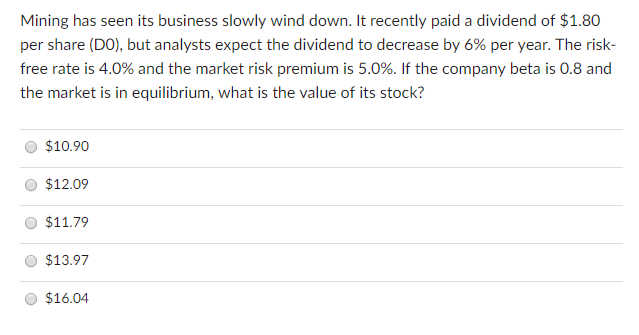

Question: Mining has seen its business slowly wind down. It recently paid a dividend of $1.80 per share (DO), but analysts expect the dividend to decrease

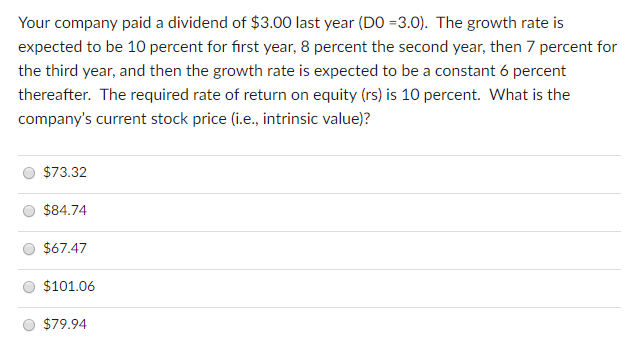

Mining has seen its business slowly wind down. It recently paid a dividend of $1.80 per share (DO), but analysts expect the dividend to decrease by 6% per year. The risk- free rate is 4.0% and the market risk premium is 5.0%. If the company beta is 0.8 and the market is in equilibrium, what is the value of its stock? O $10.90 O $12.09 O $11.79 O $13.97 O $16.04 Your company paid a dividend of $3.00 last year (DO-3.0). The growth rate is expected to be 10 percent for first year, 8 percent the second year, then 7 percent for the third year, and then the growth rate is expected to be a constant 6 percent thereafter. The required rate of return on equity (rs) is 10 percent. What is the company's current stock price (i.e., intrinsic value)? O $73.32 O $84.74 O $67.47 O $101.06 O $79.94

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts