Question: Minor Assignment The assignment is to develop the efficient frontier for two or more securities in a portfolio. You can use the following steps to

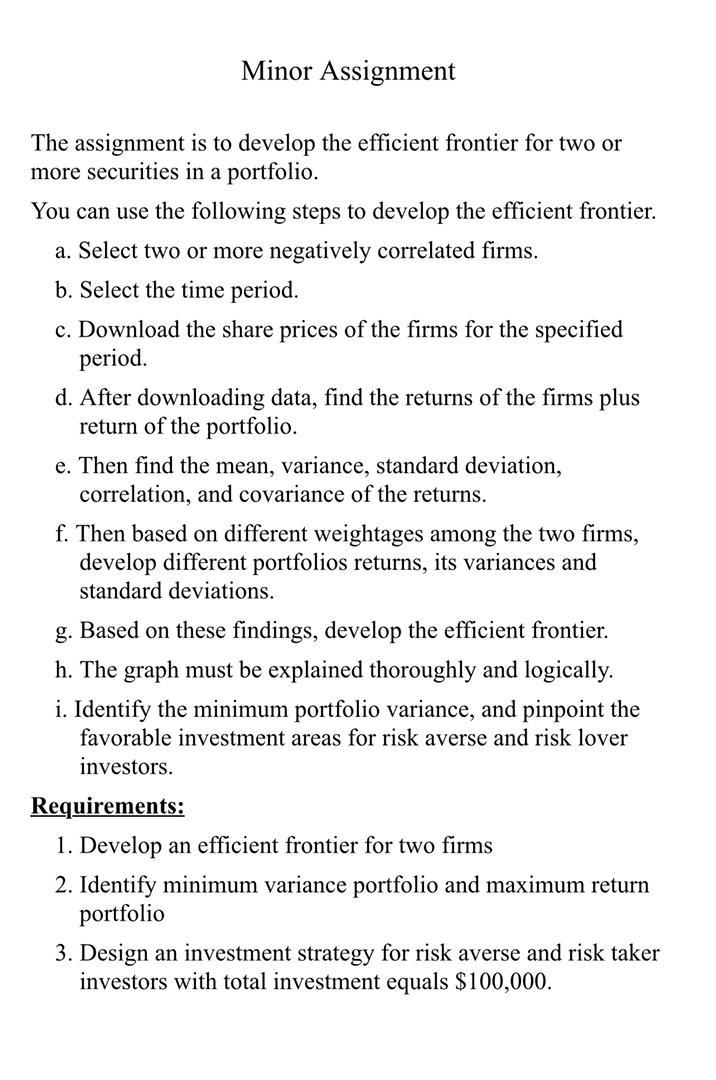

Minor Assignment The assignment is to develop the efficient frontier for two or more securities in a portfolio. You can use the following steps to develop the efficient frontier. a. Select two or more negatively correlated firms. b. Select the time period. c. Download the share prices of the firms for the specified period. d. After downloading data, find the returns of the firms plus return of the portfolio. e. Then find the mean, variance, standard deviation, correlation, and covariance of the returns. f. Then based on different weightages among the two firms, develop different portfolios returns, its variances and standard deviations. g. Based on these findings, develop the efficient frontier. h. The graph must be explained thoroughly and logically. i. Identify the minimum portfolio variance, and pinpoint the favorable investment areas for risk averse and risk lover investors. Requirements: 1. Develop an efficient frontier for two firms 2. Identify minimum variance portfolio and maximum return portfolio 3. Design an investment strategy for risk averse and risk taker investors with total investment equals $100,000. Minor Assignment The assignment is to develop the efficient frontier for two or more securities in a portfolio. You can use the following steps to develop the efficient frontier. a. Select two or more negatively correlated firms. b. Select the time period. c. Download the share prices of the firms for the specified period. d. After downloading data, find the returns of the firms plus return of the portfolio. e. Then find the mean, variance, standard deviation, correlation, and covariance of the returns. f. Then based on different weightages among the two firms, develop different portfolios returns, its variances and standard deviations. g. Based on these findings, develop the efficient frontier. h. The graph must be explained thoroughly and logically. i. Identify the minimum portfolio variance, and pinpoint the favorable investment areas for risk averse and risk lover investors. Requirements: 1. Develop an efficient frontier for two firms 2. Identify minimum variance portfolio and maximum return portfolio 3. Design an investment strategy for risk averse and risk taker investors with total investment equals $100,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts