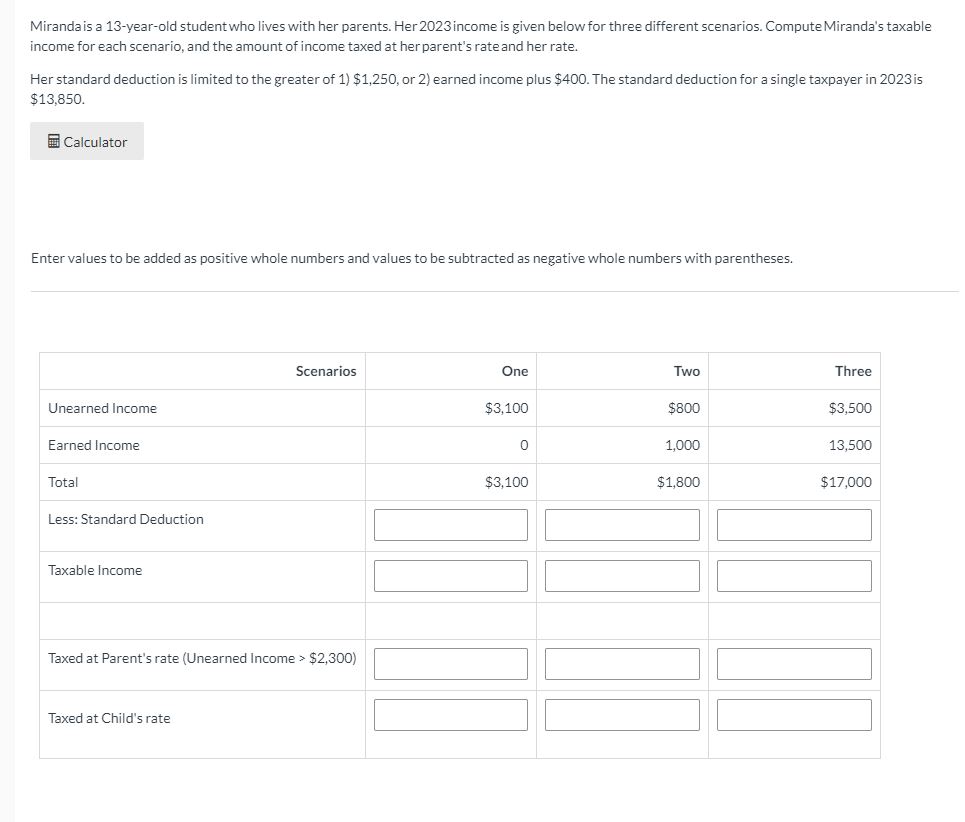

Question: Miranda is a 1 3 - year - old student who lives with her parents. Her 2 0 2 3 income is given below for

Miranda is a yearold student who lives with her parents. Her income is given below for three different scenarios. ComputeMiranda's taxable

income for each scenario, and the amount of income taxed at her parent's rate and her rate.

Her standard deduction is limited to the greater of $ or earned income plus $ The standard deduction for a single taxpayer in is

$

Enter values to be added as positive whole numbers and values to be subtracted as negative whole numbers with parentheses.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock