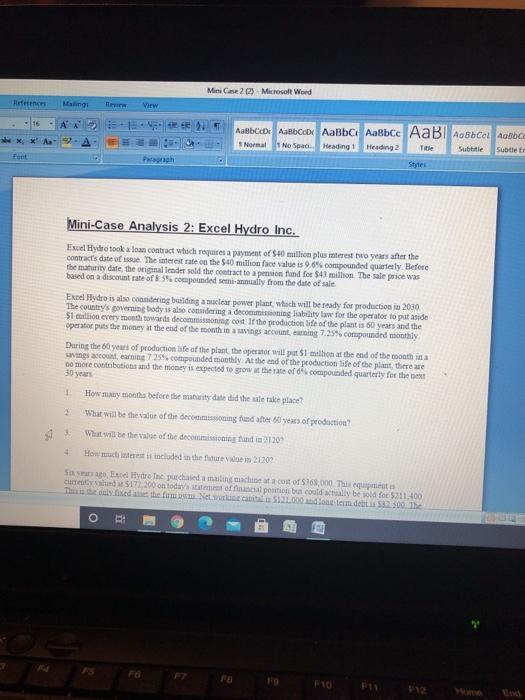

Question: Mini Case 2) Microsoft Word re . cl Nora No Space Heading 1 Heading 2 Title Subtitle Subtle Mini-Case Analysis 2: Excel Hydro Inc. Excel

Mini Case 2) Microsoft Word re . cl Nora No Space Heading 1 Heading 2 Title Subtitle Subtle Mini-Case Analysis 2: Excel Hydro Inc. Excel Hydra took a loan contract which requires a payment of $40 million plus interest two years after the contracts date of issue. The interest rate on the 540 million face value is 96% compounded quarterly Before the maturity date, the originalender sold the contract to a pension fund for $43 million The sale price was based on a discount rate of compounded semi-annually from the date of sale Excel Hydro is also considering building a clear power plant which will be ready for production in 2030 The country's governing Body is also considering a decommissioning liability faw for the operator to put aside $1 milion every month towards decommissoning cost. If the production life of the plant is 60 years and the operator puts the money at the end of the month in 3 savings account earning 7.29% compounded monthly During the 60 years of production life of the plant the operator will put 1 million at the end of the mouth is savings account, earning 755 compounded monthly. At the end of the production life of the plant, there are no more contribution in the moois expected to grow the rate of copied quarterly for the 1 How many month before the maturity dat did the sale take place What will be the sale of the decommissioning for years of production? What will be that of the decomandi 2120 How testinded in the 21209 SIE Hydro The purchases mal machine cost of 368.000 There curred 517 300 on todet official prin but could be sold for 5211450 o Fa fo 12 Mini Case 2) Microsoft Word re . cl Nora No Space Heading 1 Heading 2 Title Subtitle Subtle Mini-Case Analysis 2: Excel Hydro Inc. Excel Hydra took a loan contract which requires a payment of $40 million plus interest two years after the contracts date of issue. The interest rate on the 540 million face value is 96% compounded quarterly Before the maturity date, the originalender sold the contract to a pension fund for $43 million The sale price was based on a discount rate of compounded semi-annually from the date of sale Excel Hydro is also considering building a clear power plant which will be ready for production in 2030 The country's governing Body is also considering a decommissioning liability faw for the operator to put aside $1 milion every month towards decommissoning cost. If the production life of the plant is 60 years and the operator puts the money at the end of the month in 3 savings account earning 7.29% compounded monthly During the 60 years of production life of the plant the operator will put 1 million at the end of the mouth is savings account, earning 755 compounded monthly. At the end of the production life of the plant, there are no more contribution in the moois expected to grow the rate of copied quarterly for the 1 How many month before the maturity dat did the sale take place What will be the sale of the decommissioning for years of production? What will be that of the decomandi 2120 How testinded in the 21209 SIE Hydro The purchases mal machine cost of 368.000 There curred 517 300 on todet official prin but could be sold for 5211450 o Fa fo 12

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts