Question: Mini - Case A ( 6 marks ) Cheryl and Nabil are meeting for the first time with a financial planner at their financial institution.

MiniCase A marks

Cheryl and Nabil are meeting for the first time with a financial planner at their financial

institution. They are hoping to purchase their first home by early Both have

recently turned and have been living rentfree with Nabil's parents since their

graduation years ago. They were fortunate to immediately find employment in their

field of choice and this, combined with their reduced cost of living, has permitted them

to focus on their TFSA and RRSP savings plans.

Part mark mark each Identify your source.

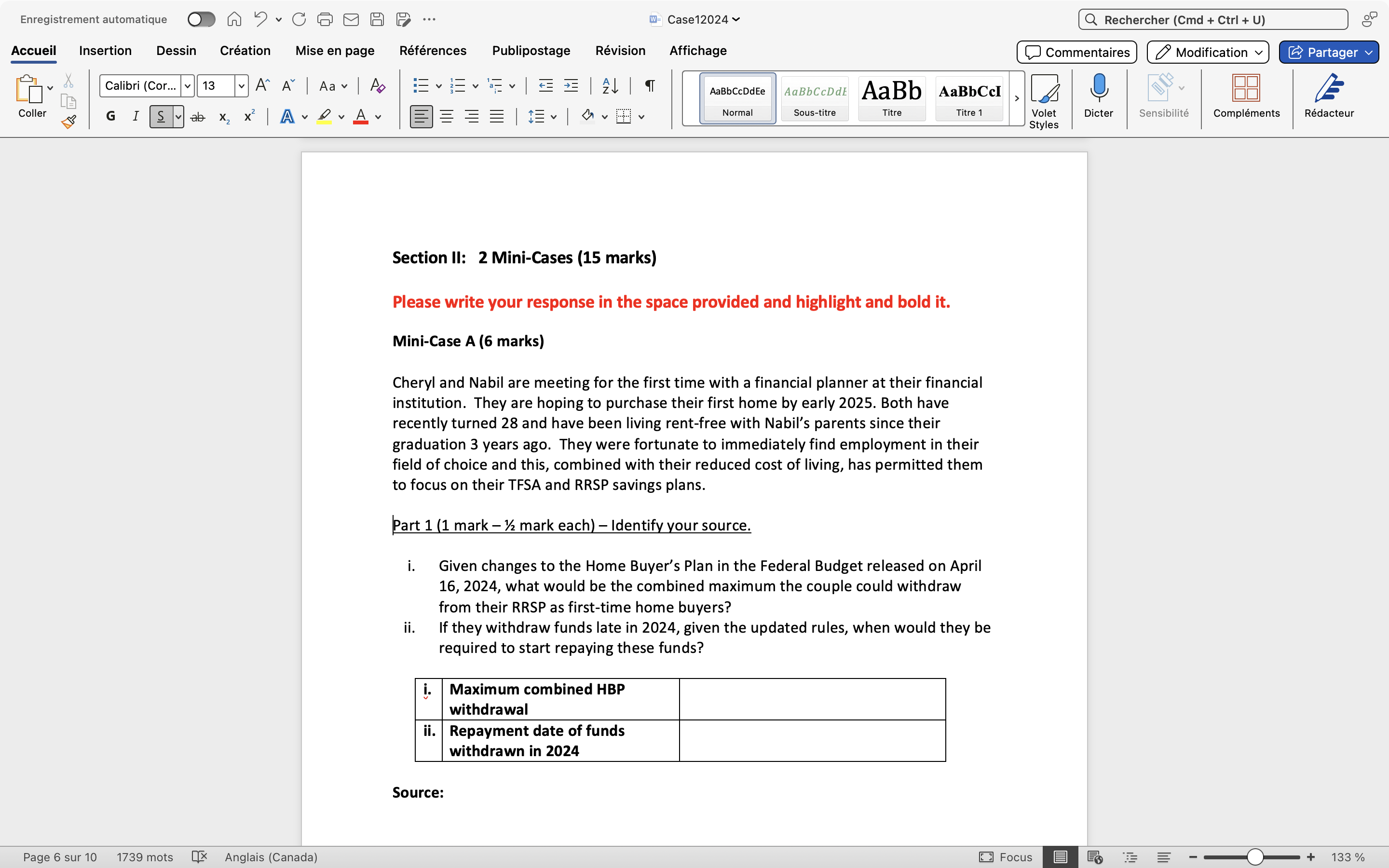

i Given changes to the Home Buyer's Plan in the Federal Budget released on April

what would be the combined maximum the couple could withdraw

from their RRSP as firsttime home buyers?

ii If they withdraw funds late in given the updated rules, when would they be

required to start repaying these funds?

Source:

Part mark

What government savings plan specifically targeting firsttime home buyers has the

couple not yet taken advantage of Provide a brief description and identify your source.

Source: Part mark

What government savings plan specifically targeting firsttime home buyers has the

couple not yet taken advantage of Provide a brief description and identify your source.

Source:

Part mark

As firsttime home buyers, the couple would qualify for a year amortization period on

an insured mortgage if they buy a newly constructed home. Identify one advantage and

one disadvantage of doing so Part marks

Assume the couple purchases a home with a $ fixedrate mortgage fixedrate mortgages are compounded semiannually in Canada and they opt for monthly payments, a term of years at a rate of and an amortization period of years.

All else equal, if they had chosen instead an accelerated biweekly payment, how much interest would they save over the life of the mortgage? Round to the nearest dollar.

tabletableTotal Interest with MonthlyPaymentstableTotal Interest with Accelerated BiweeklyPaymentsCalculationCalculationTotal Interest Savings,

Part mark

Cheryl and Nabil believe it's beneficial to have easy access to funds should they need it They have opened lines of credit, but only use one. Why is having unused lines of credit not a good idea for anyone when applying for a mortgage? State your source.

Impact of Unused Lines of Credit on a Mortgage Application

Source:

Page sur

mots

Anglais Canada

FocusSection II: MiniCases marks

Please write your response in the space provided and highlight and bold it

MiniCase A marks

Cheryl and Nabil are meeting for the first time with a financial planner at their financial

institution. They are hoping to purchase their first home by early Both have

recently turned and have been living rentfree with Nabil's parents since their

graduation years ago. They were fortunate to immediately find employment in their

field of choice and this, combined with their reduced cost of living, has permitted them

to focus on their TFSA and RRSP savings plans.

Part mark mark each Identify your source.

i Given changes to the Home Buyer's Plan in the Federal Budget released on April

what would be the combined maximum the couple could withdraw

from their RRSP as firsttime home buyers?

ii If they withdraw funds late in given the updated rules, when would they be

required to start repaying these funds?

Source:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock