Question: mit 6 (50 pts) Machine Corporation is financing an ongoing construction project. The firm needs $8 million equity each year as the funds are needed,

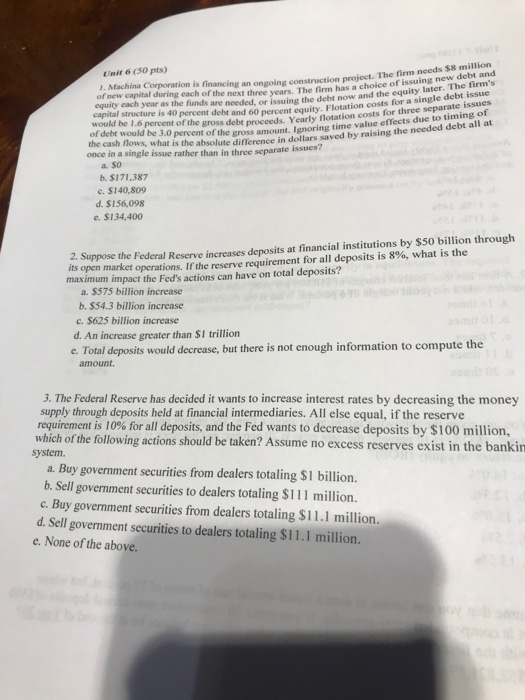

mit 6 (50 pts) Machine Corporation is financing an ongoing construction project. The firm needs $8 million equity each year as the funds are needed, or suring the debt now and the equity later. The firm's of new capital during each of the next three years. The firm has a choice of issuing new debt and would be L6 percent of the gross debt proceeds Yearly notation costs for three separate issues the cash flows what is the absolute difference in dollars saved by raising the needed debt all at once in a single issue rather than in three separate issues? a. So b. SI71.387 c. $140,809 d. S156,098 e. $134,400 2. Suppose the Federal Reserve increases deposits at financial institutions by $50 billion through its open market operations. If the reserve requirement for all deposits is 8%, what is the maximum impact the Fed's actions can have on total deposits? a. $575 billion increase b. $54.3 billion increase c. $625 billion increase d. An increase greater than $1 trillion e. Total deposits would decrease, but there is not enough information to compute the amount system. 3. The Federal Reserve has decided it wants to increase interest rates by decreasing the money supply through deposits held at financial intermediaries. All else equal, if the reserve requirement is 10% for all deposits, and the Fed wants to decrease deposits by $100 million, which of the following actions should be taken? Assume no excess reserves exist in the bankin a. Buy government securities from dealers totaling $1 billion. b. Sell government securities to dealers totaling $111 million. c. Buy government securities from dealers totaling $11.1 million. d. Sell government securities to dealers totaling $11.1 million. e. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts