Question: Mini - Case A: step by step solution Lucie and Luc can't believe their luck! They just bought their first lottery ticket together and won!

MiniCase A: step by step solution

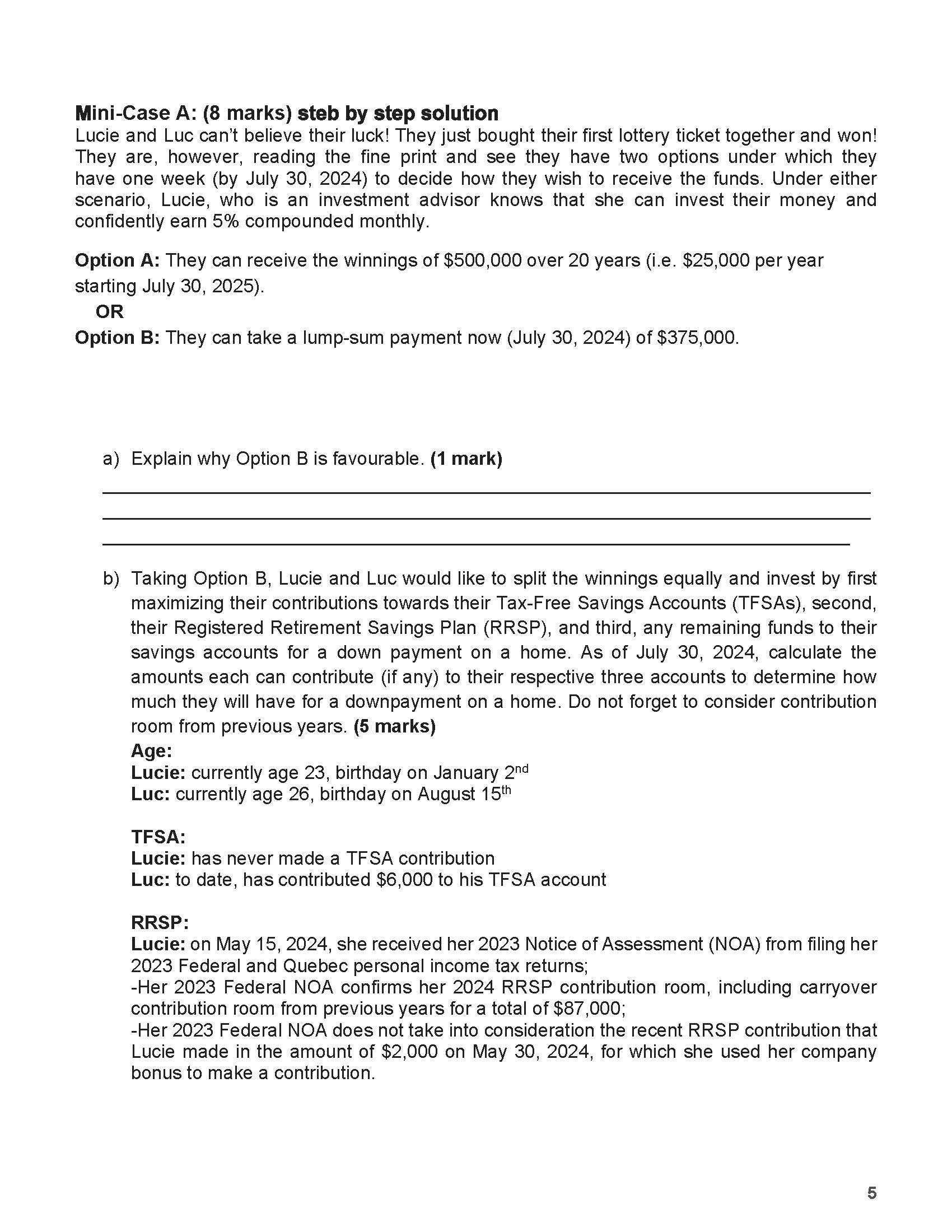

Lucie and Luc can't believe their luck! They just bought their first lottery ticket together and won!

They are, however, reading the fine print and see they have two options under which they

have one week by July to decide how they wish to receive the funds. Under either

scenario, Lucie, who is an investment advisor knows that she can invest their money and

confidently earn compounded monthly.

Option A: They can receive the winnings of $ over years ie $ per year

starting July

OR

Option B: They can take a lumpsum payment now July of $

a Explain why Option B is favourable. mark

b Taking Option B Lucie and Luc would like to split the winnings equally and invest by first

maximizing their contributions towards their TaxFree Savings Accounts TFSAs second,

their Registered Retirement Savings Plan RRSP and third, any remaining funds to their

savings accounts for a down payment on a home. As of July calculate the

amounts each can contribute if any to their respective three accounts to determine how

much they will have for a downpayment on a home. Do not forget to consider contribution

room from previous years. marks

Age:

Lucie: currently age birthday on January

Luc: currently age birthday on August

TFSA:

Lucie: has never made a TFSA contribution

Luc: to date, has contributed $ to his TFSA account

RRSP:

Lucie: on May she received her Notice of Assessment NOA from filing her

Federal and Quebec personal income tax returns;

Her Federal NOA confirms her RRSP contribution room, including carryover

contribution room from previous years for a total of $;

Her Federal NOA does not take into consideration the recent RRSP contribution that

Lucie made in the amount of $ on May for which she used her company

bonus to make a contribution. Luc: filed his personal taxes late and has not yet received his NOA which now

requires him to calculate his RRSP contribution room;

He has never made an RRSP contribution to date;

His Federal NOA confirmed his RRSP contribution room including carryover

contribution room from previous years for a total of $;

His gross salary in was $ and in is $;

He has never been part of a company pension plan, so he does not have a Pension

Adjustment PA

Lucie and Luc's calculations marks

TFSA Contribution for Lucie: mark

TFSA Contribution for Luc: mark

RRSP Contribution for Lucie: mark

RRSP Contribution for Luc: mark

Allocation of Winnings: mark

TFSA

RRSP

Savings account for home down payment

Total

c Lucie and Luc wish to buy a home. Based on your calculation in b for their down payment,

what is the home value they could purchase for a conventional mortgage? mark

Home value under a conventional mortgage mark

d Based on your calculation in c what is the mortgage amount needed? mark

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock