Question: MMJBA is considering some new equipment whose data are shown below. The equipment has a 3-year tax life and would be fully depreciates by the

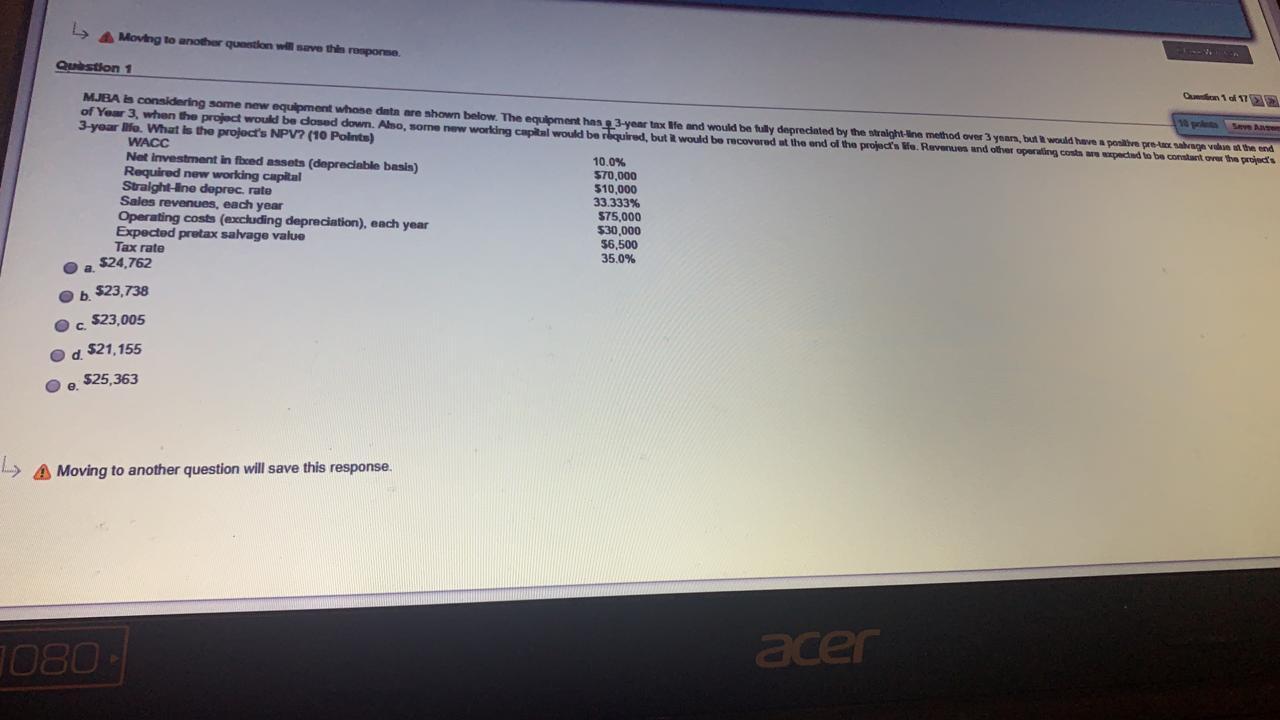

MMJBA is considering some new equipment whose data are shown below. The equipment has a 3-year tax life and would be fully depreciates by the straight-line method over 3 years, but it would have a positive pre-tax salvage value at the end of year 3, when the project would be closed down. Also, some new working capital would be required, but it would be recovered at the end of project's life. Revenues and other operating costs are expected to be constant over the project's 3-year life. What is the project's NPV?

MMJBA is considering some new equipment whose data are shown below. The equipment has a 3-year tax life and would be fully depreciates by the straight-line method over 3 years, but it would have a positive pre-tax salvage value at the end of year 3, when the project would be closed down. Also, some new working capital would be required, but it would be recovered at the end of project's life. Revenues and other operating costs are expected to be constant over the project's 3-year life. What is the project's NPV?

WACC 10%

Net investment in fixed assets $70000

Required new working capital (depreciable basis) $10000

Straight line deprec. rate 33.333%

Sales revenues, each year $75000

operating costs excluding depreciation each year $30000

Expected pretax salvage value $6500

tax rate 35%

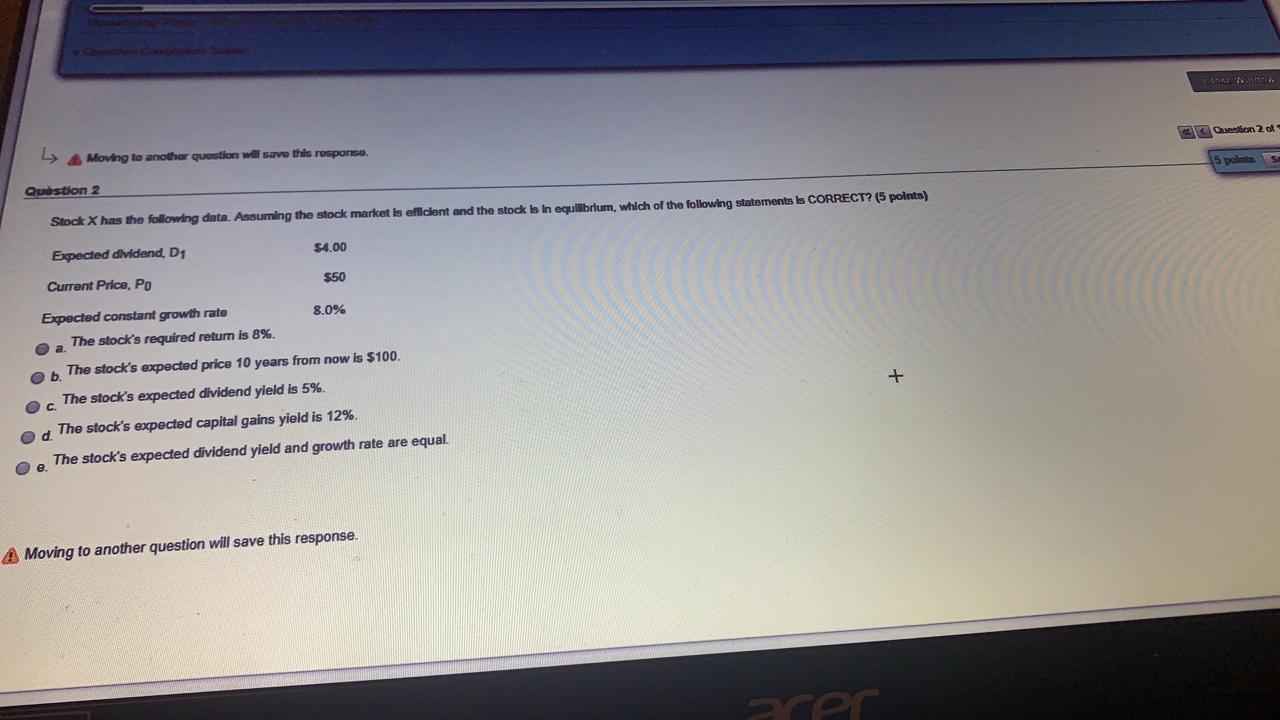

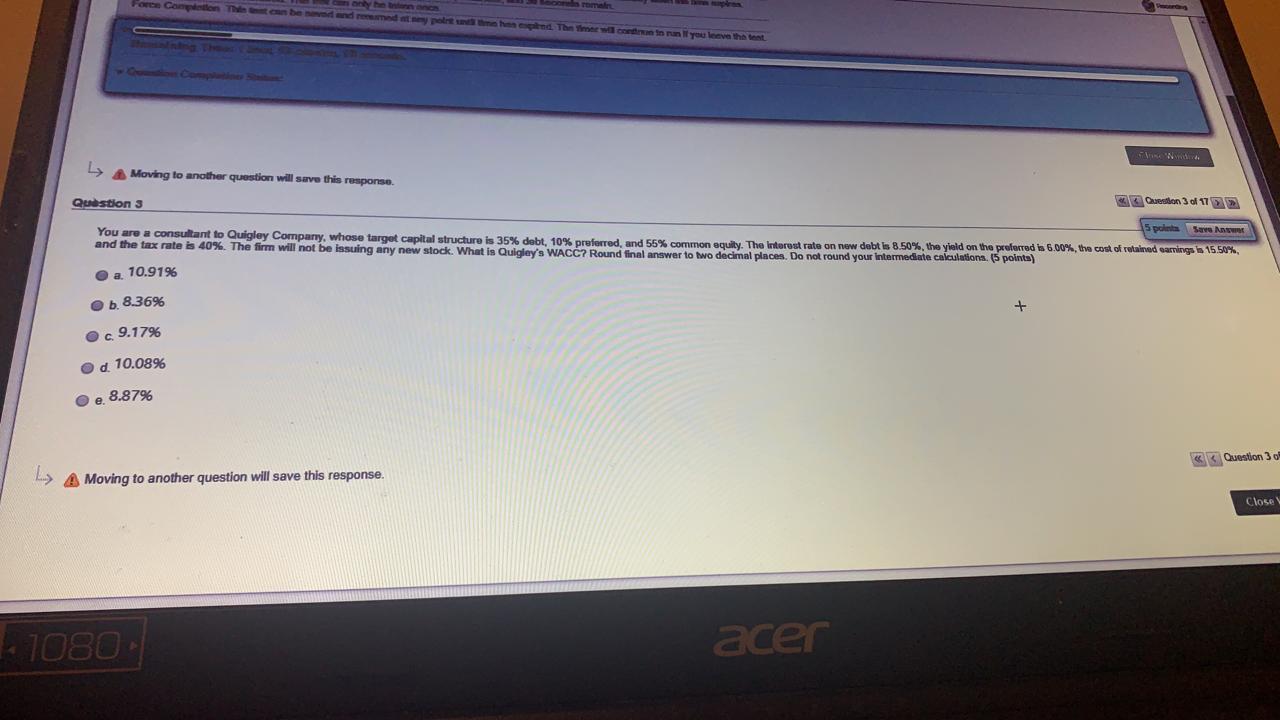

Moving to another question will save the response Question 1 Did MJBA I considering some new equipment whene dinta are shown below. The equipment has 3-year tnx fe and would be fully depreciated by the straight-line method over 3 years, but it would have a ponte pretak sabrage vedere in the end of Year 3, when the project would be dosed down. Aho, some new working capital would be required, but l would be recovered at the end of the project's tiu. Revenuen und other operating contra un expedind to be constateer the periques 3-year life. What is the project's NPV? (10 Points) WACC Net Investment in feed assets (depreciable basis) 10.0% Required new working capital $70,000 Straight-ine deprec. rate $10,000 Sales revenues, each year 33.333% $75,000 Operating costs (excluding depreciation), each year $30,000 Expected pretax salvage value $6,500 35.0% a $24.762 Tax rate b. $23,738 oc $23,005 od $21,155 e $25,363 L) A Moving to another question will save this response. 1080- acer Nie Question 2 of L Moving to another question will save this response poletas Question 2 Stock X has the following data. Assuming the stock market is efficient and the stock is in equilibrium, which of the following statements is CORRECT? (5 points) $4.00 Expected dividend, D1 $50 Current Price, Po + Expected constant growth rate 8.0% a The stock's required return is 8%. ob. The stock's expected price 10 years from now is $100. . The stock's expected dividend yield is 5%. Od. The stock's expected capital gains yield is 12%. The stock's expected dividend yield and growth rate are equal. A Moving to another question will save this response. Porn Comeone can be donde me poshtme. The time conto you love the best Moving to another question will save this response. Con 3 of 175 Questions 5 polla Sera You are a consultant to Quigley Company, whose target capital structure is 35% debt, 10% preferred, and 55% common equity. The Interest rate on new debt is 8.50%, the yield on the preferred is 6.00%, the cost of retained earning is 15.5%, and the tax rate is 40%. The firm will not be issuing any new stock. What is Quigley's WACC? Round final answer to two decimal places. Do not round your intermediate calculations. 6 points) a. 10.91% O. 8.36% + O c.9.17% od 10.08% 8.87% Question 30 L A Moving to another question will save this response. Close -1080. acer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts