Question: Mini-Case E: (1 mark) - Nancy Nancy just sold some of her shares in Spotify Inc. She has made a lot of money with this

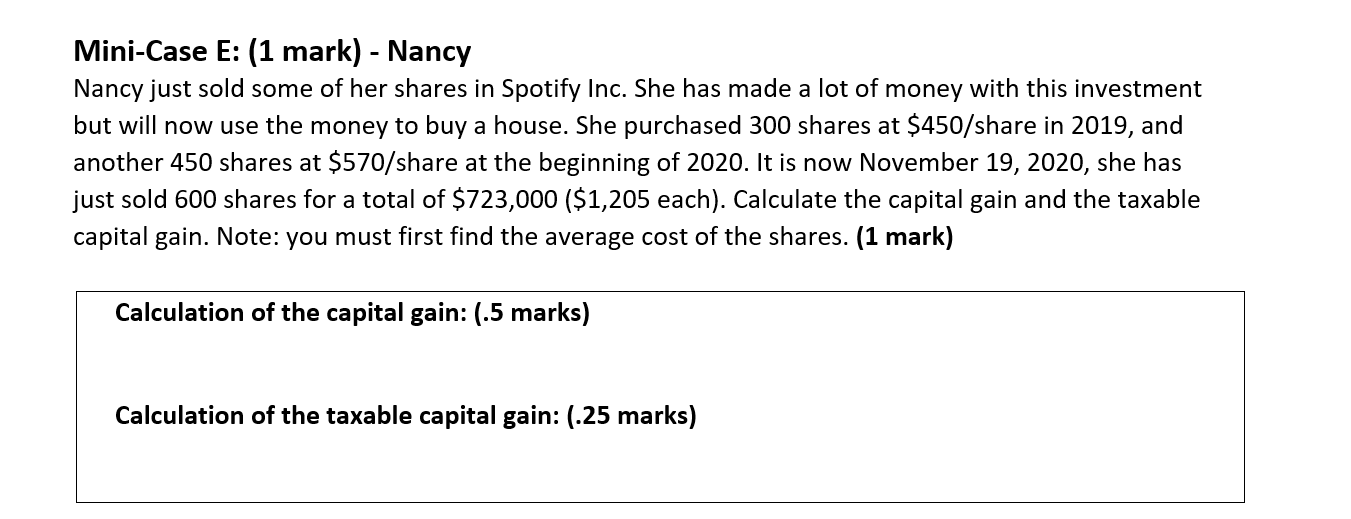

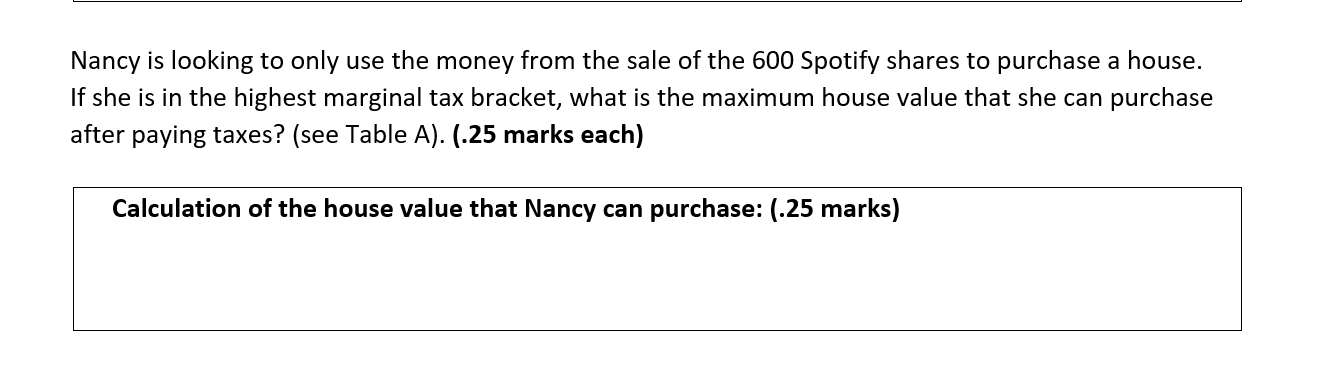

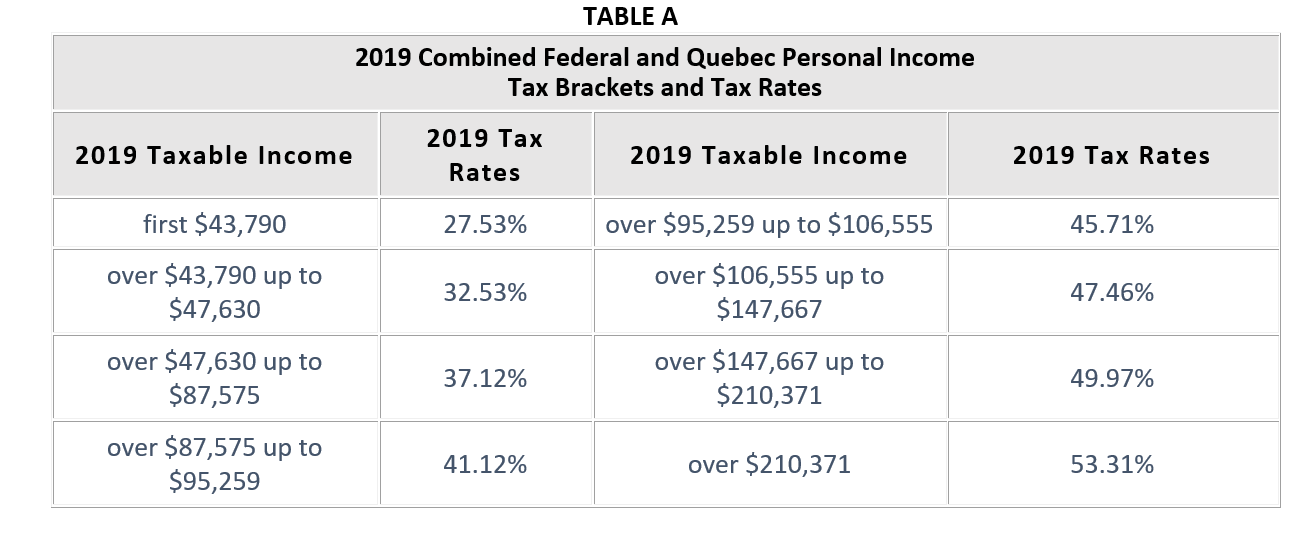

Mini-Case E: (1 mark) - Nancy Nancy just sold some of her shares in Spotify Inc. She has made a lot of money with this investment but will now use the money to buy a house. She purchased 300 shares at $450/share in 2019, and another 450 shares at $570/share at the beginning of 2020. It is now November 19, 2020, she has just sold 600 shares for a total of $723,000 ($1,205 each). Calculate the capital gain and the taxable capital gain. Note: you must first find the average cost of the shares. (1 mark) Calculation of the capital gain: (.5 marks) Calculation of the taxable capital gain: (.25 marks) Nancy is looking to only use the money from the sale of the 600 Spotify shares to purchase a house. If she is in the highest marginal tax bracket, what is the maximum house value that she can purchase after paying taxes? (see Table A). (.25 marks each) Calculation of the house value that Nancy can purchase: 0.25 marks) TABLE A 2019 Combined Federal and Quebec Personal Income Tax Brackets and Tax Rates 2019 Taxable Income 2019 Tax Rates 2019 Taxable Income 2019 Tax Rates first $43,790 27.53% 45.71% over $43,790 up to $47,630 32.53% 47.46% over $95,259 up to $106,555 over $106,555 up to $147,667 over $147,667 up to $210,371 over $47,630 up to $87,575 37.12% 49.97% over $87,575 up to $95,259 41.12% over $210,371 53.31%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts