Question: MLSE Inc. is considering purchasing a new machine that will cost $725,000 plus an additional $75,000 in installation costs. Management projects annual operating revenues to

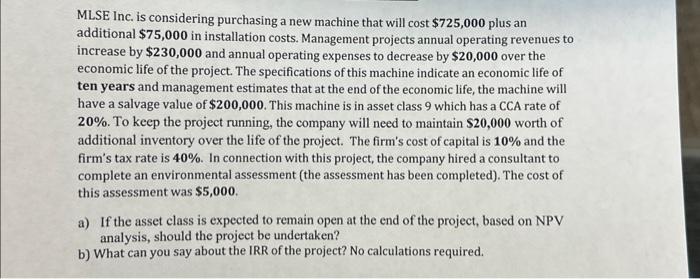

MLSE Inc. is considering purchasing a new machine that will cost $725,000 plus an additional $75,000 in installation costs. Management projects annual operating revenues to increase by $230,000 and annual operating expenses to decrease by $20,000 over the economic life of the project. The specifications of this machine indicate an economic life of ten years and management estimates that at the end of the economic life, the machine will have a salvage value of $200,000. This machine is in asset class 9 which has a CCA rate of 20%. To keep the project running, the company will need to maintain $20,000 worth of additional inventory over the life of the project. The firm's cost of capital is 10% and the firm's tax rate is 40%. In connection with this project, the company hired a consultant to complete an environmental assessment (the assessment has been completed). The cost of this assessment was $$5,000. a) If the asset class is expected to remain open at the end of the project, based on NPV analysis, should the project be undertaken? b) What can you say about the IRR of the project? No calculations required

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts