Question: MINI-CASE 1.1 - MODIFIED FROM TEXT VERSION Hasan Fareed, a 24-year old college graduate, never took a personal finance class. He pays his bills on

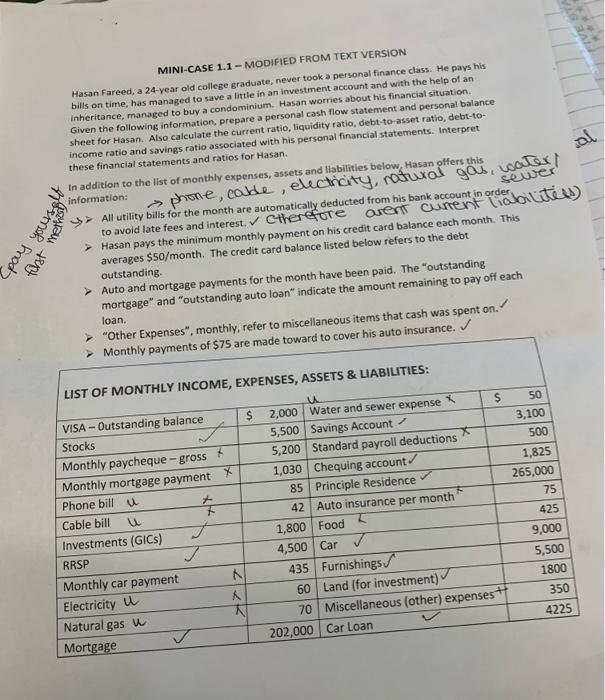

MINI-CASE 1.1 - MODIFIED FROM TEXT VERSION Hasan Fareed, a 24-year old college graduate, never took a personal finance class. He pays his bills on time, has managed to save a little in an investment account and with the help of an inheritance, managed to buy a condominium. Hasan worries about his financial situation. Given the following information, prepare a personal cash flow statement and personal balance sheet for Hasan. Also calculate the current ratio, liquidity ratio, debt-to-asset ratio, debt-toincome ratio and savings ratio associated with his personal financial statements. Interpret these financial statements and ratios for Hasan. In addition to the list of monthly expenses, assets and liabilities below, Hasan offers this information: phone, coude, electicuty, raduxal gab, sack. - All utility bills for the month are automatically deducted from his bank account in order . Cor. Hasan pays the minimum monthly payment on his credit card balance each mont $50/ month. The credit card bance listed below refers to the debt outstanding. > Auto and mortgage payments for the month have been paid. The "outstanding mortgage" and "outstanding auto loan" indicate the amount remaining to pay off each loan. "Other Expenses", monthly, refer to miscellaneous items that cash was spent on. of $75 are made toward to cover his auto insurance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts