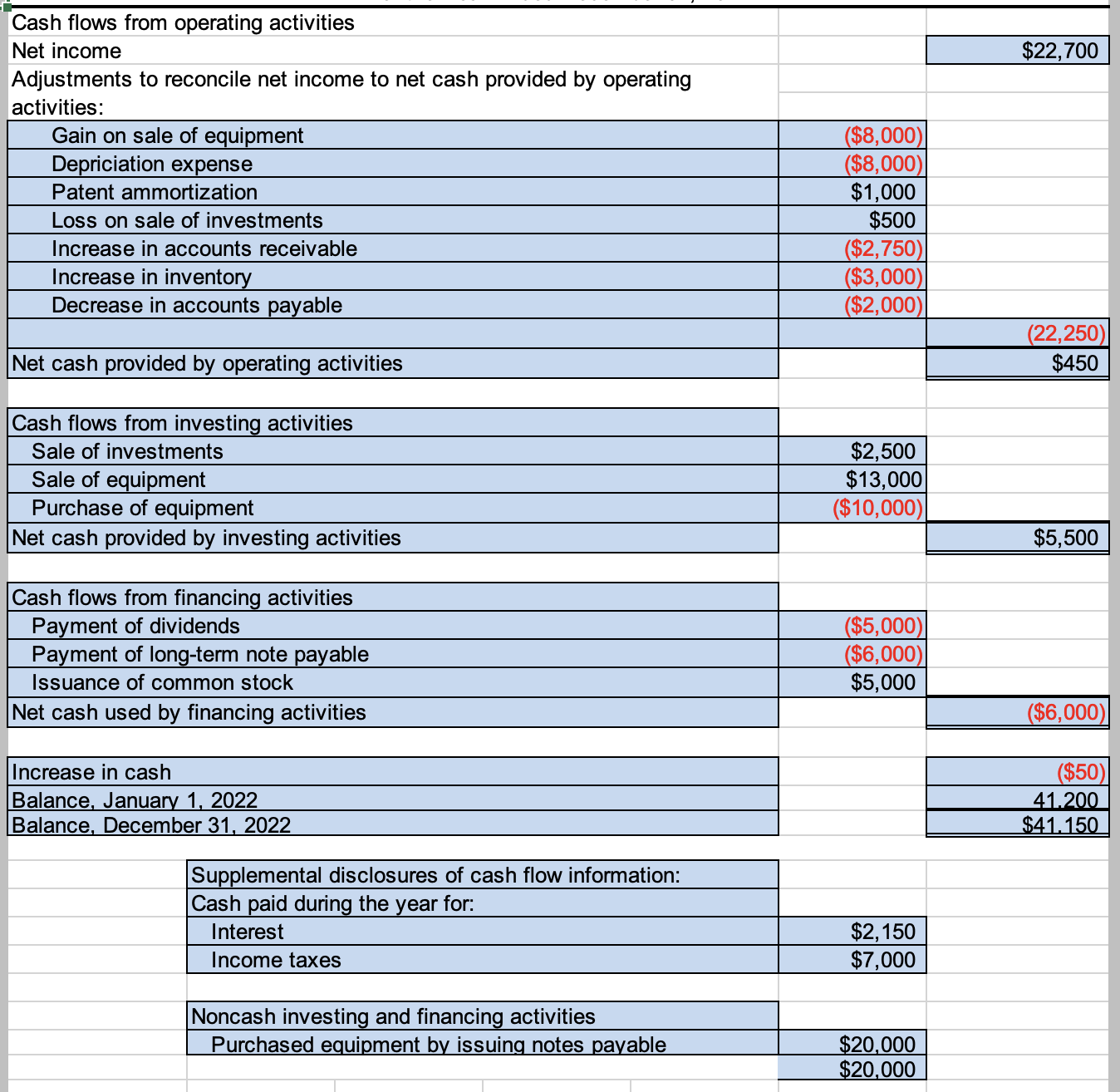

Question: Missing something from operating activities, don't know what though? Please solve the problem and show correct solution Additional data related to 2022 are as follows:

Missing something from operating activities, don't know what though? Please solve the problem and show correct solution

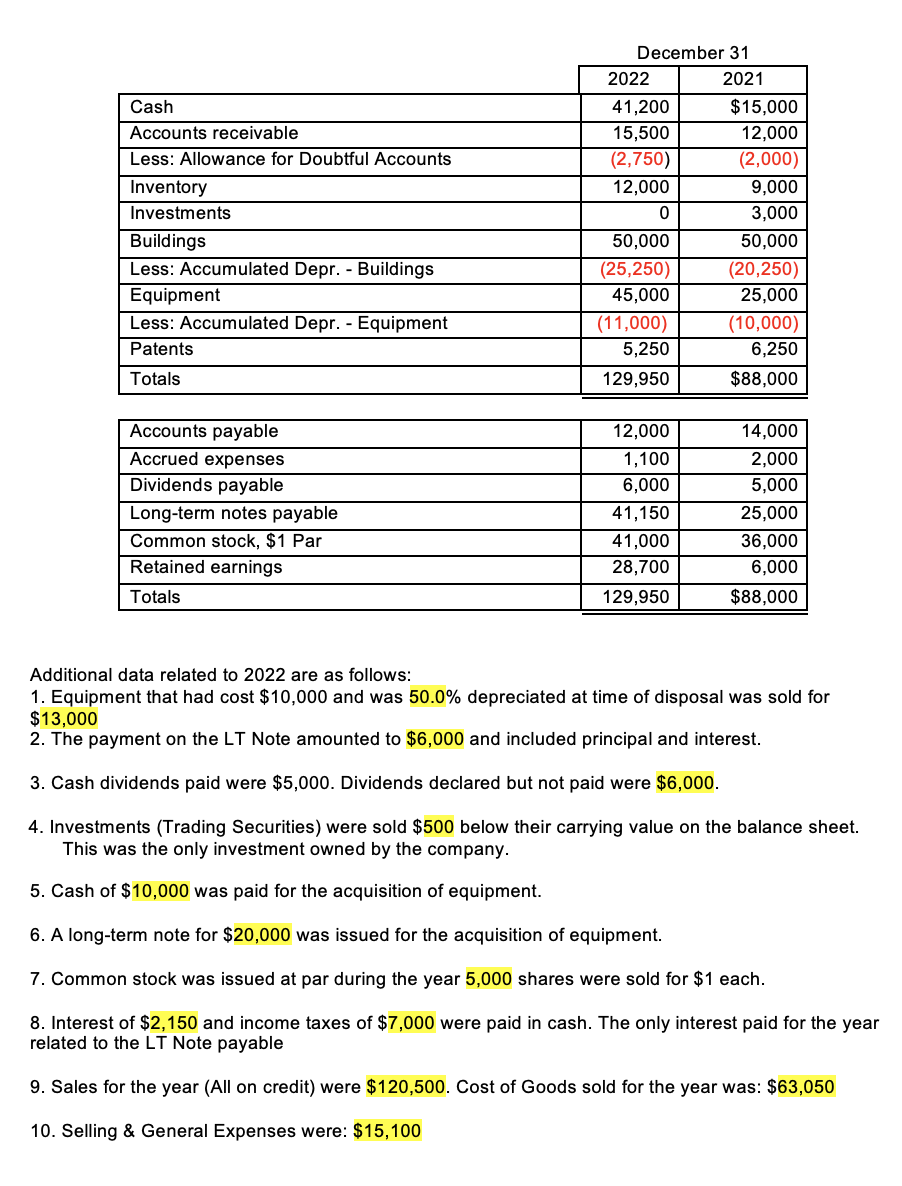

Additional data related to 2022 are as follows: 1. Equipment that had cost $10,000 and was 50.0% depreciated at time of disposal was sold for $13,000 2. The payment on the LT Note amounted to $6,000 and included principal and interest. 3. Cash dividends paid were $5,000. Dividends declared but not paid were $6,000. 4. Investments (Trading Securities) were sold $500 below their carrying value on the balance sheet. This was the only investment owned by the company. 5. Cash of $10,000 was paid for the acquisition of equipment. 6. A long-term note for $20,000 was issued for the acquisition of equipment. 7. Common stock was issued at par during the year 5,000 shares were sold for $1 each. 8. Interest of $2,150 and income taxes of $7,000 were paid in cash. The only interest paid for the year related to the LT Note payable 9. Sales for the year (All on credit) were $120,500. Cost of Goods sold for the year was: $63,050 10. Selling \& General Expenses were: $15,100 Cash flows from operating activities Net income $22,700 Adjustments to reconcile net income to net cash provided by operating activities: Cash flows from investing activities Cash flows from financing activities \begin{tabular}{|l|r|r|} \hline Payment of dividends & ($5,000) \\ \hline Payment of long-term note payable & ($6,000) \\ \hline Issuance of common stock & $5,000 & \\ \hline Net cash used by financing activities & & ($6,000) \\ \hline Increase in cash & & ($50) \\ \hline Balance, January 1,2022 & 41.200 \\ \hline Balance, December 31,2022 & $41.150 \\ \hline \end{tabular} Supplemental disclosures of cash flow information: Cash paid during the year for: \begin{tabular}{|l|r|} \hline Interest & $2,150 \\ \hline Income taxes & $7,000 \\ \hline \end{tabular} Noncash investing and financing activities Purchased equipment by issuing notes payable \begin{tabular}{|} $20,000 \\ $20,000 \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts