Question: Mini-Case C: ( 6 marks - .5 marks each) Michael turned 25 years old on March 1, 2023, and just opened a Tax-Free Savings Account

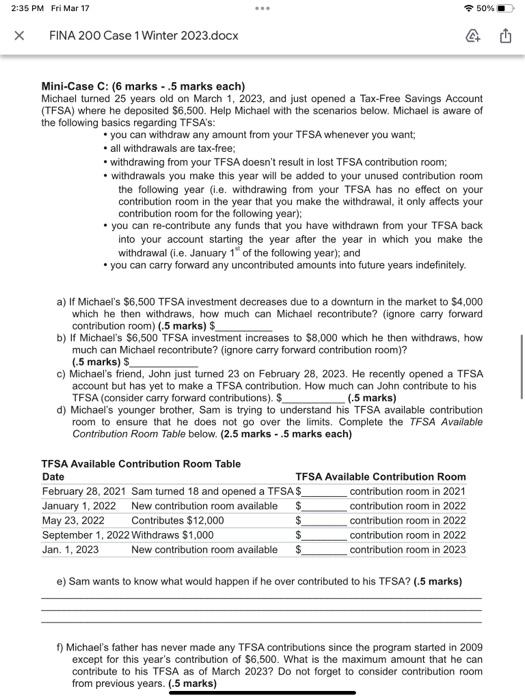

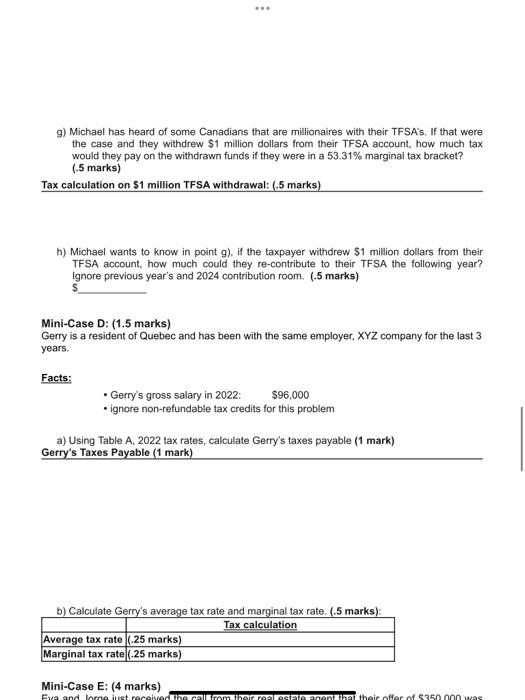

Mini-Case C: ( 6 marks - .5 marks each) Michael turned 25 years old on March 1, 2023, and just opened a Tax-Free Savings Account (TFSA) where he deposited $6,500. Help Michael with the scenarios below. Michael is aware of the following basics regarding TFSA's: - you can withdraw any amount from your TFSA whenever you want; - all withdrawals are tax-free; - withdrawing from your TFSA doesn't result in lost TFSA contribution room; - withdrawals you make this year will be added to your unused contribution room the following year (i.e. withdrawing from your TFSA has no effect on your contribution room in the year that you make the withdrawal, it only affects your contribution room for the following year); - you can re-contribute any funds that you have withdrawn from your TFSA back into your account starting the year after the year in which you make the withdrawal (i.e. January 12h of the following year); and - you can carry forward any uncontributed amounts into future years indefinitely. a) If Michael's $6,500 TFSA investment decreases due to a downturn in the market to $4,000 which he then withdraws, how much can Michael recontribute? (ignore carry forward contribution room) (.5 marks) \$ b) If Michael's $6,500 TFSA investment increases to $8,000 which he then withdraws, how much can Michael recontribute? (ignore carry forward contribution room)? (.5 marks) \$ c) Michael's friend, John just turned 23 on February 28, 2023. He recently opened a TFSA account but has yet to make a TFSA contribution. How much can John contribute to his TFSA (consider carry forward contributions). \$ (.5 marks) d) Michael's younger brother, Sam is trying to understand his TFSA available contribution room to ensure that he does not go over the limits. Complete the TFSA Available Contribution Room Table below. (2.5 marks - .5 marks each) e) Sam wants to know what would happen if he over contributed to his TFSA? (.5 marks) f) Michaef's father has never made any TFSA contributions since the program started in 2009 except for this year's contribution of $6,500. What is the maximum amount that he can contribute to his TFSA as of March 2023? Do not forget to consider contribution room from previous years. (.5 marks) g) Michael has heard of some Canadians that are millionaires with their TFSA's. If that were the case and they withdrew $1 million dollars from their TFSA account, how much tax would they pay on the withdrawn funds if they were in a 53.31% marginal tax bracket? (.5 marks) Tax calculation on $1 million TFSA withdrawal: (.5 marks) h) Michael wants to know in point g ), if the taxpayer withdrew $1 million dollars from their TFSA account, how much could they re-contribute to their TFSA the following year? Ignore previous year's and 2024 contribution room. (.5 marks) $ Mini-Case D: (1.5 marks) Gerry is a resident of Quebec and has been with the same employer, XYZ company for the last 3 years. Facts: - Gerry's gross salary in 2022: $96,000 - ignore non-refundable tax credits for this problem a) Using Table A, 2022 tax rates, calculate Gerry's taxes payable (1 mark) Gerry's Taxes Payable (1 mark) b) Calculate Gerrv's average tax rate and marainal tax rate. (.5 marks): Mini-Case C: ( 6 marks - .5 marks each) Michael turned 25 years old on March 1, 2023, and just opened a Tax-Free Savings Account (TFSA) where he deposited $6,500. Help Michael with the scenarios below. Michael is aware of the following basics regarding TFSA's: - you can withdraw any amount from your TFSA whenever you want; - all withdrawals are tax-free; - withdrawing from your TFSA doesn't result in lost TFSA contribution room; - withdrawals you make this year will be added to your unused contribution room the following year (i.e. withdrawing from your TFSA has no effect on your contribution room in the year that you make the withdrawal, it only affects your contribution room for the following year); - you can re-contribute any funds that you have withdrawn from your TFSA back into your account starting the year after the year in which you make the withdrawal (i.e. January 12h of the following year); and - you can carry forward any uncontributed amounts into future years indefinitely. a) If Michael's $6,500 TFSA investment decreases due to a downturn in the market to $4,000 which he then withdraws, how much can Michael recontribute? (ignore carry forward contribution room) (.5 marks) \$ b) If Michael's $6,500 TFSA investment increases to $8,000 which he then withdraws, how much can Michael recontribute? (ignore carry forward contribution room)? (.5 marks) \$ c) Michael's friend, John just turned 23 on February 28, 2023. He recently opened a TFSA account but has yet to make a TFSA contribution. How much can John contribute to his TFSA (consider carry forward contributions). \$ (.5 marks) d) Michael's younger brother, Sam is trying to understand his TFSA available contribution room to ensure that he does not go over the limits. Complete the TFSA Available Contribution Room Table below. (2.5 marks - .5 marks each) e) Sam wants to know what would happen if he over contributed to his TFSA? (.5 marks) f) Michaef's father has never made any TFSA contributions since the program started in 2009 except for this year's contribution of $6,500. What is the maximum amount that he can contribute to his TFSA as of March 2023? Do not forget to consider contribution room from previous years. (.5 marks) g) Michael has heard of some Canadians that are millionaires with their TFSA's. If that were the case and they withdrew $1 million dollars from their TFSA account, how much tax would they pay on the withdrawn funds if they were in a 53.31% marginal tax bracket? (.5 marks) Tax calculation on $1 million TFSA withdrawal: (.5 marks) h) Michael wants to know in point g ), if the taxpayer withdrew $1 million dollars from their TFSA account, how much could they re-contribute to their TFSA the following year? Ignore previous year's and 2024 contribution room. (.5 marks) $ Mini-Case D: (1.5 marks) Gerry is a resident of Quebec and has been with the same employer, XYZ company for the last 3 years. Facts: - Gerry's gross salary in 2022: $96,000 - ignore non-refundable tax credits for this problem a) Using Table A, 2022 tax rates, calculate Gerry's taxes payable (1 mark) Gerry's Taxes Payable (1 mark) b) Calculate Gerrv's average tax rate and marainal tax rate. (.5 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts