Question: Mini case study Heinz Inc. recently expanded its manufacturing capacity. During 2021, the firm produced and sold 5.000 units of sauces including ketchup, pesto, and

Mini case study Heinz Inc. recently expanded its manufacturing capacity. During 2021, the firm produced and sold 5.000 units of sauces including ketchup, pesto, and mayo. Ketchup represents half of their sales and the other half of sales is equally divided into pesto and mayo. The company's annual fixed costs totaled 80.000$. Alpine Ski Company is subject to a 20% income tax rate.

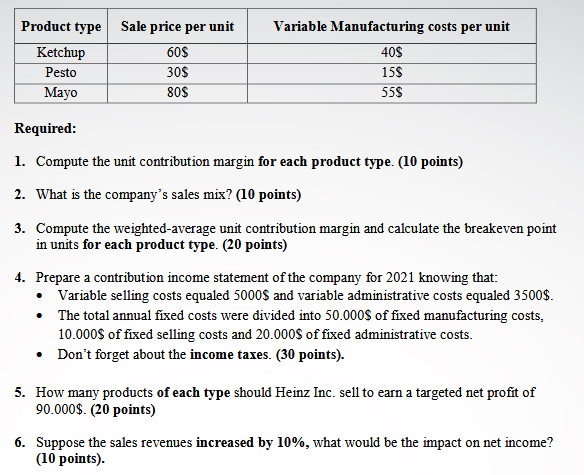

Product type Sale price per unit Variable Manufacturing costs per unit Ketchup 60$ 40S Pesto 30$ 15$ Mayo 80$ 55$ Required: 1. Compute the unit contribution margin for each product type. (10 points) 2. What is the company's sales mix? (10 points) 3. Compute the weighted-average unit contribution margin and calculate the breakeven point in units for each product type. (20 points) 4. Prepare a contribution income statement of the company for 2021 knowing that: Variable selling costs equaled 5000$ and variable administrative costs equaled 3500$. The total annual fixed costs were divided into 50.000$ of fixed manufacturing costs, 10.000$ of fixed selling costs and 20.000$ of fixed administrative costs. . Don't forget about the income taxes. (30 points). 5. How many products of each type should Heinz Inc. sell to earn a targeted net profit of 90.000$. (20 points) 6. Suppose the sales revenues increased by 10%, what would be the impact on net income? (10 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts