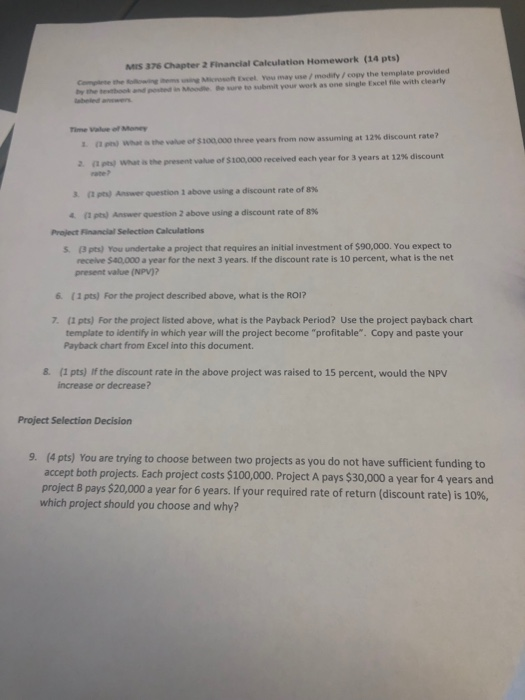

Question: MIS 376 Chapter 2 Financial Calculation Homework (14 pts) Compiete the ois igMcsoh Excel. You may use / modity / copy the template provided by

MIS 376 Chapter 2 Financial Calculation Homework (14 pts) Compiete the ois igMcsoh Excel. You may use / modity / copy the template provided by the testhook and postet in Me te sure to submit your work as one single Excel file with clearly laheled anewers Time Value of Meey (1 pts) ~ the value of $300.000 three years from now assuming at 12% discount rate ? value of $100,000 received each year for 3 years at 12% discount (1 pts) what is rate? 2. present (1 pts) Answer question above usig a discount rate of 8% 3. (1 pt) Answer question 2 above using a discount rate of 8% Project Financial Selection Calculations (3 pts) You undertake a project that requires an initial investment of $90,000. You expect to receive $40,000 a year for the next 3 years. If the discount rate is 10 percent, what is the net present value (NPV)? S. 6 (1 pts) For the project described above, what is the ROI? (1 pts) For the project listed above, what is the Payback Period? Use the project payback chart template to identify in which year will the project become "profitable". Copy and paste your Payback chart from Excel into this document. 7. 8. (1 pts) if the discount rate in the above project was raised to 15 percent, would the NPV increase or decrease? Project Selection Decision 9 (4 pts) You are trying to choose between two projects as you do not have sufficient funding to accept both projects. Each project costs $100,000. Project A pays $30,000 a year for 4 years and project B pays $20,000 a year for 6 years. If your required rate of return (discount rate) is 10%, which project should you choose and why? MIS 376 Chapter 2 Financial Calculation Homework (14 pts) Compiete the ois igMcsoh Excel. You may use / modity / copy the template provided by the testhook and postet in Me te sure to submit your work as one single Excel file with clearly laheled anewers Time Value of Meey (1 pts) ~ the value of $300.000 three years from now assuming at 12% discount rate ? value of $100,000 received each year for 3 years at 12% discount (1 pts) what is rate? 2. present (1 pts) Answer question above usig a discount rate of 8% 3. (1 pt) Answer question 2 above using a discount rate of 8% Project Financial Selection Calculations (3 pts) You undertake a project that requires an initial investment of $90,000. You expect to receive $40,000 a year for the next 3 years. If the discount rate is 10 percent, what is the net present value (NPV)? S. 6 (1 pts) For the project described above, what is the ROI? (1 pts) For the project listed above, what is the Payback Period? Use the project payback chart template to identify in which year will the project become "profitable". Copy and paste your Payback chart from Excel into this document. 7. 8. (1 pts) if the discount rate in the above project was raised to 15 percent, would the NPV increase or decrease? Project Selection Decision 9 (4 pts) You are trying to choose between two projects as you do not have sufficient funding to accept both projects. Each project costs $100,000. Project A pays $30,000 a year for 4 years and project B pays $20,000 a year for 6 years. If your required rate of return (discount rate) is 10%, which project should you choose and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts