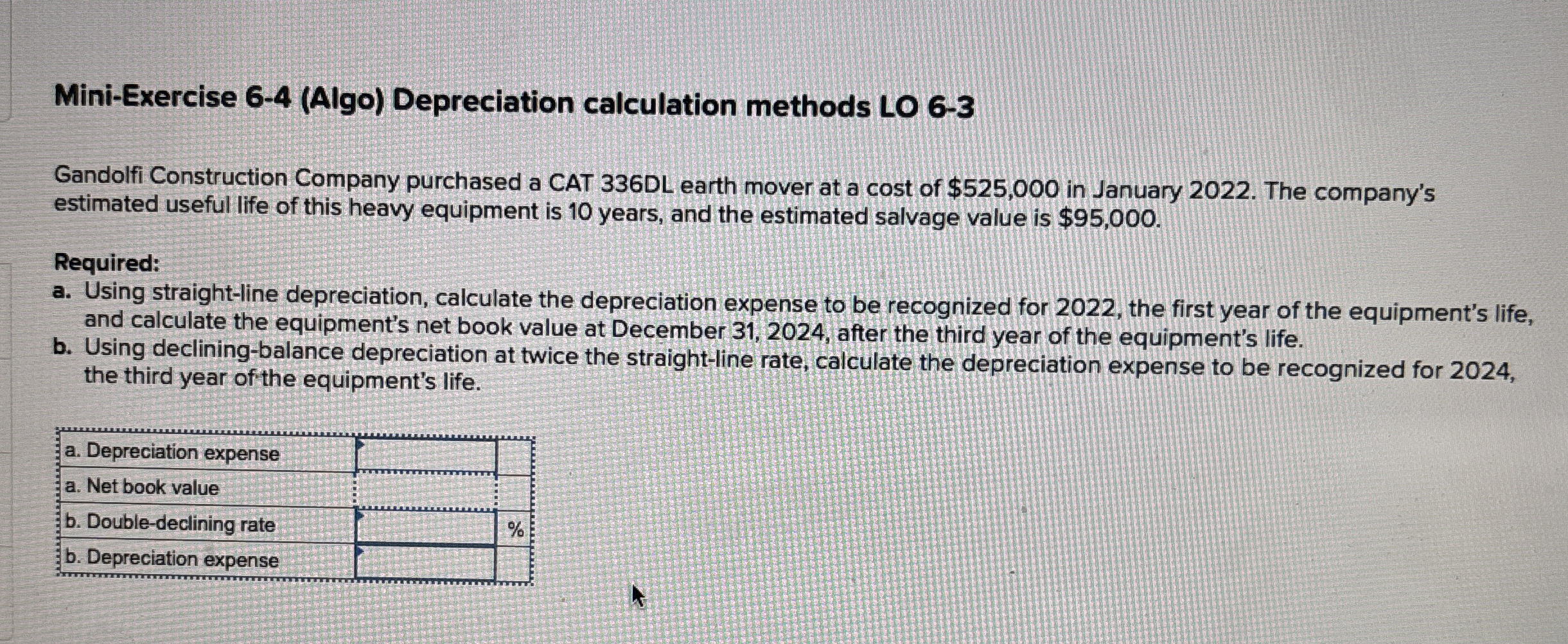

Question: Mini - Exercise 6 - 4 ( Algo ) Depreciation calculation methods LO 6 - 3 Gandolfi Construction Company purchased a CAT 3 3 6

MiniExercise Algo Depreciation calculation methods LO

Gandolfi Construction Company purchased a CAT DL earth mover at a cost of $ in January The company's

estimated useful life of this heavy equipment is years, and the estimated salvage value is $

Required:

a Using straightline depreciation, calculate the depreciation expense to be recognized for the first year of the equipment's life,

and calculate the equipment's net book value at December after the third year of the equipment's life.

b Using decliningbalance depreciation at twice the straightline rate, calculate the depreciation expense to be recognized for

the third year of the equipment's life.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock